NetSpend 2015 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2015 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

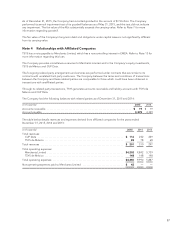

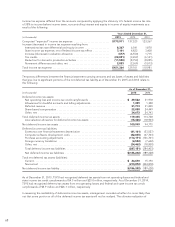

Note 14 Other Current Liabilities

Significant components of other current liabilities as of December 31, 2015 and 2014 are summarized as follows:

(in thousands) 2015 2014

Deferred revenues ............................................................ $ 39,863 41,773

Accrued expenses ............................................................. 26,017 23,617

Dividends payable ............................................................ 19,367 19,006

Other ....................................................................... 81,332 70,409

Total ...................................................................... $166,579 154,805

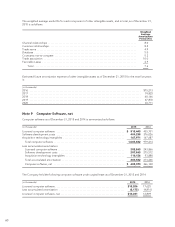

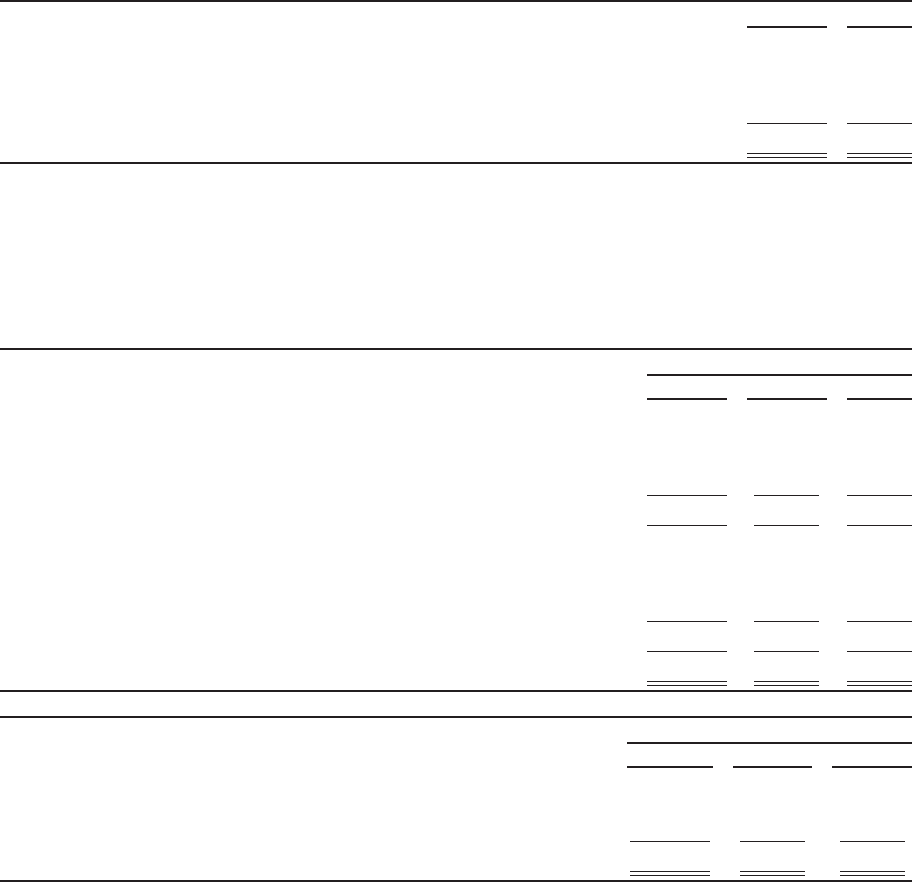

Note 15 Income Taxes

The provision for income taxes includes income taxes currently payable and those deferred because of temporary

differences between the financial statement carrying amounts and tax bases of assets and liabilities.

The components of income tax expense included in the Consolidated Statements of Income were as follows:

Years Ended December 31,

(in thousands) 2015 2014 2013

Current income tax expense:

Federal ......................................................... $139,228 126,203 74,327

State ........................................................... 9,255 5,161 2,949

Foreign ......................................................... 4,762 7,694 6,822

Total current income tax expense ................................. 153,245 139,058 84,098

Deferred income tax expense (benefit):

Federal ......................................................... (2,198) (3,623) 27,447

State ........................................................... 442 (2,039) (55)

Foreign ......................................................... (125) (3,635) (509)

Total deferred income tax expense (benefit) ......................... (1,881) (9,297) 26,883

Total income tax expense ...................................... $151,364 129,761 110,981

Years Ended December 31,

(in thousands) 2015 2014 2013

Components of income before income tax expense:

Domestic ..................................................... $488,515 369,888 328,052

Foreign ....................................................... 8,373 23,041 24,424

Total income before income tax expense ............................. $496,888 392,929 352,476

67