Metro PCS 2011 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2011 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

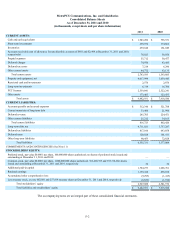

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2011, 2010 and 2009

F-7

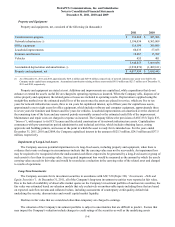

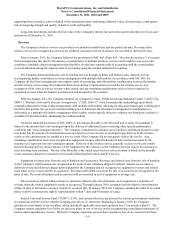

Derivative Instruments and Hedging Activities

The Company accounts for its hedging activities under ASC 815 (Topic 815, “Derivatives and Hedging”). The standard

requires the Company to recognize all derivatives on the consolidated balance sheet at fair value. Changes in the fair value of

derivatives are to be recorded each period in earnings or on the accompanying consolidated balance sheets in accumulated

other comprehensive income (loss) depending on the type of hedged transaction and whether the derivative is designated and

effective as part of a hedged transaction. Gains or losses on derivative instruments reported in accumulated other

comprehensive income (loss) must be reclassified to earnings in the period in which earnings are affected by the underlying

hedged transaction and the ineffective portion of all hedges must be recognized in earnings in the current period. The

Company's use of derivative financial instruments is discussed in Note 5.

Cash and Cash Equivalents

The Company includes as cash and cash equivalents (i) cash on hand, (ii) cash in bank accounts, (iii) investments in

money market funds, and (iv) U.S. Treasury securities with an original maturity of 90 days or less.

Short-Term Investments

The Company's short-term investments consist of securities classified as available-for-sale, which are stated at fair value.

The securities include U.S. Treasury securities with an original maturity of over 90 days. Unrealized gains, net of related

income taxes, for available-for-sale securities are reported in accumulated other comprehensive loss, a component of

stockholders' equity, until realized. The estimated fair values of investments are based on quoted market prices as of the end of

the reporting period. The U.S. Treasury securities reported as of December 31, 2011 have contractual maturities of less than

one year (See Note 4).

Inventories

Substantially all of the Company's inventories are stated at the lower of average cost or market. Inventories consist mainly

of handsets that are available for sale to customers and independent retailers.

Allowance for Uncollectible Accounts Receivable

The Company maintains allowances for uncollectible accounts for estimated losses resulting from the inability of

independent retailers to pay for equipment purchases, for amounts estimated to be uncollectible from other carriers for

intercarrier compensation and for amounts estimated to be uncollectible from customers with mid-cycle plan changes where

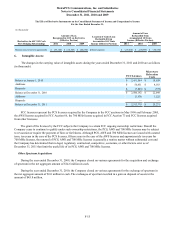

service has been provided prior to the receipt of payment based on billing terms. The following table summarizes the changes

in the Company's allowance for uncollectible accounts (in thousands):

2011 2010 2009

Balance at beginning of period $ 2,494 $ 2,045 $ 4,106

Additions:

Charged to expense 518 2 199

Direct reduction to revenue and other accounts 104 602 595

Deductions (2,515)(155)(2,855)

Balance at end of period $ 601 $ 2,494 $ 2,045