NetSpend 2015 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2015 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 3

Combined with higher margins, robust organic growth

made for superb consolidated results in 2015

—

and

gave us the ideal launching pad for 2016.

And what a year it’s been! Most exciting of all has

been the announcement, on January 26, 2016, of

our intent to acquire TransFirst® for $2.35 billion.

That’s the largest acquisition in our history.

TransFirst is a leading provider of payment technology

solutions to businesses across the United States. What

sets TransFirst apart is its partner-centric, vertically

focused distribution capability

—

a capability that’s

sure to accelerate our position in the high growth

area of integrated payments.

The transaction, which we aim to close in the second

quarter of 2016, will strategically position TSYS in the

highly competitive, rapidly changing merchant

acquiring landscape.

Some of the greatest innovations in payments involve

both merchants and consumers. With our TransFirst

colleagues as part of the TSYS family, we’ll be

exceptionally well-positioned to deliver on these

evolving trends.

I want to share the highlights of this historic year

with you, along with how we plan to transform and

differentiate our company, and position ourselves to

lead the marketplace.

In this letter, I explain how our three businesses set

us apart in the payments space, and how we win on

scale, reach and distribution. We now service several

hundred payment providers, hundreds of thousands

of businesses and millions of consumers across the

payments landscape.

Today, that landscape is more competitive than

ever. But we’re confident that our strong, balanced

portfolio of businesses within TSYS will help us adapt

and evolve as often as this dynamic, fast-changing

industry demands. Disruptors and legacy players are

relying on TSYS to unlock the opportunities for growth

that payments can provide and keep the heart of

commerce beating strongly.

2015 FINANCIAL PERFORMANCE

It’s no accident that TSYS is operating from a position

of tremendous strength. We’ve achieved strong

financial performance because we’re able to foresee

the future of payments, and to execute and deliver

leading payment solutions at scale, with unrivaled

security and reliability.

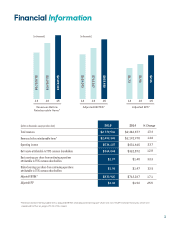

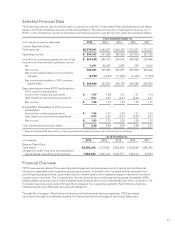

Revenue and Income: Total revenues were

$2.8 billion, resulting in double-digit growth of

13.6 percent. Revenues before reimbursable items

were $2.5 billion: up 14.0 percent.

Earnings Per Share: Adjusted earnings per share

(EPS)* was $2.46, an increase of 25.5 percent.

Adjusted EBITDA* was $833.9 million, an increase of

17.1 percent. Basic EPS from continuing operations

was $1.97, an increase of 33.3 percent. Diluted EPS

from continuing operations was $1.96, an increase

of 33.5 percent.

Return to Shareholders: TSYS stock was ranked

ninth in the S&P 500’s list of the highest performing

stocks for 2015. Our closing stock price at year end

was $49.80. We bought 5.2 million shares, totaling

$242.1 million. These purchases along with our

dividends of $73.7 million, returned $315.8 million to

our shareholders. That’s more than 92 percent of

available free cash flow for the year

—

an increase

of 31.5 percent over 2014.

Let’s take a look at our three businesses, and the

solutions we deliver.

* Revenues before reimbursable items, adjusted EBITDA and adjusted earnings per share are non-GAAP financial measures, which are

explained further on pages 29-32 of this report.