NetSpend 2015 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2015 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

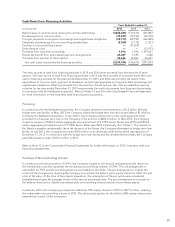

Additional Cash Flow Information

Off-Balance Sheet Financing

TSYS uses various operating leases in its normal course of business. These “off-balance sheet” arrangements

obligate TSYS to make payments for computer equipment, software and facilities. These computer and software

lease commitments may be replaced with new lease commitments due to new technology. Management expects

that, as these leases expire, they will be evaluated and renewed or replaced by similar leases based on need.

The following table summarizes future contractual cash obligations, including lease payments and software

arrangements, as of December 31, 2015, for the next five years and thereafter:

Contractual Cash Obligations

Payments Due By Period

(in thousands) Total 1 Year

or Less 2-3

Years 4-5

Years After

5 Years

Debt obligations (principal) ........................ $1,433,669 50,364 833,305 — 550,000

Debt obligations (interest) ......................... 195,403 37,932 64,658 41,250 51,563

Operating leases ................................ 495,238 123,812 218,550 130,159 22,716

Purchase commitments ........................... 67,425 18,144 27,165 22,091 25

Redeemable noncontrolling interest ................ 23,410 — 23,410 — —

Capital lease obligations .......................... 7,362 3,637 3,662 63 —

Total contractual cash obligations .................. $2,222,507 233,889 1,170,750 193,563 624,304

Amounts utilize prevailing interest rates as of December 31, 2015.

Income Taxes

The total liability for uncertain tax positions as of December 31, 2015 is $13.1 million. Refer to Note 15 in the

Consolidated Financial Statements for more information on income taxes. The Company is not able to reasonably

estimate the amount by which the liability will increase or decrease over time; however, at this time, the

Company does not expect any significant changes related to these obligations within the next twelve months.

Foreign Operations

TSYS operates internationally and is subject to the impact of adverse movements in foreign currency exchange

rates. TSYS does not enter into foreign exchange forward contracts to reduce its exposure to foreign currency

rate changes; however, the Company continues to analyze the potential use of hedging instruments to safeguard

it from significant foreign currency translation risks.

TSYS maintains operating cash accounts outside the United States. Refer to Note 5 in the Consolidated Financial

Statements for more information on cash and cash equivalents. TSYS has adopted the permanent reinvestment

exception under GAAP with respect to future earnings of certain foreign subsidiaries. While some of the foreign

cash is available to repay intercompany financing arrangements, remaining amounts are not presently available to

fund domestic operations and obligations without paying a significant amount of taxes upon its repatriation.

Demand on the Company’s cash has increased as a result of its strategic initiatives. TSYS funds these initiatives

through a balance of internally generated cash, external sources of capital and, when advantageous, access to

foreign cash in a tax efficient manner. Where local regulations limit an efficient intercompany transfer of amounts

held outside of the U.S., TSYS will continue to utilize these funds for local liquidity needs. Under current law,

balances available to be repatriated to the U.S. would be subject to U.S. federal income taxes, less applicable

foreign tax credits. TSYS has provided for the U.S. federal tax liability on these amounts for financial statement

purposes, except for foreign earnings that are considered permanently reinvested outside of the U.S. TSYS

utilizes a variety of tax planning and financing strategies with the objective of having its worldwide cash available

in the locations where it is needed.

37