NetSpend 2015 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2015 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

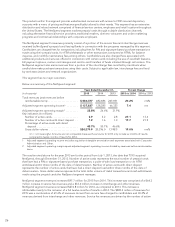

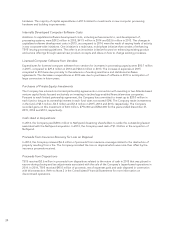

Cash Flows from Financing Activities

Years Ended December 31,

(in thousands) 2015 2014 2013

Repurchases of common stock under plans and tax withholding ........... $(242,235) (170,516) (103,857)

Dividends paid on common stock .................................... (73,677) (74,796) (56,510)

Principal payments on long-term borrowings and capital lease obligations . . (54,719) (69,939) (166,805)

Subsidiary dividends paid to noncontrolling shareholders ................ (5,028) (7,172) (7,321)

Purchase of noncontrolling interest ................................... —(37,500) —

Debt issuance costs ................................................ —— (13,573)

Proceeds from long-term borrowings ................................. 1,912 1,396 1,395,661

Excess tax benefit from share-based payment arrangements .............. 24,357 7,185 3,528

Proceeds from exercise of stock options ............................... 58,636 34,869 40,691

Net cash (used in) provided by financing activities ..................... $(290,754) (316,473) 1,091,814

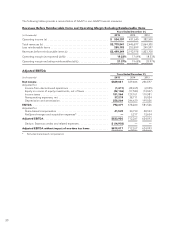

The main sources of cash from financing activities in 2015 and 2014 were proceeds from the exercise of stock

options. The main source of cash from financing activities in 2013 was the proceeds of borrowed funds. Net cash

used in financing activities for the years ended December 31, 2015 and 2014 was primarily the result of the

repurchases of common stock, payment of dividends, and principal payments on long-term debt borrowings and

capital lease obligations offset by proceeds from the exercise of stock options. Net cash provided by financing

activities for the year ended December 31, 2013 was primarily the result of proceeds from long-term borrowings

in connection with the NetSpend acquisition. Refer to Notes 13 and 24 in the Consolidated Financial Statements

for more information on the long-term debt financing and acquisitions.

Financing

In connection with the NetSpend acquisition, the Company obtained commitments for a $1.2 billion 364-day

bridge term loan facility. In May, 2013 the Company closed the bridge term loan and issued debt of $1.4 billion

to finance the NetSpend acquisition. In April 2013, the Company entered into a new credit agreement that

provided for a five-year term loan to the Company in the amount of $200.0 million. In May 2013, the Company

closed its issuance of $550.0 million aggregate principal amount of 2.375% Senior Notes due 2018 and $550.0

million aggregate principal amount of 3.750% Senior Notes due 2023 (collectively, the “Notes”). The interest on

the Notes is payable semiannually. Upon the issuance of the Notes, the Company eliminated its bridge term loan

facility. In July 2013, the Company borrowed $100 million on its revolving credit facility which was repaid as of

December 31, 2013. In connection with the bridge term loan facility and the aforementioned loans, the Company

paid debt issuance costs of $13.6 million in 2013.

Refer to Note 13 in the Consolidated Financial Statements for further information on TSYS’ long-term debt and

financing arrangements.

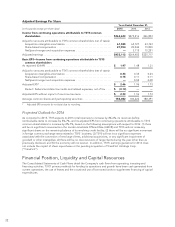

Purchase of Noncontrolling Interest

In connection with the acquisition of CPAY, the Company is party to call and put arrangements with respect to

the membership units that represent the remaining noncontrolling interest of CPAY. The call arrangement is

exercisable by TSYS and the put arrangement is exercisable by the Seller. The put arrangement is outside the

control of the Company by requiring the Company to purchase the Seller’s entire equity interest in CPAY at a put

price at fair value. At the time of the original acquisition, the redemption of the put option was considered

probable based upon the passage of time of the second anniversary date. The put arrangement is recorded on

the balance sheet and is classified as redeemable noncontrolling interest outside of permanent equity.

In February 2014, the Company purchased an additional 15% equity interest in CPAY for $37.5 million, reducing

the redeemable noncontrolling interest to 25%. The call and put options for the Seller’s 25% equity interest were

extended as a result of this transaction.

35