Metro PCS 2011 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2011 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

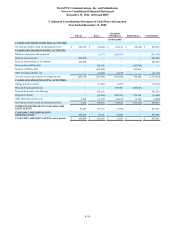

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2011, 2010 and 2009

F-35

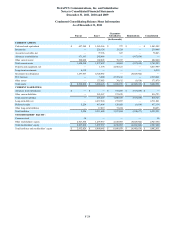

Condensed Consolidating Statement of Cash Flows Information

Year Ended December 31, 2009

Parent Issuer Guarantor

Subsidiaries Eliminations Consolidated

(in thousands)

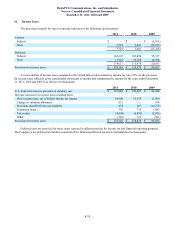

CASH FLOWS FROM OPERATING ACTIVITIES:

Net cash provided by (used in) operating activities $ 258,785 $ (26,058) $ 683,212 $ (16,590) $ 899,349

CASH FLOWS FROM INVESTING ACTIVITIES:

Purchases of property and equipment — (9,177) (822,497) — (831,674)

Purchase of investments (486,645) — — — (486,645)

Proceeds from maturity of investments 262,500 — — — 262,500

Proceeds from affiliate debt — 296,700 — (296,700) —

Issuance of affiliate debt — (465,000) — 465,000 —

Other investing activities, net — (52,028) (9,107) — (61,135)

Net cash (used in) provided by investing activities (224,145) (229,505) (831,604) 168,300 (1,116,954)

CASH FLOWS FROM FINANCING ACTIVITIES:

Change in book overdraft — (17,047) (3,267) — (20,314)

Proceeds from long-term loan — — 465,000 (465,000) —

Proceeds from senior note offerings — 492,250 — — 492,250

Repayment of debt — (16,000) (296,700) 296,700 (16,000)

Other financing activities, net 8,626 (11,925) (20,189) 16,590 (6,898)

Net cash provided by (used in) financing activities 8,626 447,278 144,844 (151,710) 449,038

INCREASE (DECREASE) IN CASH AND CASH

EQUIVALENTS 43,266 191,715 (3,548) — 231,433

CASH AND CASH EQUIVALENTS,

beginning of period 598,823 78,121 21,004 — 697,948

CASH AND CASH EQUIVALENTS, end of period $ 642,089 $ 269,836 $ 17,456 $ — $ 929,381