NetSpend 2015 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2015 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

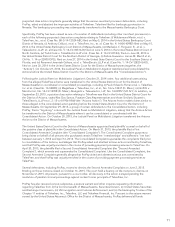

The following table sets forth information regarding the Company’s purchases of its common stock on a monthly

basis during the three months ended December 31, 2015:

(in thousands, except per share data) Total Number of

Shares Purchased Average Price Paid

per Share

Total Number of

Cumulative shares

Purchased as Part

of Publicly

announced Plans

or Programs

Maximum Number

of Shares That

May Yet Be

Purchased Under

the Plans or

Programs

October 2015 ................. — $ — 2,150 17,850

November 2015 ............... 3,000 52.85 5,150 14,850

December 2015 ............... 1

149.80 5,150 14,850

Total ...................... 3,001 $52.85

1 Consists of delivery of shares to TSYS on vesting of shares to pay taxes.

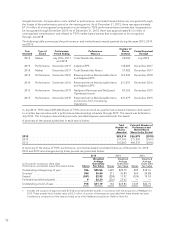

Treasury Shares

In 2008, the Compensation Committee approved “share withholding for taxes” for all employee nonvested

awards, and also for employee stock options under specified circumstances. The dollar amount of the income tax

liability from each exercise is converted into TSYS shares and withheld at the statutory minimum. The shares are

added to the treasury account and TSYS remits funds to the Internal Revenue Service to settle the tax liability.

During 2015 and 2014, the Company acquired 3,344 shares for approximately $0.2 million and acquired 162,489

shares for approximately $5.2 million, respectively, as a result of share withholding for taxes.

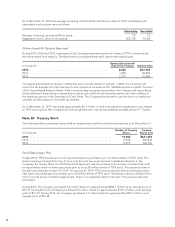

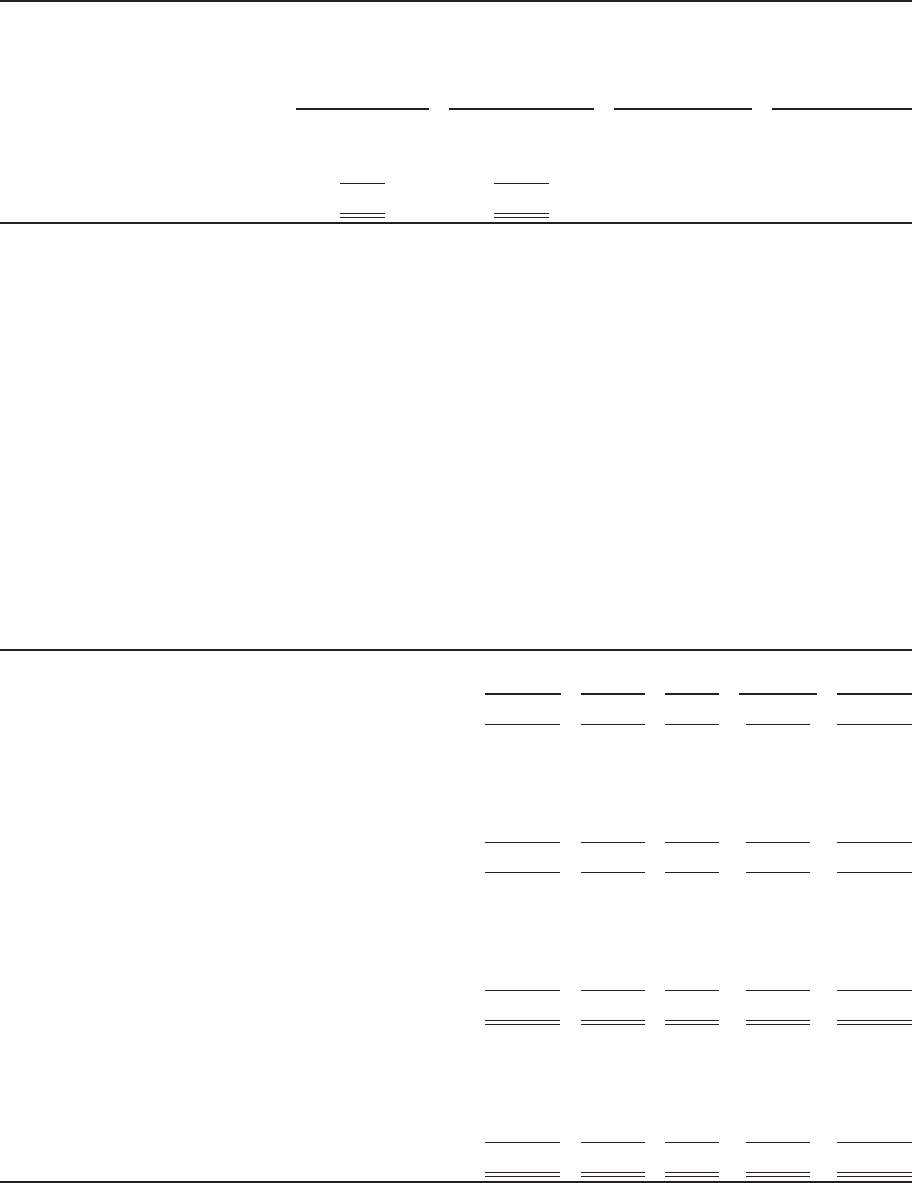

Note 21 Other Comprehensive Income (Loss)

Comprehensive income (loss) for TSYS consists of net income, cumulative foreign currency translation

adjustments, unrealized gains on available for sale securities and the recognition of an overfunded or

underfunded status of a defined benefit postretirement plan recorded as a component of shareholders’ equity.

The income tax effects allocated to and the cumulative balance of each component of accumulated other

comprehensive income (loss) are as follows:

(in thousands) Beginning

Balance Pretax

amount Tax

effect Net-of-tax

Amount Ending

Balance

As of December 31, 2012 ........................... $ (445) 2,272 419 1,853 $ 1,408

Foreign currency translation adjustments ............ $ 3,332 (295) 1,033 (1,328) $ 2,004

Transfer from NCI ............................... 28 — — — 28

Gain on available for sale securities ................. — 2,810 1,037 1,773 1,773

Change in AOCI related to postretirement healthcare

plans ........................................ (1,952) 1,926 30 1,896 (56)

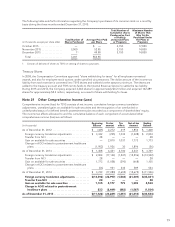

As of December 31, 2013 ........................... $ 1,408 4,441 2,100 2,341 $ 3,749

Foreign currency translation adjustments ............ $ 2,004 (17,143) (1,547) (15,596) $ (13,592)

Transfer from NCI ............................... 28 — — — 28

Gain on available for sale securities ................. 1,773 (1,058) (390) (668) 1,105

Change in AOCI related to postretirement healthcare

plans ........................................ (56) 921 332 589 533

As of December 31, 2014 ........................... $ 3,749 (17,280) (1,605) (15,675) $ (11,926)

Foreign currency translation adjustments .......... $(13,592) (22,997) (1,548) (21,449) $(35,041)

Transfer from NCI .............................. 28 — — — 28

Gain on available for sale securities ............... 1,105 2,177 779 1,398 2,503

Change in AOCI related to postretirement

healthcare plans .............................. 533 (2,449) (882) (1,567) (1,034)

As of December 31, 2015 .......................... $(11,926) (23,269) (1,651) (21,618) $(33,544)

79