NetSpend 2015 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2015 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.interim periods in fiscal years beginning after December 15, 2015. Early adoption is permitted. The Company

does not expect the adoption of this ASU to have a material impact on the Company’s financial position, results

of operations or cash flows.

In June 2015, the FASB issued ASU 2015-15 “Presentation and Subsequent Measurement of Debt Issuance Costs

Associated with Line-of-Credit Arrangements – Amendments to SEC Paragraphs Pursuant to Staff Announcement

at June 18, 2015 EITF Meeting.” This ASU allows entities to defer and present debt issuance costs as an asset

and subsequently amortize deferred debt issuance costs ratably over the term of a line-of-credit arrangement.

The guidance is effective for annual periods and interim periods within those annual periods beginning after

December 15, 2015. Early adoption is permitted. The guidance will be applied retrospectively. The Company

does not expect the adoption of this guidance to have a material impact on the Company’s financial position,

results of operations or cash flows.

In April 2015, the FASB issued ASU 2015-05 “Intangibles – Goodwill and Other – Internal-Use Software (Subtopic

350-40): Customer’s Accounting for Fees Paid in a Cloud Computing Arrangement.” The amendments in this

Update provide guidance to customers about whether a cloud computing arrangement includes a software

license or a service agreement. The Company does not expect the adoption of this ASU to have a material

impact on the Company’s financial position, results of operations or cash flows.

In April 2015, the FASB issued ASU 2015-03 “Interest – Imputation of Interest (Subtopic 835-30), Simplifying the

Presentation of Debt Issuance Cost.” The amendments in this update will require entities to present debt

issuance costs in the balance sheet as a direct deduction from the carrying amount of the corresponding debt

liability, consistent with debt discounts. The guidance is effective for annual periods and interim periods within

those annual periods beginning after December 15, 2015. Early adoption is permitted. The guidance will be

applied retrospectively. The Company does not expect the adoption of this guidance to have a material impact

on the Company’s financial position, results of operations or cash flows.

In January 2015, the FASB issued ASU 2015-01 “Income Statement – Extraordinary and Unusual Items (Subtopic

225-20): Simplifying Income Statement Presentation by Eliminating the Concept of Extraordinary Items.” ASU

2015-01 eliminates from GAAP the concept of extraordinary items. For all entities, the ASU is effective for fiscal

years, and interim periods within those years, beginning after December 15, 2015. Early adoption is permitted

provided the guidance is applied from the beginning of the fiscal year of adoption. The Company does not

expect the adoption of this ASU to have a material impact on the financial position, results of operations or cash

flows of the Company.

In May 2014, the FASB issued ASU 2014-09 “Revenue from Contracts with Customers,” which requires an entity

to recognize the amount of revenue to which it expects to be entitled for the transfer of promised goods or

services to customers. The ASU will replace most existing revenue recognition guidance in U.S. GAAP when it

becomes effective. The new standard is effective for the Company on January 1, 2018. Early application is not

permitted. The standard permits the use of either the retrospective or cumulative effect transition method. The

Company is evaluating the effect that ASU 2014-09 will have on its consolidated financial statements and related

disclosures. The Company has not yet selected a transition method nor has it determined the effect on its

ongoing financial reporting.

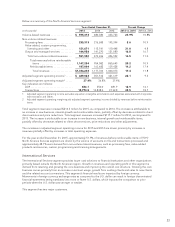

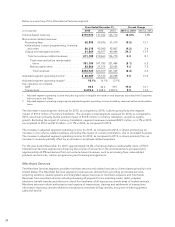

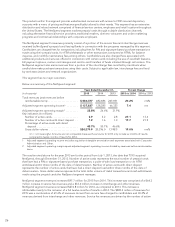

Results of Operations

Revenues

The Company generates revenues by providing transaction processing and other payment-related services. The

Company’s pricing for transactions and services is complex. Each category of revenue has numerous fee

components depending on the types of transactions processed or services provided. TSYS reviews its pricing and

implements pricing changes on an ongoing basis. In addition, standard pricing varies among its regional

businesses, and such pricing can be customized further for customers through tiered pricing of various thresholds

for volume activity. TSYS’ revenues are based upon transactional information accumulated by its systems or

reported by its customers. The Company’s revenues are impacted by currency translation of foreign operations,

as well as doing business in the current economic environment.

18