Metro PCS 2011 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2011 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86

During the year ended December 31, 2009, we received $52.3 million in fair value of FCC licenses in exchanges with

other parties.

During the year ended December 31, 2010, we closed on various agreements for the exchange of spectrum in the net

aggregate amount of $3.0 million in cash. The spectrum exchanges resulted in a gain on disposal of assets in the amount of

$45.8 million.

In October 2010, we entered into an asset purchase agreement to acquire 10 MHz of AWS spectrum and certain related

network assets adjacent to the Northeast metropolitan areas and surrounding areas for a total purchase price of $49.2 million. In

November 2010, we closed on the acquisition of the network assets and paid a total of $41.1 million in cash. In February 2011,

we closed on the acquisition of the 10 MHz of AWS spectrum and paid $8.0 million in cash. In June 2011, we completed a

final settlement of costs and received $0.5 million in cash as reimbursement for pre-acquisition payments made on behalf of the

seller.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements.

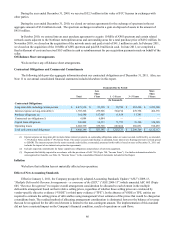

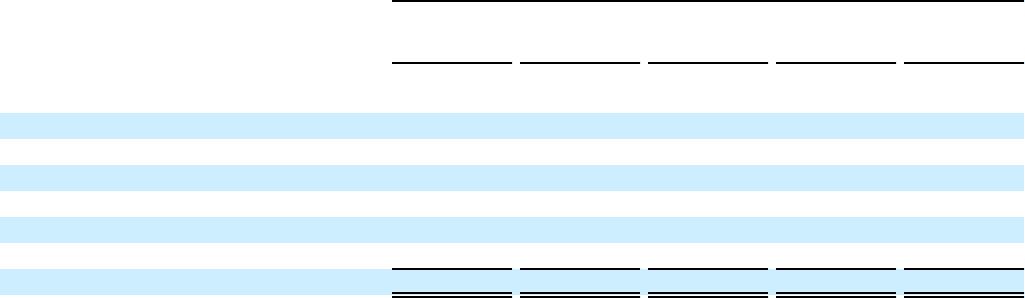

Contractual Obligations and Commercial Commitments

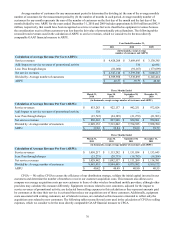

The following table provides aggregate information about our contractual obligations as of December 31, 2011. Also, see

Note 11 to our annual consolidated financial statements included elsewhere in this report.

Payments Due by Period

Total

Less

Than

1 Year 1 - 3 Years 3 - 5 Years

More

Than

5 Years

(In thousands)

Contractual Obligations:

Long-term debt, including current portion $ 4,471,916 $ 25,390 $ 50,780 $ 983,246 $ 3,412,500

Interest expense on long-term debt(1) 1,705,268 259,906 504,194 478,798 462,370

Purchase obligations (2) 181,590 157,907 11,938 11,745 —

Contractual tax obligations (3) 6,084 6,084 — — —

Capital lease obligations 520,802 34,333 71,755 76,126 338,588

Operating leases 2,602,739 339,765 687,464 656,851 918,659

Total cash contractual obligations $ 9,488,399 $ 823,385 $ 1,326,131 $ 2,206,766 $ 5,132,117

————————————

(1) Interest expense on long-term debt includes future interest payments on outstanding obligations under our senior secured credit facility, as amended,

7 7/8% Senior Notes and the 6 5/8% Senior Notes. The senior secured credit facility, as amended, bears interest at a floating rate tied to a fixed spread

to LIBOR. The interest expense for the senior secured credit facility, as amended, presented in this table is based on rates at December 31, 2011 and

includes the impact of our interest rate protection agreements.

(2) Includes expected commitments for future capital lease obligations and purchases of network equipment.

(3) Represents the liability reported in accordance with the provisions of ASC 740 (Topic 740, “Income Taxes”). For further information related to

unrecognized tax benefits, see Note 14, “Income Taxes,” to the consolidated financial statements included in this Report.

Inflation

We believe that inflation has not materially affected our operations.

Effect of New Accounting Standards

Effective January 1, 2011, the Company prospectively adopted Accounting Standards Update (“ASU”) 2009-13,

“Multiple Deliverable Revenue Arrangements – a consensus of the EITF,” (“ASU 2009-13”) which amended ASC 605 (Topic

605, “Revenue Recognition”) to require overall arrangement consideration be allocated to each element in the multiple

deliverable arrangement based on their relative selling prices, regardless of whether those selling prices are evidenced by

vendor-specific objective evidence (“VSOE”) or third party evidence (“TPE”). In the absence of VSOE or TPE, entities are

required to estimate the selling prices of deliverables using management’s best estimates of the prices that would be charged on

a standalone basis. The residual method of allocating arrangement consideration is eliminated; however the balance of revenue

that can be recognized for the delivered element is limited to the non-contingent amount. The implementation of this standard

did not have a material impact on the Company’s financial condition, results of operations or cash flows.