NetSpend 2015 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2015 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

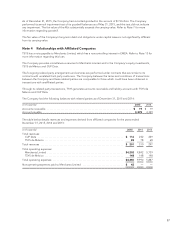

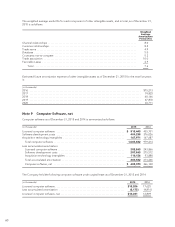

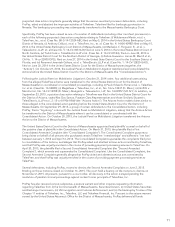

The Company has various types of equipment under capital lease arrangements. The Company has the following

amounts of equipment under capital lease obligations as of December 31, 2015 and 2014:

(in thousands) 2015 2014

Computer equipment ........................................................... $ 55,450 49,118

Furniture and other equipment ................................................... 5,374 5,374

Total equipment ............................................................. 60,824 54,492

Less accumulated depreciation:

Computer and other equipment .................................................. (36,134) (29,816)

Furniture and other equipment ................................................... (2,731) (1,666)

Total accumulated depreciation ................................................ (38,865) (31,482)

Total equipment, net ......................................................... $ 21,959 23,010

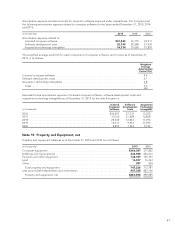

Depreciation and amortization expense includes amounts for computer equipment, furniture and other

equipment acquired under capital lease. Depreciation and amortization expense related to property and

equipment was $56.6 million, $53.5 million and $45.5 million for the years ended December 31, 2015, 2014 and

2013, respectively.

Note 11 Contract Acquisition Costs, net

Significant components of contract acquisition costs as of December 31, 2015 and 2014 are summarized as

follows:

(in thousands) 2015 2014

Conversion costs, net .......................................................... $159,000 159,339

Payments for processing rights, net .............................................. 88,811 76,966

Total ...................................................................... $247,811 236,305

Amortization expense related to contract acquisition cost for the years ended December 31, 2015, 2014 and

2013 are as follows:

(in thousands) 2015 2014 2013

Amortization expense related to:

Conversion costs ................................................. $27,392 17,816 19,515

Payments for processing rights ...................................... 17,039 16,209 13,099

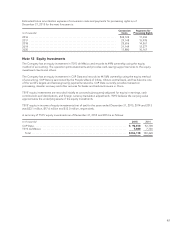

The weighted average useful life for each component of contract acquisition costs, and in total, as of

December 31, 2015 is as follows:

Weighted

Average

Amortization

Period (Yrs)

Payments for processing rights ......................................................... 14.7

Conversion costs ..................................................................... 12.3

Total ............................................................................. 13.3

62