NetSpend 2015 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2015 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

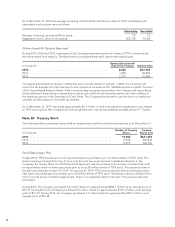

straight-line basis. Compensation costs related to performance- and market-based shares are recognized through

the longer of the performance period or the vesting period. As of December 31, 2015, there was approximately

$11.0 million of unrecognized compensation cost related to TSYS performance-based awards that is expected to

be recognized through December 2018. As of December 31, 2015, there was approximately $1.5 million of

unrecognized compensation cost related to TSYS market-based awards that is expected to be recognized

through July 2018.

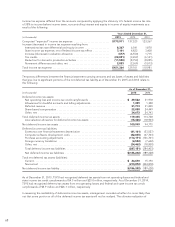

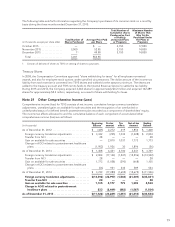

The following table summarizes the performance- and market-based awards granted during the years 2015, 2014

and 2013:

Year

Awarded Type of

Award Performance

Period Ending Performance

Measure

Number of

Shares

Granted Period Expensed

Through

2015 Market July 2016, 2017

and 2018

Total Shareholder Return 25,000 July 2018

2015 Performance December 2017 Adjusted EPS 135,289 December 2017

2015 Market December 2017 Total Shareholder Return 57,982 December 2017

2015 Performance December 2015 Revenues before Reimbursable Items

and Adjusted EPS

165,543 December 2018

2014 Performance December 2016 Revenues before Reimbursable Items

and Adjusted EPS

211,593 December 2016

2013 Performance December 2015 NetSpend Revenues and NetSpend

Operating Income

87,356 December 2015

2013 Performance December 2015 Revenues before Reimbursable Items

and Income from Continuing

Operations

237,679 December 2015

In July 2013, TSYS issued 225,000 shares of TSYS common stock as a performance-based retention stock award

to a certain key executive with a performance-based vesting schedule through 2015. This award was forfeited in

July 2014. The Company reversed all previously recorded expense associated with this award.

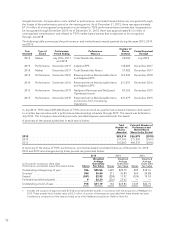

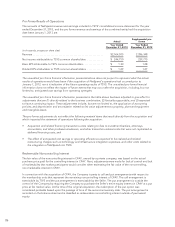

A summary of the awards authorized in each year is below:

Total

Number of

Shares

Awarded

Potential Number of

Performance-and

Market-Based

Shares to be Vested

2015 ............................................................. 383,814 526,879 (2018)

2014 .............................................................. 211,593 211,593 (2017)

2013 .............................................................. 563,803 400,539 (2016)

A summary of the status of TSYS’ performance- and market-based nonvested shares as of December 31, 2015,

2014 and 2013 and changes during those periods are presented below:

2015 2014 2013

(in thousands, except per share data)

Performance- and market-based Nonvested shares Shares

Weighted

Average

Grant Date

Fair Value Shares

Weighted

Average

Grant Date

Fair Value Shares

Weighted

Average

Grant Date

Fair Value

Outstanding at beginning of year ............. 766 $25.86 1,049 $22.75 809 $18.76

Granted1.................................. 384 36.84 211 30.89 564 24.88

Vested .................................... (241) 22.92 (258) 17.57 (324) 15.93

Forfeited/canceled/adjusted .................. 9 22.20 (236) 25.62 — —

Outstanding at end of year ................... 918 $31.19 766 $25.86 1,049 $22.75

1 Includes the issuance of approximately 87,356 stock replacement awards in connection with the acquisition of NetSpend in

2013. These awards had a market value of $2.2 million. A portion of the expense associated with these awards has been

included as a component of the total purchase price of the NetSpend acquisition. Refer to Note 24.

76