NetSpend 2015 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2015 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

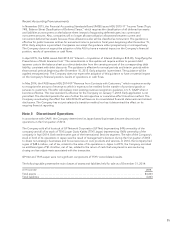

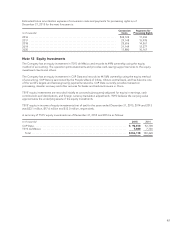

Note 13 Long-term Borrowings and Capital Lease Obligations

Long-term debt as of December 31, 2015 and 2014 consists of:

(in thousands) 2015 2014

2.375% Senior Notes due June 1, 2018 (5 year tranche), net of discount ............ $ 549,919 549,889

3.75% Senior Notes due June 1, 2023 (10 year tranche), net of discount ............ 546,746 546,379

LIBOR + 1.125%, unsecured term loan, due April 8, 2018, with quarterly principal and

interest payments ........................................................ 175,000 185,000

LIBOR + 1.125%, unsecured term loan, due September 10, 2017, with quarterly

principal and interest payments ............................................ 120,000 131,250

1.38% note payable due January 31, 2017, with monthly interest and principal

payments ............................................................... 30,000 —

1.50% note payable, due September 30, 2016, with monthly interest and principal

payments ............................................................... 5,132 11,886

LIBOR + 2.0%, unsecured term loan, due December 7, 2017, with monthly interest

payments and principal paid at maturity ..................................... 3,202 1,396

1.50% note payable, due January 31, 2016, with monthly interest and principal

payments ............................................................... 336 4,332

1.50% note payable, due December 31, 2015, with monthly interest and principal

payments ............................................................... —10,075

1.50% note payable, due July 31, 2015, with monthly interest and principal

payments ............................................................... —1,709

Total debt .............................................................. 1,430,335 1,441,916

Less current portion ...................................................... 50,364 43,784

Noncurrent portion of long-term debt ....................................... $1,379,971 1,398,132

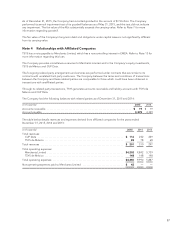

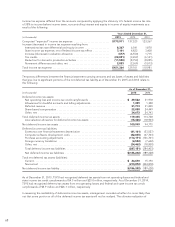

During December 2014, EMEA obtained a £900,000, or approximately $1.4 million term loan. In September

2015, TSYS increased the loan by £1.3 million, or approximately $1.9 million. The loan bears interest at a rate of

LIBOR plus two percent. The loan matures in December 2017, and has monthly interest payments. The lender in

this transaction is Merchants Limited, who has a noncontrolling interest in EMEA. The balance as of

December 31, 2015 was $3.2 million.

In December 2015, the Company entered into a $30.0 million financing agreement for perpetual software

licenses. The balance as of December 31, 2015 was $30.0 million.

In September 2014, the Company entered into a $13.6 million financing agreement for perpetual software

licenses. The balance as of December 31, 2015 was $5.1 million.

In December 2013, the Company entered into a $20.0 million financing arrangement to purchase additional

software licenses. The financing arrangement was repaid in 2015.

TSYS acquired additional mainframe software licenses to increase capacity in 2012. The Company entered into an

$8.6 million and an $11.9 million financing agreement in June and December of 2012, respectively, to purchase

these additional software licenses. The balance as of December 31, 2015 for the $11.9 million financing

agreement was $0.3 million. The $8.6 million financing agreement was repaid in 2015.

In addition, TSYS maintains an unsecured credit agreement with Columbus Bank and Trust. The credit agreement

has a maximum available principal balance of $5.0 million, with interest at prime. TSYS did not use the credit

facility during 2015, 2014 or 2013.

Acquisition-Related Borrowings

In April 2013, the Company entered into a Credit Agreement (the “Credit Agreement”) with JPMorgan Chase

Bank, N.A., as Administrative Agent, The Bank of Tokyo-Mitsubishi UFJ, Ltd., as Syndication Agent, Regions Bank

64