NetSpend 2015 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2015 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and U.S. Bank National Association, as Documentation Agents, and other lenders party thereto, with J.P. Morgan

Securities LLC, The Bank of Tokyo Mitsubishi UFJ, Ltd., Regions Capital Markets, and U.S. Bank National

Association as joint lead arrangers and joint bookrunners. The Credit Agreement provides for a five-year term

loan to the Company in the amount of $200.0 million (the “Term Loan”) and bears interest at LIBOR plus 1.125%,

which are subject to adjustment based on changes in the Company’s credit ratings, with margins ranging from

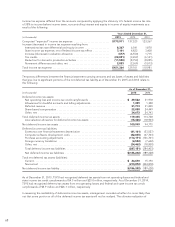

1.00% to 1.75%. As of December 31, 2015, the outstanding balance on the Credit Agreement was $175.0

million.

Concurrently with entering into the Merger Agreement, TSYS obtained commitments for a $1.2 billion 364-day

bridge term loan facility from JPMorgan Chase Bank, N.A., J.P. Morgan Securities LLC and The Bank of Tokyo-

Mitsubishi UFJ, Ltd. Thereafter, JPMorgan Chase Bank, N.A. and The Bank of Tokyo-Mitsubishi UFJ, Ltd.

assigned portions of their commitments to other bridge facility lenders. The Company paid fees in 2013

associated with the bridge term loan of approximately $5.9 million. The total commitments under the bridge

term loan facility were eliminated in May 2013 after the issuance of the Notes described below.

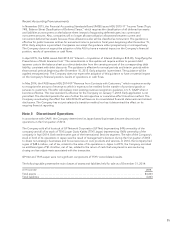

In May 2013, the Company closed its issuance (the “Transaction”) of $550.0 million aggregate principal amount

of 2.375% Senior Notes due 2018 and $550.0 million aggregate principal amount of 3.750% Senior Notes due

2023 (collectively, the “Notes”) pursuant to an Underwriting Agreement with J.P. Morgan Securities LLC, as

representative of certain underwriters (the “Underwriters”), whereby the Company agreed to sell and the

Underwriters agreed to purchase the Notes from the Company, subject to and upon the terms and conditions set

forth in the Underwriting Agreement. The interest on the Notes are payable semiannually. The Company paid

fees in 2013 associated with the issuance of these Notes of approximately $8.9 million and recorded discounts of

approximately $4.3 million that are being amortized over the life of the Notes. The Company used the net

proceeds of the Transaction to pay a portion of the $1.4 billion purchase price of the Company’s acquisition of

NetSpend and related fees and expenses. The Notes were issued pursuant to an Indenture dated as of May 22,

2013 between the Company and Wells Fargo Bank, National Association, as trustee. The balance as of

December 31, 2015 was $549.9 million net of discount for the Senior Notes due June 2018 and $546.7 million

net of discount for the Senior Notes due June 2023.

The Notes also contain various affirmative and negative covenants, including those that create limitations on the

Company’s:

• creation of liens;

• merging or selling assets unless certain conditions are met; and

• entering into sale/leaseback transactions.

The Notes also contain a provision that requires the Company to repurchase all or any portion of a holder’s

Notes, at the holder’s option, if a Change in Control Repurchase Event occurs.

Amendment to Existing Credit Agreement

In September 2012, the Company entered into a credit agreement with JPMorgan Chase Bank, N.A., as

Administrative Agent, The Bank of Tokyo-Mitsubishi UFJ, Ltd., Regions Bank and U.S. Bank National Association,

as Syndication Agents, and the other lenders named therein, with J.P. Morgan Securities LLC, The Bank of Tokyo-

Mitsubishi UFJ, Ltd., Regions Capital Markets and U.S. Bank National Association, as joint lead arrangers and

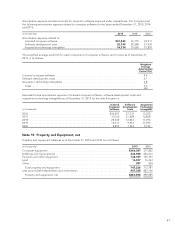

joint bookrunners (the “Existing Credit Agreement”). The Existing Credit Agreement provides for a $350.0 million

five-year unsecured revolving credit facility (which may be increased by up to an additional $350.0 million under

certain circumstances) and includes a $50.0 million subfacility for the issuance of standby letters of credit and a

$50.0 million subfacility for swingline loans. The Existing Credit Agreement also provides for a $150 million five-

year unsecured term loan, which was fully funded on the closing of the Existing Credit Agreement. As of

December 31, 2015, the outstanding balance on the Existing Credit Agreement was $120.0 million.

In April 2013, the Company entered into the First Amendment to the Existing Credit Agreement (the “Revolver”)

in order to conform certain provisions of the Existing Credit Agreement to the Credit Agreement for the Term

Loan. On July 1, 2013, an additional $100.0 million was used as funding in the NetSpend Merger. As of

December 31, 2015, there was no outstanding balance on the Revolver.

65