Metro PCS 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

Depreciation and Amortization. Depreciation and amortization expense increased $89.1 million, or 20%, to $538.8

million for the year ended December 31, 2011 from $449.7 million for the year ended December 31, 2010. The increase related

primarily to network infrastructure assets placed into service during the twelve months ended December 31, 2011 to support the

continued growth and expansion of our network.

Loss (gain) on Disposal of Assets. Loss on disposal of assets was $3.6 million for the year ended December 31, 2011

compared to a gain on disposal of assets of $38.8 million for the year ended December 31, 2010. The loss on disposal of assets

during the year ended December 31, 2011 was due primarily to the disposal of assets related to certain network technology that

were retired and replaced with newer technology. The gain on disposal of assets during the year ended December 31, 2010 was

primarily due to spectrum exchange agreements that were consummated during the period.

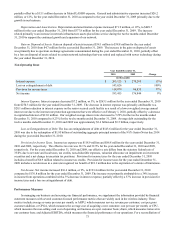

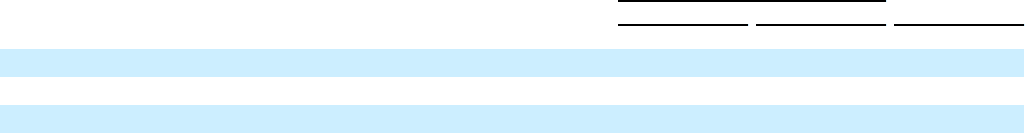

Non-Operating Items

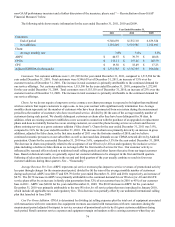

Year Ended December 31,

2011 2010 Change

(in thousands)

Interest expense $ 261,073 $ 263,125 (1%)

Loss on extinguishment of debt 9,536 143,626 (93%)

Provision for income taxes 178,346 118,879 50%

Net income 301,310 193,415 56%

Interest Expense. Interest expense decreased $2.0 million, or 1%, to $261.1 million for the year ended December 31, 2011

from $263.1 million for the year ended December 31, 2010. The decrease in interest expense was primarily attributable to a

$36.7 million decrease in interest expense on our senior notes as a result of the redemption of our 9¼% senior notes due 2014,

or 9¼% Senior Notes, in late 2010 and the issuance of new senior notes at a lower rate of interest. This decrease was partially

offset by a $37.8 million increase in interest expense on the senior secured credit facility, as amended, as a result of the

issuance of a new tranche of term loans in the amount of $500.0 million, or Tranche B-3 Term Loans, in March 2011 as well as

the issuance of an additional $1.0 billion of Tranche B-3 Term Loans, or the Incremental Tranche B-3 Term Loans, in May

2011. This increase in interest expense was partially offset by lower interest expense due to the repayment of $535.8 million of

existing tranche B-1 term loans, or Tranche B-1 Term Loans, in May 2011. Our weighted average interest rate decreased to

6.09% for the twelve months ended December 31, 2011 compared to 7.29% for the twelve months ended December 31, 2010.

Average debt outstanding for the twelve months ended December 31, 2011 and 2010 was approximately $4.2 billion and $3.6

billion, respectively.

Loss on Extinguishment of Debt. The loss on extinguishment of debt of $9.5 million for the year ended December 31,

2011 was due to the repayment of $535.8 million in outstanding principal under the Tranche B-1 Term Loans in May 2011.

The loss on extinguishment of debt of $143.6 million for the year ended December 31, 2010 was due to the redemption of

$1.95 billion of outstanding aggregate principal amount of the 9¼% Senior Notes during the year ended December 31, 2010.

Provision for Income Taxes. Income tax expense was $178.3 million and $118.9 million for the years ended December

31, 2011 and 2010, respectively. The effective tax rate was 37.2% and 38.1% for the years ended December 31, 2011 and

2010, respectively. For the year ended December 31, 2011, our effective tax rate differs from the statutory federal rate of

35.0% primarily due to net state and local taxes, tax credits and state legislative changes. For the year ended December 31,

2010, our effective tax rate differs from the statutory federal rate of 35.0% due to net state and local taxes, tax credits and non-

deductible expenses. Provision for income taxes for the years ended December 31, 2011 and 2010 include a benefit of $4.8

million and $6.9 million, respectively, related to income tax credits.

Net Income. Net income increased $107.9 million, or 56%, to $301.3 million for the year ended December 31, 2011

compared to $193.4 million for the year ended December 31, 2010. The increase was primarily attributable to a 93% decrease

in loss on extinguishment of debt and an increase in income from operations, partially offset by a 50% increase in provision for

income taxes.