NetSpend 2015 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2015 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

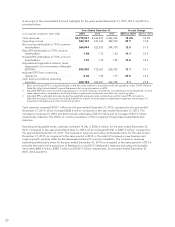

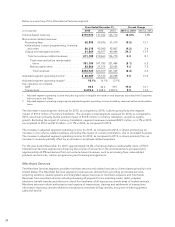

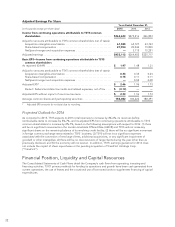

Income Taxes

Below is a summary of income tax expense:

Years Ended December 31, Percent Change

(in thousands) 2015 2014 2013 2015 vs. 2014 2014 vs. 2013

Income tax expense ........................ $151,364 129,761 110,981 16.6% 16.9%

Effective income tax rate .................... 30.5% 32.0% 31.5%

The pretax income and the effective income tax rate includes noncontrolling interest in consolidated subsidiaries’

net income and excludes equity in income of equity investments.

During 2015, the Company generated income tax credits in excess of its utilization capacity based on both the

Company’s current operations and with consideration of future tax planning strategies. Based upon these same

considerations, the Company reassessed its need for valuation allowances in all jurisdictions. Accordingly, the

Company experienced a net decrease in its valuation allowance for deferred income tax assets of $0.5 million.

TSYS has adopted the permanent reinvestment exception as allowed by GAAP, with respect to future earnings of

certain foreign subsidiaries. As a result, TSYS considers foreign earnings related to these foreign operations to be

permanently reinvested. No provision for U.S. federal and state incomes taxes has been made in the

Consolidated Financial Statements for those non-U.S. subsidiaries whose earnings are considered to be

reinvested. The amount of undistributed earnings considered to be “reinvested” which may be subject to tax

upon distribution was approximately $83.9 million as of December 31, 2015. Although TSYS does not intend to

repatriate these earnings, a distribution of these non-U.S. earnings in the form of dividends, or otherwise, would

subject the Company to both U.S. federal and state income taxes, as adjusted for non-U.S. tax credits, and

withholding taxes payable to the various non-U.S. countries. Determination of the amount of any unrecognized

deferred income tax liability on these undistributed earnings is not practicable.

In 2015, TSYS reassessed its contingencies for foreign, federal and state exposures, which resulted in a net

increase in tax contingency amounts of approximately $6.4 million.

Refer to Note 15 in the Consolidated Financial Statements for more information on income taxes.

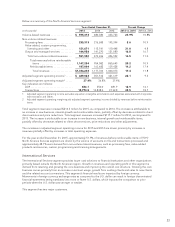

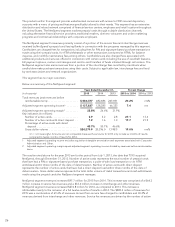

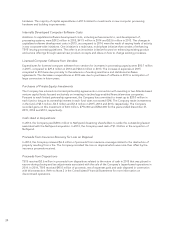

Equity in Income of Equity Investments

Below is a summary of TSYS’ share of income from its interest in equity investments:

Years Ended December 31, Percent Change

(in thousands) 2015 2014 2013 2015 vs. 2014 2014 vs. 2013

Equity in income of equity investments ............ $22,106 17,583 13,047 25.7% 34.8%

The increase in equity income in 2015 and 2014 is the result of organic growth in CUP Data. Refer to Note 12 in

the Consolidated Financial Statements for more information on equity investments.

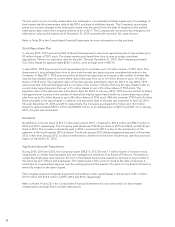

Discontinued Operations

TSYS sold its Japan-based operations during 2014 and recorded income from discontinued operations, net of

tax, of $1.4 million, $48.7 million and $2.1 million for 2015, 2014 and 2013, respectively. Refer to Note 2 in the

Consolidated Financial Statements for more information on discontinued operations.

28