NetSpend 2015 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2015 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the account’s transactions. Fraud management services monitor the unauthorized use of accounts which have

been reported to be lost, stolen, or which exceed credit limits. Fraud detection systems help identify fraudulent

transactions by monitoring each account holder’s purchasing patterns and flagging unusual purchases. Other

services provided include customized communications to cardholders, information verification associated with

granting credit, debt collection and customer service.

TSYS’ revenues in its North America Services and International Services segments are derived from electronic

payment processing. There are certain basic core services directly tied to accounts on file and transactions. These

are provided to all of TSYS’ processing clients. The core services begin with an account on file.

The core services include housing an account on TSYS’ system (AOF), authorizing transactions (authorizations),

accumulating monthly transactional activity (transactions) and providing a monthly statement (statements billed).

From these core services, TSYS’ clients also have the option to use fraud and portfolio management services.

Collectively, these services are considered volume-based revenues.

Non-volume related revenues include processing fees which are not directly associated with AOF and

transactional activity, such as value added products and services, custom programming and certain other

services, which are only offered to TSYS’ processing clients.

Value added products and services, which includes services such as data analytics and application processing, are

primarily non-volume related and are only offered to TSYS’ processing clients (i.e., indirectly derived from

accounts on file). These ancillary products and services, along with offerings such as card production, statement

production, managed services, customized reporting and custom programming provided to clients at an hourly

rate, are considered non-volume based products and services.

Additionally, certain clients license the Company’s processing systems and process in-house. Since the accounts

are processed outside of TSYS for licensing arrangements, the AOF and other volumes are not available to TSYS.

Thus, volumes reported by TSYS do not include volumes associated with licensing.

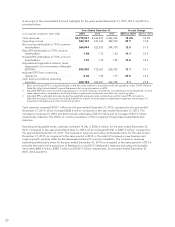

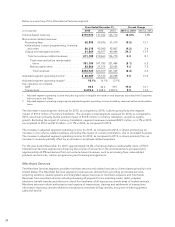

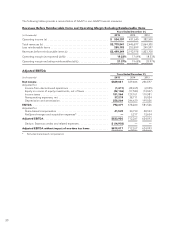

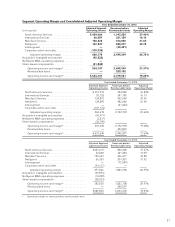

A summary of each segment’s results follows:

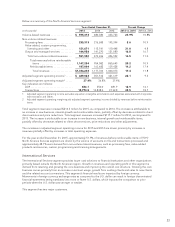

North America Services

The North America Services segment provides issuer account solutions for financial institutions and other

organizations primarily based in North America. Growth in revenues and operating profit in this segment is

derived from retaining and growing the core business and improving the overall cost structure. Growing the core

business comes primarily from an increase in account usage, growth from existing clients and sales to new clients

and the related account conversions.

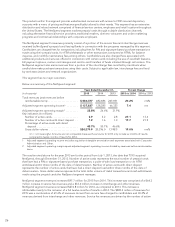

In July 2012, TSYS executed a master services agreement, with a minimum six year term, with Bank of America to

provide processing services for its consumer credit card portfolios in the U.S. In addition, TSYS continues to

process Bank of America’s commercial credit card portfolios in the U.S. and internationally. In May 2015, the

contract term for processing both the consumer and commercial credit card portfolios was extended for an

additional 18 months.

The master services agreement with Bank of America provides for a tiered-pricing arrangement for both the

consumer card portfolio and the existing commercial card portfolios.

This segment has two major customers.

22