Metro PCS 2011 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2011 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2011, 2010 and 2009

F-11

spectrum.

In accordance with the requirements of ASC 350, the Company performs its annual indefinite-lived intangible assets

impairment test as of each September 30th or more frequently if events or changes in circumstances indicate that the carrying

value of the indefinite-lived intangible assets might be impaired. The impairment test consists of a comparison of estimated fair

value with the carrying value. The Company estimates the fair value of its indefinite-lived intangible assets using a direct value

methodology. The direct value approach determines fair value using a discounted cash flow model. Cash flow projections

involve assumptions by management that include a degree of uncertainty including future cash flows, long-term growth rates,

appropriate discount rates, and other inputs. The Company believes that its estimates are consistent with assumptions that

marketplace participants would use to estimate fair value. An impairment loss would be recorded as a reduction in the carrying

value of the related indefinite-lived intangible assets and charged to results of operations.

For the purpose of performing the annual impairment test as of September 30, 2011, the indefinite-lived intangible assets

were aggregated and combined into a single unit of accounting, consistent with the management of the business on a national

scope. No impairment was recognized as a result of the test performed at September 30, 2011 as the fair value of the indefinite

lived intangible assets was in excess of the carrying value. Although the Company does not expect its estimates or assumptions

to change significantly in the future, the use of different estimates or assumptions within the discounted cash flow model when

determining the fair value of the indefinite-lived intangible assets or using a methodology other than a discounted cash flow

model could result in different values for the indefinite-lived intangible assets and may affect any related impairment charge.

The most significant assumptions within the Company's discounted cash flow model are the discount rate, the projected growth

rate, and projected cash flows. A one percent decline in annual revenue growth rates, a one percent decline in annual net cash

flows or a one percent increase in discount rate would result in no impairment as of September 30, 2011.

Furthermore, if any of the indefinite-lived intangible assets are subsequently determined to have a finite useful life, such

assets would be tested for impairment in accordance with ASC 360 (Topic 360, “Property, Plant, and Equipment”), and the

intangible assets would then be amortized prospectively over the estimated remaining useful life. There have been no

subsequent indicators of impairment including those indicated in ASC 360. Accordingly, no subsequent interim impairment

tests were performed.

Advertising and Promotion Costs

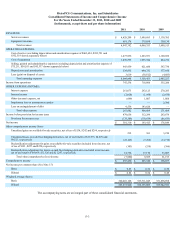

Advertising and promotion costs are expensed as incurred and are included in selling, general and administrative

expenses in the accompanying consolidated statements of income and comprehensive income. Advertising costs totaled $194.3

million, $187.3 million and $150.8 million during the years ended December 31, 2011, 2010 and 2009, respectively.

Income Taxes

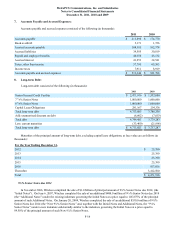

The Company records income taxes pursuant to ASC 740 (Topic 740, “Income Taxes”). ASC 740 uses an asset and

liability approach to account for income taxes, wherein deferred taxes are provided for book and tax basis differences for assets

and liabilities. In the event differences between the financial reporting basis and the tax basis of the Company's assets and

liabilities result in deferred tax assets, a valuation allowance is provided for a portion or all of the deferred tax assets when

there is sufficient uncertainty regarding the Company's ability to recognize the benefits of the assets in future years.

The Company accounts for uncertainty in income taxes recognized in the financial statements in accordance with ASC

740, which provides guidance on the financial statement recognition and measurement of a tax position taken or expected to be

taken in a tax return. ASC 740 also provides guidance on de-recognition, classification, interest and penalties, accounting in

interim periods, disclosures, and transition issues.

Other Comprehensive Income (Loss)

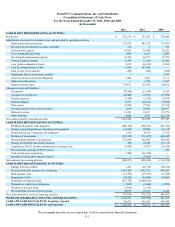

Unrealized gains on available-for-sale securities and cash flow hedging derivatives are reported in accumulated other

comprehensive loss as a separate component of stockholders' equity until realized. Realized gains and losses on available-for-

sale securities are included in interest income. Gains or losses on cash flow hedging derivatives reported in accumulated other

comprehensive loss are reclassified to earnings in the period in which earnings are affected by the underlying hedged

transaction. Accumulated other comprehensive loss consisted of a $3.6 million comprehensive gain related to available-for-sale

securities and a $12.9 million net comprehensive loss related to cash flow hedging derivatives as of December 31, 2011.