NetSpend 2015 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2015 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

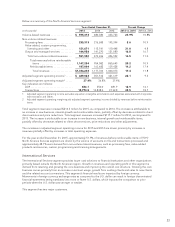

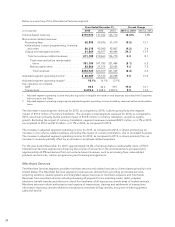

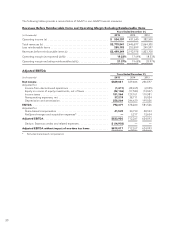

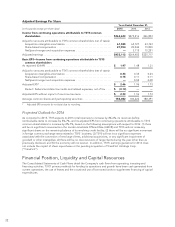

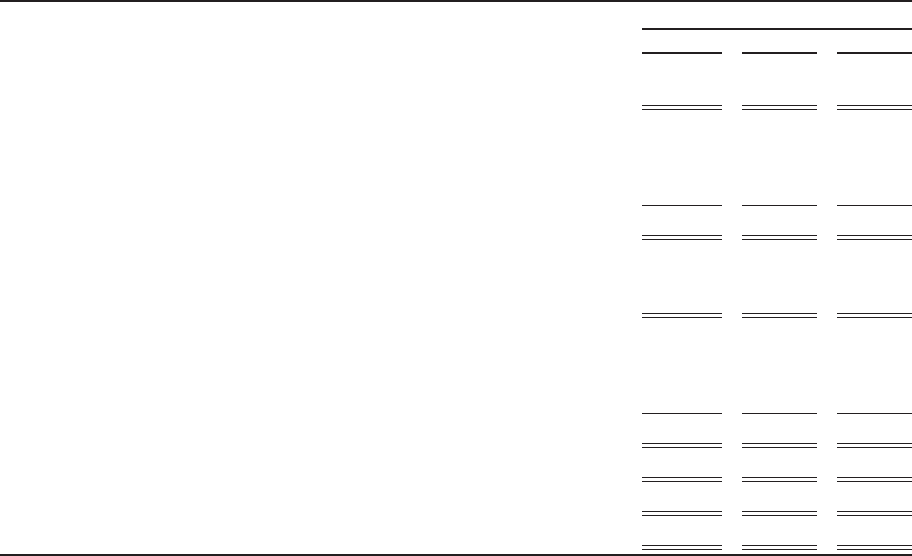

Adjusted Earnings Per Share

Years Ended December 31,

(in thousands except per share data) 2015 2014 2013

Income from continuing operations attributable to TSYS common

shareholders .................................................... $362,633 $275,216 246,893

Adjust for amounts attributable to TSYS common shareholders (net of taxes):

Acquisition intangible amortization .................................. 61,525 65,127 43,743

Share-based compensation ........................................ 27,954 20,944 19,830

NetSpend merger and acquisition expenses .......................... —3,115 15,251

Adjusted earnings .................................................. $452,112 $364,402 $325,717

Basic EPS—Income from continuing operations attributable to TSYS

common shareholders

As reported (GAAP) ................................................ $ 1.97 1.48 1.31

Adjust for amounts attributable to TSYS common shareholders (net of taxes):

Acquisition intangible amortization .................................. 0.33 0.35 0.23

Share-based compensation ........................................ 0.15 0.11 0.11

NetSpend merger and acquisition expenses .......................... —0.02 0.08

Adjusted EPS* ..................................................... $ 2.46 1.96 1.73

Deduct: Federal and state tax credits and related expenses, net of tax .... $ (0.13) ——

Adjusted EPS without impact of one-time tax items ...................... $ 2.33 1.96 1.73

Average common shares and participating securities ..................... 184,082 186,222 188,391

* Adjusted EPS amounts do not total due to rounding.

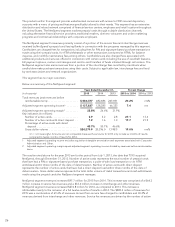

Projected Outlook for 2016

As compared to 2015, TSYS expects its 2016 total revenues to increase by 4%-6%, its revenues before

reimbursable items to increase by 5%-7%, and its adjusted EPS from continuing operations attributable to TSYS

common shareholders to increase by 4%-7%, based on the following assumptions with respect to 2016: (1) there

will be no significant movements in the London Interbank Offered Rate (LIBOR) and TSYS will not make any

significant draws on the remaining balance of its revolving credit facility; (2) there will be no significant movement

in foreign currency exchange rates related to TSYS’ business; (3) TSYS will not incur significant expenses

associated with the conversion of new large clients, additional acquisitions, or any significant impairment of

goodwill or other intangibles; (4) there will be no deconversions of large clients during the year other than as

previously disclosed; and (5) the economy will not worsen. In addition, TSYS’ earnings guidance for 2016 does

not include the impact of share repurchases or the pending acquisition of TransFirst Holdings Corp.

(“TransFirst”).

Financial Position, Liquidity and Capital Resources

The Consolidated Statements of Cash Flows detail the Company’s cash flows from operating, investing and

financing activities. TSYS’ primary methods for funding its operations and growth have been cash generated from

current operations, the use of leases and the occasional use of borrowed funds to supplement financing of capital

expenditures.

32