NetSpend 2015 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2015 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

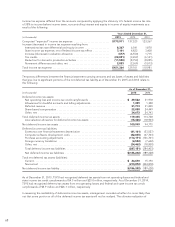

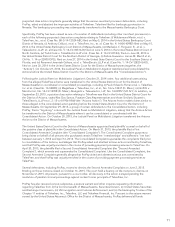

Income tax expense differed from the amounts computed by applying the statutory U.S. federal income tax rate

of 35% to income before income taxes, noncontrolling interest and equity in income of equity investments as a

result of the following:

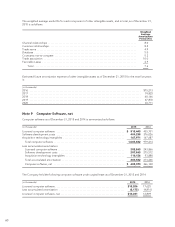

Years Ended December 31,

(in thousands) 2015 2014 2013

Computed “expected” income tax expense .......................... $173,911 137,525 123,367

Increase (decrease) in income tax expense resulting from:

International tax rate differential and equity income .................. 8,367 6,541 1,870

State income tax expense, net of federal income tax effect ............ 7,101 4,823 3,408

Increase (decrease) in valuation allowance .......................... (517) (4,550) 1,715

Tax credits .................................................... (28,831) (3,459) (6,141)

Deduction for domestic production activities ........................ (11,550) (8,750) (8,225)

Permanent differences and other, net .............................. 2,883 (2,369) (5,013)

Total income tax expense .......................................... $151,364 129,761 110,981

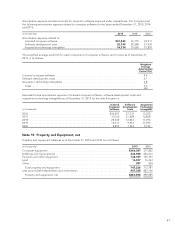

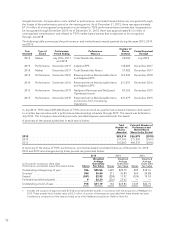

Temporary differences between the financial statement carrying amounts and tax bases of assets and liabilities

that give rise to significant portions of the net deferred tax liability as of December 31, 2015 and 2014 relate to

the following:

As of December 31,

(in thousands) 2015 2014

Deferred income tax assets:

Net operating loss and income tax credit carryforwards ........................... $ 29,522 31,978

Allowances for doubtful accounts and billing adjustments ......................... 1,399 1,328

Deferred revenue .......................................................... 31,713 31,240

Share-based compensation .................................................. 22,088 24,449

Other, net ................................................................ 34,673 24,743

Total deferred income tax assets ............................................... 119,395 113,738

Less valuation allowance for deferred income tax assets .......................... (18,446) (18,963)

Net deferred income tax assets ................................................. 100,949 94,775

Deferred income tax liabilities:

Excess tax over financial statement depreciation ................................ (61,161) (53,527)

Computer software development costs ........................................ (82,835) (67,703)

Purchase accounting adjustments ............................................. (114,171) (136,701)

Foreign currency translation ................................................. (4,522) (7,642)

Other, net ................................................................ (24,462) (18,830)

Total deferred income tax liabilities ........................................... (287,151) (284,403)

Net deferred income tax liabilities ............................................ $(186,202) (189,628)

Total net deferred tax assets (liabilities):

Current ................................................................... $ 24,670 15,190

Noncurrent ............................................................... (210,872) (204,818)

Net deferred income tax liability ................................................ $(186,202) (189,628)

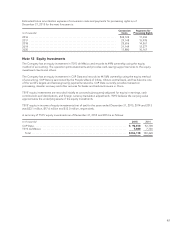

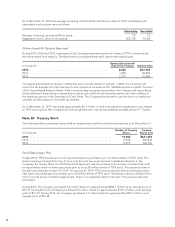

As of December 31, 2015, TSYS had recognized deferred tax assets from net operating losses and federal and

state income tax credit carryforwards of $4.5 million and $25.0 million, respectively. As of December 31, 2014,

TSYS had recognized deferred tax assets from net operating losses and federal and state income tax credit

carryforwards of $5.9 million and $26.1 million, respectively

In assessing the realizability of deferred income tax assets, management considers whether it is more likely than

not that some portion or all of the deferred income tax assets will not be realized. The ultimate realization of

68