NetSpend 2015 Annual Report Download - page 84

Download and view the complete annual report

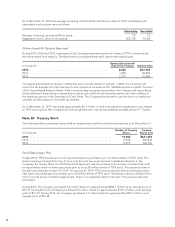

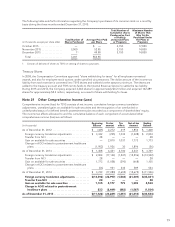

Please find page 84 of the 2015 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Consistent with its overall strategy of pursuing international investment opportunities, TSYS adopted the

permanent reinvestment exception under GAAP, with respect to future earnings of certain foreign subsidiaries. Its

decision to permanently reinvest foreign earnings offshore means TSYS will no longer allocate taxes to foreign

currency translation adjustments associated with these foreign subsidiaries accumulated in other comprehensive

income.

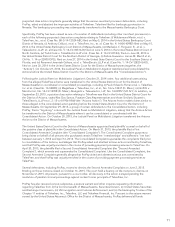

Note 22 Segment Reporting, including Geographic Area Data and Major Customers

TSYS provides global payment processing and other services to card-issuing and merchant acquiring institutions

in the United States and internationally through online accounting and electronic payment processing systems.

Corporate expenses, such as finance, legal, human resources, mergers and acquisitions and investor relations are

categorized as Corporate Administration and Other.

In the first quarter of 2014, the Company’s Japan-based entities qualified for discontinued operations treatment.

In July 2013, TSYS completed its acquisition of all the outstanding stock of NetSpend, which previously operated

as a publicly traded company. NetSpend’s financial results are included in the NetSpend segment.

Refer to Note 24 for more information on acquisitions.

North America Services includes electronic payment processing services and other services provided from within

the North America region. International Services includes electronic payment processing and other services

provided from outside the North America region. Merchant Services includes electronic processing and other

services provided to merchants and merchant acquirers. The NetSpend segment provides GPR prepaid debit and

payroll cards and alternative financial service solutions to the underbanked and other consumers in the United

States.

At TSYS, the chief operating decision maker (CODM) is a group consisting of Senior Executive Management and

above. In the first quarter of 2014, the CODM decided that all share-based compensation costs should be

included in the category “Corporate Administration and Other” for purposes of segment disclosures. All prior

periods were restated to reflect this change. This change is used to evaluate performance and assess resources

starting in the first quarter of 2014. The information utilized by the CODM consists of the financial statements and

the main metrics monitored are revenue growth and growth in profitability.

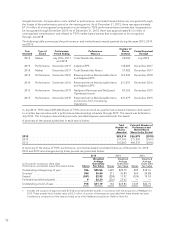

Upon completion of the NetSpend acquisition in 2013, the CODM implemented a new metric called adjusted

segment operating income in order to analyze each segment’s results of operations. This new metric consists of

operating income adjusted for amortization of acquisition related intangibles and corporate administrative and

other costs. All periods presented have been adjusted to reflect this new measure. Depreciation and amortization

for the segments changed as a result of this new metric removing amortization associated with intangible assets

from the total for the segments.

The Company believes the terms and conditions of transactions between the segments are comparable to those

which could have been obtained in transactions with unaffiliated parties. TSYS’ operating segments share certain

resources, such as information technology support, that TSYS allocates asymmetrically.

80