NetSpend 2015 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2015 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

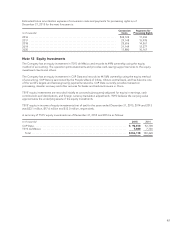

$11.9 million, respectively, as of December 31, 2015 and 2014. The Company recognized gains of $4.0 million,

$0.8 million, and $1.0 million due to increases in fair value in the years ended December 31, 2015, 2014 and

2013, respectively.

Note 17 Employee Benefit Plans

The Company provides benefits to its employees by offering employees participation in certain defined

contribution plans. The employee benefit plans through which TSYS provided benefits to its employees during

2015 are described as follows:

RETIREMENT SAVINGS AND STOCK PURCHASE PLANS: TSYS maintains a single plan, the Retirement

Savings Plan, which is designed to reward all team members of TSYS U.S.-based companies with a uniform

employer contribution. The terms of the plan provide for the Company to match 100% of the employee

contribution up to 4% of eligible compensation. The Company can make discretionary contributions up to

another 4% based upon business conditions.

The Company also maintains a stock purchase plan for employees. The Company contributes 15% of employee

contributions. The funds are used to purchase presently issued and outstanding shares of TSYS common stock on

the open market at fair market value for the benefit of participants. The Company’s contributions to the plans

charged to expense for the years ended December 31, 2015, 2014 and 2013 are as follows:

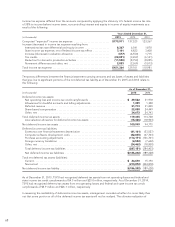

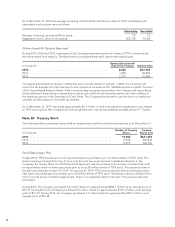

(in thousands) 2015 2014 2013

TSYS Retirement Savings Plan ............................................. $24,169 17,531 14,506

TSYS Stock Purchase Plan ................................................. 1,378 1,288 1,236

POSTRETIREMENT MEDICAL BENEFITS PLAN: TSYS provides certain medical benefits to qualified retirees

through a postretirement medical benefits plan, which is immaterial to the Company’s consolidated financial

statements. The measurement of the benefit expense and accrual of benefit costs associated with the plan do not

reflect the effects of the 2003 Medicare Act. Additionally, the benefit expense and accrued benefit cost

associated with the plan, as well as any potential impact of the effects of the 2003 Medicare Act, are not

significant to the Company’s consolidated financial statements.

Note 18 Equity

DIVIDENDS: Dividends on common stock of $73.7 million were paid in 2015, compared to $74.8 million and

$56.5 million in 2014 and 2013, respectively. The increase in dividends paid in 2014 compared to 2013 is due to

the acceleration of payment of the fourth quarter 2012 dividend. The fourth quarter 2012 dividend payment was

paid in December 2012, rather than January 2013, to allow shareholders to benefit from the lower dividend tax

rate that was set to expire on December 31, 2012.

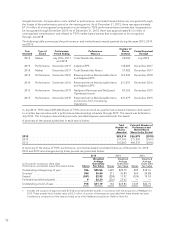

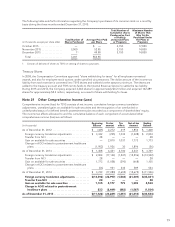

EQUITY COMPENSATION PLANS: The following table summarizes TSYS’ equity compensation plans by

category as of December 31, 2015:

(in thousands, except per share data)

Plan Category

(a)

Number of securities to

be issued upon exercise

of outstanding options,

warrants and rights

(b)

Weighted-average

exercise price of

outstanding

options, warrants

and rights

(c)

Number of securities remaining

available for future issuance

under equity compensation plans

(excluding securities reflected in

column (a))

Equity compensation plans

approved by security holders .... 4,475 $28.0718,5502

The Company does not have any equity compensation plans that were not approved by security holders.

1 Weighted-average exercise price represents 2,887 thousand options only and does not include performance shares and

other awards that have no exercise price.

2 Shares available for future grants under the Total System Services Inc. 2007 Omnibus Plan and 2012 Omnibus Plan, which

could be in the form of options, nonvested awards and performance shares.

73