NetSpend 2015 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2015 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Financial Reform Act, which includes the Durbin Amendment to the Electronic Funds Transfer Act, mandates

that the Board of Governors of the Federal Reserve System (Board) limit debit card interchange fees. Final rules

were issued in June 2011. The final rules cap interchange fees for debit transactions at $0.21 plus five basis

points of the transaction and require that the amount of any debit interchange transaction fee charged be

reasonable and proportional to the costs incurred in connection with the transaction.

Although this legislative action by the U.S. Congress had been anticipated for some time, it remains impossible

to predict the impact, if any, that the law and the regulations to be promulgated thereunder may have on the

Company’s operations or its financial condition in the future. However, as TSYS’ business is predominately credit

card related, the Durbin Amendment is not expected to have a significant negative impact upon TSYS’ business.

The Financial Reform Act also created a new Consumer Financial Protection Bureau (“CFPB”) with responsibility

for regulating consumer financial products and services and enforcing most federal consumer protection laws in

the area of financial services, including consumer credit and the prepaid card industry. For example, the CFPB

has proposed regulations regarding the prepaid industry, which, if adopted as proposed, could impose

significant additional disclosure requirements, overdraft requirements, and other requirements on the prepaid

card industry, including the Company’s NetSpend business, effective in 2016 or 2017. Similarly, other future

actions of the CFPB may make payment card or product transactions generally less attractive to card issuers,

acquirers, consumers and merchants by further regulatory disclosures, payment card practices, fees, routing and

other matters with respect to credit, debit and prepaid cards, and thus negatively impact the Company’s

business.

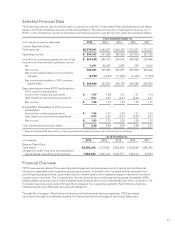

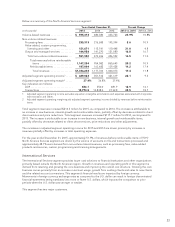

Financial Review

This Financial Review provides a discussion of critical accounting policies and estimates, related party transactions

and off-balance sheet arrangements. This Financial Review also discusses the results of operations, financial

position, liquidity and capital resources of TSYS and outlines the factors that have affected its recent earnings, as

well as those factors that may affect its future earnings. The accompanying Consolidated Financial Statements and

related Notes are an integral part of this Financial Review and should be read in conjunction with it.

Critical Accounting Policies and Estimates

Risk factors that could affect the Company’s future operating results and cause actual results to vary materially

from expectations are listed in the Company’s forward-looking statements. Negative developments in these or

other risk factors could have a material adverse effect on the Company’s financial position, results of operations

and cash flows.

TSYS’ financial position, results of operations and cash flows are impacted by the accounting policies the

Company has adopted. Refer to Note 1 in the Consolidated Financial Statements for more information on the

Company’s basis of presentation and a summary of significant accounting policies.

Management believes that the following accounting policies are the most critical to fully understand and evaluate

the Company’s results. Within each critical policy, the Company makes estimates that require management’s

subjective or complex judgments about the effects of matters that are inherently uncertain.

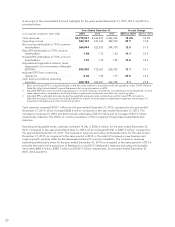

A summary of the Company’s critical accounting estimates applicable to the reportable operating segments

follows:

Allowance for Doubtful Accounts and Billing Adjustments

The Company estimates the allowance for doubtful accounts. When estimating the allowance, the Company

takes into consideration such factors as its knowledge of the financial position of specific clients, the industry and

size of its clients, the overall composition of its accounts receivable aging, prior experience with specific

customers of accounts receivable write-offs and prior history of allowances in proportion to the overall receivable

balance. This analysis includes an ongoing and continuous communication with its largest clients and those

clients with past due balances. A financial decline of any one of the Company’s large clients could have a material

13