NetSpend 2015 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2015 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

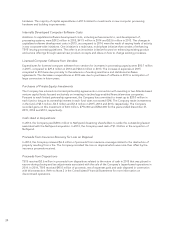

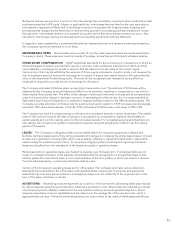

Consolidated Statements of Cash Flows

Years Ended December 31,

(in thousands) 2015 2014 2013

Cash flows from operating activities:

Net income .................................................................. $ 369,041 329,406 256,597

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation and amortization ................................................ 258,264 248,018 205,351

Share-based compensation .................................................. 41,549 30,790 28,933

Provisions for cardholder losses ............................................... 41,264 38,381 11,912

Dividends received from equity investments .................................... 12,097 9,189 8,595

Charges for transaction processing provisions ................................... 6,976 9,468 7,458

Provisions for bad debt expenses, billing adjustments and merchant losses ........... 4,495 2,823 2,000

Amortization of debt issuance costs ............................................ 1,841 1,817 7,269

Amortization of bond discount ................................................ 397 383 225

Loss on foreign currency ..................................................... 388 999 1,027

Gain on disposals of equipment, net ........................................... (397) (293) (79)

Gain on disposal of subsidiaries ............................................... (3,568) (86,961) —

Changes in value of private equity investments .................................. (4,038) (793) (966)

Deferred income tax (benefit) expense ......................................... (4,083) (8,963) 26,945

Equity in income of equity investments ......................................... (22,106) (17,583) (13,047)

Excess tax benefit from share-based payment arrangements ....................... (24,357) (7,185) (3,528)

Changes in operating assets and liabilities, net of effects of acquisition:

Accounts receivable ....................................................... (39,218) (33,406) (8,667)

Prepaid expenses, other current assets and other long-term assets ................ (8,498) (10,525) (571)

Accounts payable ......................................................... (3,987) 8,765 (52,042)

Accrued salaries and employee benefits ...................................... 29,168 414 (403)

Other current liabilities and other long-term liabilities ........................... (55,034) 45,457 (24,611)

Net cash provided by operating activities ................................ 600,194 560,201 452,398

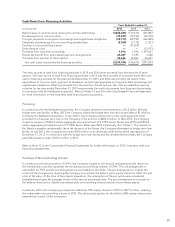

Cash flows from investing activities:

Additions to contract acquisition costs ......................................... (58,728) (88,871) (55,965)

Purchases of property and equipment .......................................... (54,640) (75,913) (40,598)

Additions to licensed computer software from vendors ........................... (50,729) (29,638) (63,635)

Additions to internally developed computer software ............................. (39,219) (41,501) (33,600)

Purchases of private equity investments ........................................ (3,525) (3,291) (1,378)

Cash used in acquisitions, net of cash acquired .................................. (750) (38,584) (1,314,660)

Proceeds from insurance recovery for loss on disposal ............................ —6,212 —

Proceeds from sale of private equity investment ................................. 1,839 ——

Proceeds from dispositions, net of expenses paid and cash disposed ................ 3,568 44,979 —

Net cash used in investing activities ...................................... (202,184) (226,607) (1,509,836)

Cash flows from financing activities:

Repurchases of common stock under plans and tax withholding .................... (242,235) (170,516) (103,857)

Dividends paid on common stock ............................................. (73,677) (74,796) (56,510)

Principal payments on long-term borrowings and capital lease obligations ........... (54,719) (69,939) (166,805)

Subsidiary dividends paid to noncontrolling shareholders ......................... (5,028) (7,172) (7,321)

Purchase of noncontrolling interests ........................................... —(37,500) —

Debt issuance costs ......................................................... —— (13,573)

Proceeds from long-term borrowings .......................................... 1,912 1,396 1,395,661

Excess tax benefit from share-based payment arrangements ....................... 24,357 7,185 3,528

Proceeds from exercise of stock options ........................................ 58,636 34,869 40,691

Net cash (used in) provided by financing activities ......................... (290,754) (316,473) 1,091,814

Cash and cash equivalents:

Effect of exchange rate changes on cash and cash equivalents ..................... (7,111) (6,168) (3,758)

Net increase (decrease) in cash and cash equivalents ............................. 100,145 10,953 30,618

Cash and cash equivalents at beginning of period ................................ 289,183 278,230 247,612

Cash and cash equivalents at end of period ..................................... 389,328 289,183 278,230

Less cash and cash equivalents of discontinued operations at end of period .......... —— (30,530)

Cash and cash equivalents of continued operations at end of period ................ $ 389,328 289,183 247,700

Supplemental cash flow information:

Interest paid ............................................................... $ 40,425 40,969 23,157

Income taxes paid, net ...................................................... $ 171,455 135,770 80,033

See accompanying Notes to Consolidated Financial Statements

44