NetSpend 2015 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2015 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note 23 Supplemental Cash Flow Information

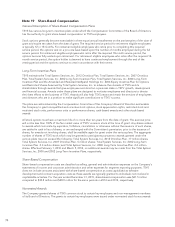

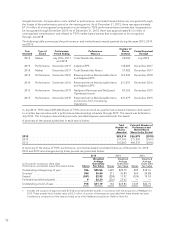

Nonvested Share Awards

The Company has issued shares of TSYS common stock to certain key employees and non-management

members of its Board of Directors. The grants to certain key employees were issued in the form of nonvested

stock bonus awards for services to be provided in the future by such officers and employees. The grants to the

Board of Directors were fully vested on the date of grant. Refer to Note 18 for more information on nonvested

share awards.

Equipment and Software Acquired Under Capital Lease Obligations

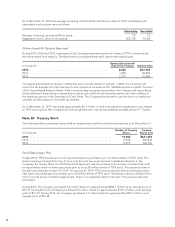

The Company acquired computer equipment and software under capital leases in the amount of $4.1 million,

$17.9 million and $14.8 million in 2015, 2014 and 2013, respectively.

Software Acquired Under Direct Financing

The Company acquired software under direct financing in the amount of $30.0 million in 2015. The Company

acquired software under direct financing in the amount of $13.6 million in 2014. The Company did not acquire

any software under direct financing in 2013. Refer to Note 13 for more information.

Note 24 Acquisitions

2015

In September 2015, TSYS purchased certain assets for its NetSpend segment for $750,000. The purchase

qualifies as a business combination in accordance with GAAP. The Company recorded an acquisition technology

intangible asset for the amount of the purchase price. This acquisition intangible asset represents software and is

being amortized over a five year life. There were no other material assets included in the purchase. The

acquisition included the employment of certain key employees which resulted in the transaction qualifying as a

business combination.

2014

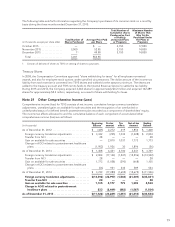

In February 2014, the Company acquired an additional 15% equity interest in CPAY from its privately held owner

for $37.5 million, which increased its equity interest in CPAY from 60% to 75%. This purchase reduced the

remaining redeemable noncontrolling interest in CPAY to 25% of its total outstanding equity.

2013

On July 1, 2013, TSYS acquired all the outstanding stock of NetSpend, which previously operated as a publicly

traded company and is a leading provider of GPR prepaid debit and payroll cards and related financial services to

underbanked and other consumers in the U.S. The acquisition complements the Company’s existing presence in

the prepaid processing space. The results of the newly acquired business are being reported by TSYS as a new

operating segment titled NetSpend.

Under the terms of the Merger Agreement, TSYS acquired 100 percent ownership of NetSpend for approximately

$1.4 billion, including $1.2 billion of cash to shareholders, $70.7 million of cash for payment to holders of vested

stock options and awards, $58.3 million of cash for repayment of NetSpend’s revolving credit facility and $15.6

million in replacement stock options and awards. NetSpend shareholders received $16.00 in cash for each share

of NetSpend common stock. There were 1.6 million NetSpend shares held by five shareholders who asserted

appraisal (or dissenters’) rights with respect to their NetSpend shares, for a preliminary value of $25.7 million at

$16.00 per share that were not funded at the closing of the acquisition. During 2014, TSYS paid $38.6 million to

dissenting shareholders to settle the lawsuit.

83