Metro PCS 2011 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2011 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2011, 2010 and 2009

F-13

Recent Accounting Pronouncements

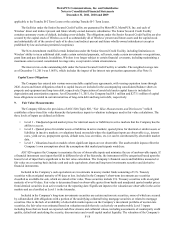

In May 2011, the FASB issued ASU 2011-04, "Fair Value Measurement - Amendments to Achieve Common Fair Value

Measurement and Disclosure Requirements in U.S. GAAP and IFRSs," addressing how to measure fair value and what

disclosures to provide about fair value measurements. This amendment is largely consistent with the existing GAAP guidance,

but aligned the international guidance and eliminated unnecessary wording differences between GAAP and International

Financial Reporting Standards ("IFRS"). The amendment is effective for interim and annual periods beginning after December

15, 2011, and should be applied prospectively. The implementation of this standard will not affect the Company's financial

condition, results of operations, or cash flows.

In June 2011, the FASB issued ASU 2011-05 "Statement of Comprehensive Income," which revises the manner in which

entities present comprehensive income in their financial statements, requiring entities to report components of comprehensive

income in either (1) a continuous statement of comprehensive income or (2) two separate but consecutive statements. The

amendments are effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2011 and

should be applied retrospectively. The implementation of this standard will not affect the Company's financial condition, results

of operations, or cash flows.

3. Asset Acquisition:

In October 2010, the Company entered into an asset purchase agreement to acquire 10 MHz of AWS spectrum and certain

related network assets adjacent to the Northeast metropolitan areas for a total purchase price of $49.2 million. In November

2010, the Company closed on the acquisition of the network assets and paid a total of $41.1 million in cash. In February 2011,

the Company closed on the acquisition of the 10 MHz of AWS spectrum and paid $8.0 million in cash. In June 2011, the

Company completed its final settlement of costs and received $0.5 million in cash as reimbursement for pre-acquisition

payments made on behalf of the seller. The Company used the relative fair values of the assets acquired to allocate the

purchase price, of which $35.6 million was allocated to property and equipment and $13.6 million was allocated to FCC

licenses.

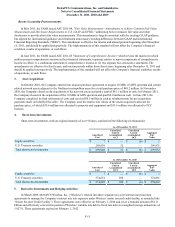

4. Short-term Investments:

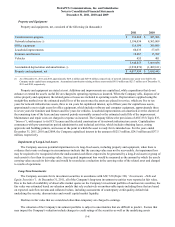

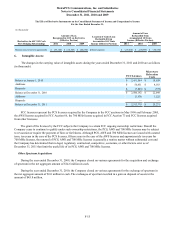

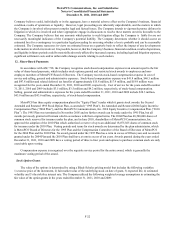

Short-term investments, with an original maturity of over 90 days, consisted of the following (in thousands):

As of December 31, 2011

Amortized

Cost

Unrealized

Gain in

Accumulated

OCI

Unrealized

Loss in

Accumulated

OCI

Aggregate

Fair

Value

Equity securities $ 7 $ — $ (6) $ 1

U.S. Treasury securities 299,939 32 — 299,971

Total short-term investments $ 299,946 $ 32 $ (6) $ 299,972

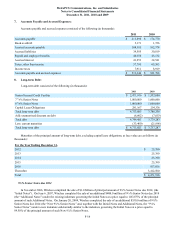

As of December 31, 2010

Amortized

Cost

Unrealized

Gain in

Accumulated

OCI

Unrealized

Loss in

Accumulated

OCI

Aggregate

Fair

Value

Equity securities $ 7 $ — $ (6) $ 1

U.S. Treasury securities 374,681 180 — 374,861

Total short-term investments $ 374,688 $ 180 $ (6) $ 374,862

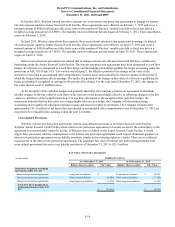

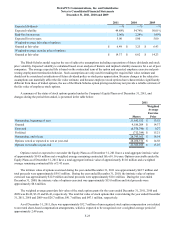

5. Derivative Instruments and Hedging Activities:

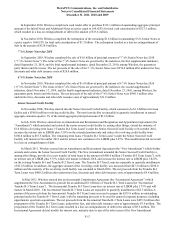

In March 2009, MetroPCS Wireless, Inc. (“Wireless”) entered into three separate two-year interest rate protection

agreements to manage the Company’s interest rate risk exposure under Wireless’ senior secured credit facility, as amended (the

“Senior Secured Credit Facility”). These agreements were effective on February 1, 2010 and cover a notional amount of $1.0

billion and effectively convert this portion of Wireless’ variable rate debt to fixed rate debt at a weighted average annual rate of

5.927%. These agreements expired on February 1, 2012.