Metro PCS 2011 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2011 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.84

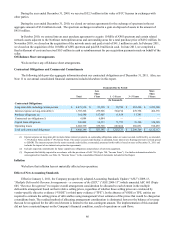

Senior Secured Credit Facility

Wireless, an indirect wholly-owned subsidiary of MetroPCS Communications, Inc., entered into the Senior Secured

Credit Facility on November 3, 2006, or senior secured credit facility. The senior secured credit facility consists of a

$1.6 billion term loan facility and a $100 million revolving credit facility. The term loan facility is repayable in quarterly

installments in annual aggregate amounts equal to 1% of the initial aggregate principal amount of $1.6 billion.

In July 2010, Wireless entered into the Amendment which amended and restated the senior secured credit facility to,

among other things, extend the maturity of the Tranche B-2 Term Loans under the senior secured credit facility to November

2016 as well as increase the interest rate to the London Inter Bank Offered Rate, or LIBOR, plus 3.50% on the extended portion

only and reduce the revolving credit facility from $100.0 million to $67.5 million.

In March 2011, Wireless entered into the New Amendment which further amends and restates the senior secured credit

facility, as amended, to, among other things, provide for the Tranche B-3 Term Loans, which will mature in March 2018 and

have an interest rate of LIBOR plus 3.75%. The New Amendment also increases the interest rate on the existing Tranche B-2

Term Loans under the senior secured credit facility, as amended, to LIBOR plus 3.821%. In addition, the aggregate amount of

the revolving credit facility was increased from $67.5 million to $100.0 million and the maturity of the revolving credit facility

was extended to March 2016. The New Amendment modified certain limitations under the senior secured credit facility, as

amended, including limitations on our ability to incur additional debt, make certain restricted payments, sell assets, make

certain investments or acquisitions, grant liens and pay dividends. In addition, Wireless is no longer subject to certain financial

covenants, including maintaining a maximum senior secured consolidated leverage ratio. However, under certain

circumstances, we could be subject to certain financial covenants that contain ratios based on consolidated Adjusted EBITDA

as defined by the senior secured credit facility, as amended. Under the New Amendment, the definition of consolidated

Adjusted EBITDA has changed and no longer excludes interest and other income.

In May 2011, Wireless entered into the Incremental Agreement which supplements the New Amendment to provide for

the Incremental Tranche B-3 Term Loans which amount was borrowed on May 10, 2011. The Incremental Tranche B-3 Term

Loans have an interest rate of LIBOR plus 3.75% and will mature in March 2018. The Incremental Tranche B-3 Term Loans

are repayable in quarterly installments of $2.5 million. A portion of the proceeds from the Incremental Tranche B-3 Term Loans

were used to prepay the $535.8 million in outstanding principal under the Tranche B-1 Term Loans, with the remaining

proceeds to be used for general corporate purposes, including opportunistic spectrum acquisitions. The net proceeds from the

Incremental Tranche B-3 Term Loans were $455.5 million after prepayment of the Tranche B-1 Term Loans, underwriter fees,

other debt issuance costs of approximately $7.9 million. The Incremental Agreement did not modify the interest rate, maturity

date or any of the other terms of the New Amendment applicable to the Tranche B-2 Term Loans or the existing Tranche B-3

Term Loans.

The facilities under the senior secured credit agreement, as amended, are guaranteed by MetroPCS Communications, Inc.,

MetroPCS, Inc. and each of Wireless' direct and indirect present and future wholly-owned domestic subsidiaries. The senior

secured credit facility, as amended, contains customary events of default, including cross defaults. The obligations under the

senior secured credit facility are also secured by the capital stock of Wireless as well as substantially all of the present and

future assets of Wireless and each of its direct and indirect present and future wholly-owned subsidiaries (except as prohibited

by law and certain permitted exceptions).

In March 2009, Wireless entered into three separate two-year interest rate protection agreements to manage the

Company's interest rate risk exposure under the senior secured credit facility, as amended. These agreements were effective on

February 1, 2010 and covered a notional amount of $1.0 billion and effectively converted this portion of Wireless' variable rate

debt to fixed rate debt at a weighted average annual rate of 5.927%. These agreements expired on February 1, 2012.

In October 2010, Wireless entered into three separate two-year interest rate protection agreements to manage the

Company's interest rate risk exposure under the senior secured credit facility, as amended. These agreements were effective on

February 1, 2012 and cover a notional amount of $950.0 million and effectively convert this portion of Wireless' variable rate

debt to fixed rate debt at a weighted average annual rate of 4.908%. The monthly interest settlement periods began on February

1, 2012. These agreements expire on February 1, 2014.

In April 2011, Wireless entered into three separate three-year interest rate protection agreements to manage its interest

rate risk exposure under the senior secured credit facility, as amended. These agreements were effective on April 15, 2011 and

cover a notional amount of $450.0 million and effectively convert this portion of Wireless’ variable rate debt to fixed rate debt

at a weighted average annual rate of 5.242%. The monthly interest settlement periods began on April 15, 2011. These