NetSpend 2015 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2015 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

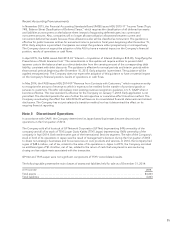

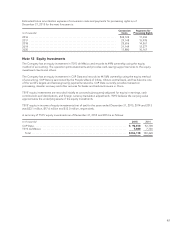

The changes in the carrying amount of goodwill as of December 31, 2015 and 2014 are as follows:

(in thousands) North America

Services International

Services Merchant

Services NetSpend Consolidated

Balance as of December 31, 2013 ...... $70,796 34,201 413,748 1,024,434 $ 1,543,179

Disposal of GP Net ................ (182) (1,605) — — (1,787)

NetSpend purchase price

allocation ...................... — — — 8,525 8,525

Currency translation adjustments .... — (2,520) — — (2,520)

Balance as of December 31, 2014 ...... $70,614 30,076 413,748 1,032,959 $ 1,547,397

NetSpend tax adjustment ......... — — — 627 627

Currency translation adjustments .. — (2,600) — — (2,600)

Balance as of December 31, 2015 .... $70,614 $27,476 $413,748 $1,033,586 $1,545,424

Refer to Note 24 for more information on acquisitions.

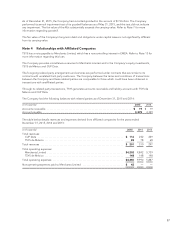

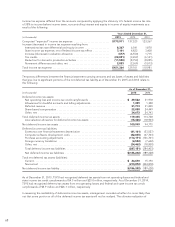

Note 8 Other Intangible Assets, net

In 2015, the changes related to other gross intangible assets were related to foreign currency translation and an

acquisition of an acquisition technology intangible asset. Refer to Note 24 for more information on acquisitions.

Significant components of other intangible assets as of December 31, 2015 and 2014 are summarized as follows:

2015

(in thousands) Gross Accumulated

Amortization Net

Channel relationships .......................................... $ 318,600 (99,909) $218,691

Customer relationships ......................................... 166,579 (104,736) 61,843

Trade name ................................................... 46,422 (24,422) 22,000

Database ..................................................... 28,000 (14,000) 14,000

Covenants-not-to-compete ..................................... 14,940 (7,834) 7,106

Trade association .............................................. 10,000 (5,750) 4,250

Favorable lease ............................................... 875 (445) 430

Total ....................................................... $ 585,416 (257,096) $328,320

2014

(in thousands) Gross Accumulated

Amortization Net

Channel relationships ............................................. $318,600 (60,079) $258,521

Customer relationships ............................................ 167,140 (87,201) 79,939

Trade name ..................................................... 46,480 (15,680) 30,800

Database ....................................................... 28,000 (8,400) 19,600

Covenants-not-to-compete ........................................ 14,940 (5,551) 9,389

Trade association ................................................. 10,000 (4,750) 5,250

Favorable lease .................................................. 875 (267) 608

Total ....................................................... $586,035 (181,928) $404,107

Amortization related to other intangible assets, which is recorded in selling, general and administrative expenses,

was $75.8 million, $77.3 million and $50.0 million for 2015, 2014 and 2013, respectively.

59