Metro PCS 2011 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2011 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.87

In May 2011, the FASB issued ASU 2011-04, "Fair Value Measurement - Amendments to Achieve Common Fair Value

Measurement and Disclosure Requirements in U.S. GAAP and IFRSs," addressing how to measure fair value and what

disclosures to provide about fair value measurements. This amendment is largely consistent with the existing GAAP guidance,

but aligned the international guidance and eliminated unnecessary wording differences between GAAP and International

Financial Reporting Standards ("IFRS"). The amendment is effective for interim and annual periods beginning after December

15, 2011, and should be applied prospectively. The implementation of this standard will not affect the Company's financial

condition, results of operations, or cash flows.

In June 2011, the FASB issued ASU 2011-05 "Statement of Comprehensive Income," which revises the manner in which

entities present comprehensive income in their financial statements, requiring entities to report components of comprehensive

income in either (1) a continuous statement of comprehensive income or (2) two separate but consecutive statements. The

amendments are effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2011 and

should be applied retrospectively. The implementation of this standard will not affect the Company's financial condition, results

of operations, or cash flows.

Fair Value Measurements

We do not expect changes in the aggregate fair value of our financial assets and liabilities to have a material adverse

impact on the consolidated financial statements. See Note 9 to the financial statements included in this report.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

Market risk is the potential loss arising from adverse changes in market prices and rates, including interest rates. We do

not routinely enter into derivatives or other financial instruments for trading, speculative or hedging purposes, unless it is

hedging interest rate risk exposure or is required by our senior secured credit facility, as amended. We do not currently conduct

business internationally, so we are generally not subject to foreign currency exchange rate risk.

As of December 31, 2011, we had approximately $2.5 billion in outstanding indebtedness under our senior secured credit

facility, as amended, that bears interest at floating rates based on LIBOR plus 3.821% for the Tranche B-2 Term Loans and

LIBOR plus 3.75% for the Tranche B-3 Term Loans and Incremental Tranche B-3 Term Loans. The interest rate on the

outstanding debt under our senior secured credit facility, as amended, as of December 31, 2011 was 5.065%, which includes the

impact of our interest rate protection agreements. In March 2009, we entered into three separate two-year interest rate

protection agreements to manage the Company's interest rate risk exposure. These agreements were effective on February 1,

2010 and cover a notional amount of $1.0 billion and effectively convert this portion of our variable rate debt to fixed rate debt

at a weighted average annual rate of 5.927%. The monthly interest settlement periods began on February 1, 2010. These

agreements expired on February 1, 2012. In April 2011, we entered into three separate three-year interest rate protection

agreements to manage the Company's interest rate risk exposure under our senior secured credit facility, as amended. These

agreements were effective on April 15, 2011 and cover a notional amount of $450.0 million and effectively convert this portion

of our variable rate debt to fixed rate debt at a weighted average annual rate of 5.242%. The monthly interest settlement

periods began on April 15, 2011. These agreements expire on April 15, 2014. If market LIBOR rates increase 100 basis points

over the rates in effect at December 31, 2011, annual interest expense on the $1.0 billion in variable rate debt that is not subject

to interest rate protection agreements would increase approximately $10.2 million.

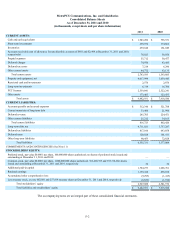

Item 8. Financial Statements and Supplementary Data

The information required by this item is included in Part IV, Item 15(a)(1) and is presented beginning on Page F-1.

Item 9. Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

None.

Item 9A. Controls and Procedures

Evaluation of Disclosure Controls and Procedures

We maintain disclosure controls and procedures that are designed to ensure that information required to be disclosed in

our Exchange Act reports is recorded, processed, summarized and reported as required by the SEC and that such information is

accumulated and communicated to management, including our CEO and CFO, as appropriate, to allow for appropriate and

timely decisions regarding required disclosure. Our management, with participation by our CEO and CFO, has designed the

Company’s disclosure controls and procedures to provide reasonable assurance of achieving these desired objectives. As

required by SEC Rule 13a-15(b), we conducted an evaluation, with the participation of our CEO and CFO, of the effectiveness