NetSpend 2015 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2015 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.associated with Telexfree held for chargeback and other purposes by ProPay to US Immigration and Customs

Enforcement. In addition, ProPay received a notice of potential claim from the bankruptcy Trustee as a result of

the relationship of ProPay with Telexfree and its affiliates.

The above proceedings and actions are preliminary in nature. While the Company and ProPay intend to

vigorously defend matters arising out of the relationship of ProPay with Telexfree and believe ProPay has

substantial defenses related to these purported claims, the Company currently cannot reasonably estimate losses

attributable to these matters.

GUARANTEES AND INDEMNIFICATIONS: The Company has entered into processing and licensing

agreements with its clients that include intellectual property indemnification clauses. Under these clauses, the

Company generally agrees to indemnify its clients, subject to certain exceptions, against legal claims that TSYS’

services or systems infringe on certain third party patents, copyrights or other proprietary rights. In the event of

such a claim, the Company is generally obligated to hold the client harmless and pay for related losses, liabilities,

costs and expenses, including, without limitation, court costs and reasonable attorney’s fees. The Company has

not made any indemnification payments pursuant to these indemnification clauses.

A portion of the Company’s business is conducted through distributors that provide load and reload services to

cardholders at their locations. Members of the Company’s distribution and reload network collect cardholder

funds and remit them by electronic transfer to the Issuing Banks for deposit in the cardholder accounts. The

Company’s Issuing Banks typically receive cardholders’ funds no earlier than three business days after they are

collected by the distributor. If any distributor fails to remit cardholders’ funds to the Company’s Issuing Banks,

the Company typically reimburses the Issuing Banks for the shortfall created thereby. The Company manages the

risk associated with this process through a formalized set of credit standards, volume limits and deposit

requirements for certain distributors and by typically maintaining the right to offset any settlement shortfall

against the commissions payable to the relevant distributor. To date, the Company has not experienced any

significant losses associated with settlement failures and the Company had not recorded a settlement guarantee

liability as of December 31, 2015. As of December 31, 2015, the Company’s estimated gross settlement

exposure was $9.9 million.

GPR cardholders can incur charges in excess of the funds available in their accounts and are liable for the

resulting overdrawn account balance. Although the Company generally declines authorization attempts for

amounts that exceed the available balance in a cardholder’s account, the application of the Networks’ rules and

regulations, the timing of the settlement of transactions and the assessment of subscription, maintenance or

other fees can, among other things, result in overdrawn card accounts. The Company also provides, as a courtesy

and in its discretion, certain cardholders with a “cushion” that allows them to overdraw their card accounts by up

to $10. In addition, eligible cardholders may enroll in the Issuing Banks’ overdraft protection programs and fund

transactions that exceed the available balance in their accounts. The Company generally provides the funds used

as part of these overdraft programs (one of the Company’s Issuing Banks will advance the first $1.0 million on

behalf of its cardholders) and is responsible to the Issuing Banks for any losses associated with any overdrawn

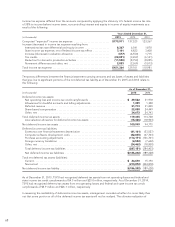

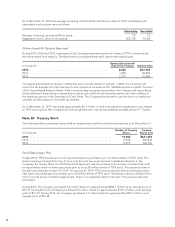

account balances. As of December 31, 2015 and 2014, cardholders’ overdrawn account balances totaled $17.9

million and $14.0 million, respectively. As of December 31, 2015 and 2014, the Company’s reserves for the losses

it estimates will arise from processing customer transactions, debit card overdrafts, chargebacks for unauthorized

card use and merchant-related chargebacks due to non-delivery of goods or services was $9.4 million and $6.3

million, respectively.

The Company has not recorded a liability for guarantees or indemnities in the accompanying consolidated

balance sheet since the maximum amount of potential future payments under such guarantees and indemnities is

not determinable.

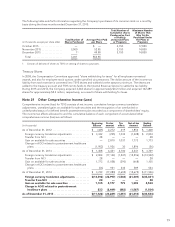

PRIVATE EQUITY INVESTMENTS: The Company has entered into limited partnership agreements in

connection with investing in two Atlanta-based venture capital funds focused exclusively on investing in

technology-enabled financial services companies. Pursuant to each limited partnership agreement, the Company

has committed to invest up to $20.0 million in each fund so long as its ownership interest in each fund does not

exceed 50%. As of December 31, 2015 and 2014, the Company had made contributions to the funds of $15.0

million and $10.8 million, respectively. The Company had investments, including gains, totaling $17.6 million and

72