NetSpend 2015 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2015 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

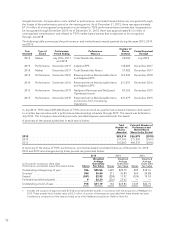

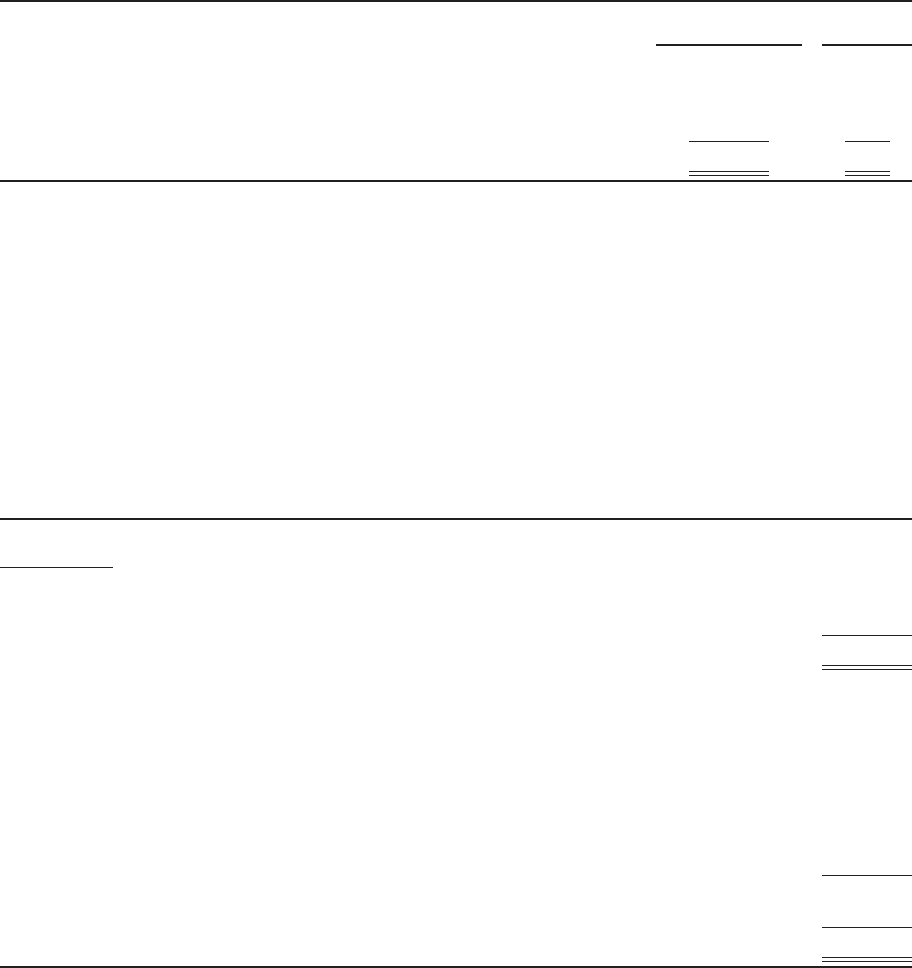

Under the terms of the Merger Agreement, the Company replaced unvested share-based awards for certain

current employees of NetSpend. The following table provides a list of all replacement awards and the estimated

fair value of those awards issued in conjunction with the acquisition of NetSpend:

Number of Shares

and Options Issued Fair Value

(in millions)

Time-based restricted stock ........................................... 870,361 $21.5

Non-qualified stock options ........................................... 530,696 8.4

Incentive stock options ............................................... 529,452 5.3

Performance-based restricted stock ..................................... 87,356 2.2

Total ............................................................ 2,017,865 $37.4

The portion of the fair value of the replacement awards related to services provided prior to the business

combination was included in the total purchase price. The portion of the fair value associated with future service

is recognized as expense over the future service period, which varies by award. The Company determined that

$15.6 million ($11.1 million net of tax) of the replacement awards was related to services rendered prior to the

business combination.

The goodwill amount of $1.0 billion arising from the acquisition consists largely of expansion of customer base,

differentiation in market opportunity and economies of scale expected from combining the operations of TSYS

and NetSpend. All of the goodwill was assigned to TSYS’ new NetSpend segment. The goodwill recognized is

not expected to be deductible for income tax purposes.

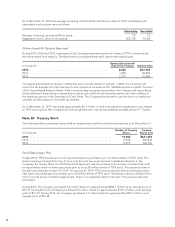

The following table summarizes the consideration paid for NetSpend and the initially recognized amounts of the

identifiable assets acquired and liabilities assumed on July 1, 2013 (the acquisition date).

(in thousands)

Consideration

Cash ................................................................................ $1,355,270

Equity instruments .................................................................... 15,557

Dissenting shareholder liability* ......................................................... 25,723

Fair value of total consideration transferred ................................................ $1,396,550

Recognized amounts of identifiable assets acquired and liabilities assumed:

Cash ................................................................................ $ 40,610

Accounts receivable ................................................................... 11,335

Property equipment and software ........................................................ 11,657

Identifiable intangible assets ............................................................ 480,086

Deferred tax asset ..................................................................... 10,165

Other assets ......................................................................... 36,660

Deferred tax liability ................................................................... (155,945)

Financial liabilities ..................................................................... (62,452)

Total identifiable net assets ............................................................. 372,116

Goodwill ............................................................................ 1,024,434

$1,396,550

* Represents 1.6 million NetSpend shares held by dissenting shareholders

In 2015, the Company adjusted goodwill for NetSpend to include an additional $627,000 for a change in a sales

and use tax reserve associated with the acquisition. As of December 31, 2014, goodwill related to NetSpend

increased $8.5 million due to changes during the measurement period. For more information, refer to Note 7.

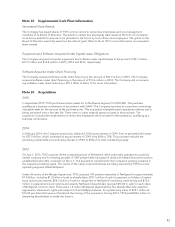

Identifiable intangible assets acquired in the NetSpend acquisition include channel relationships, current

technology, a prospect database, the NetSpend trade name and non-compete agreements.

84