Metro PCS 2011 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2011 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

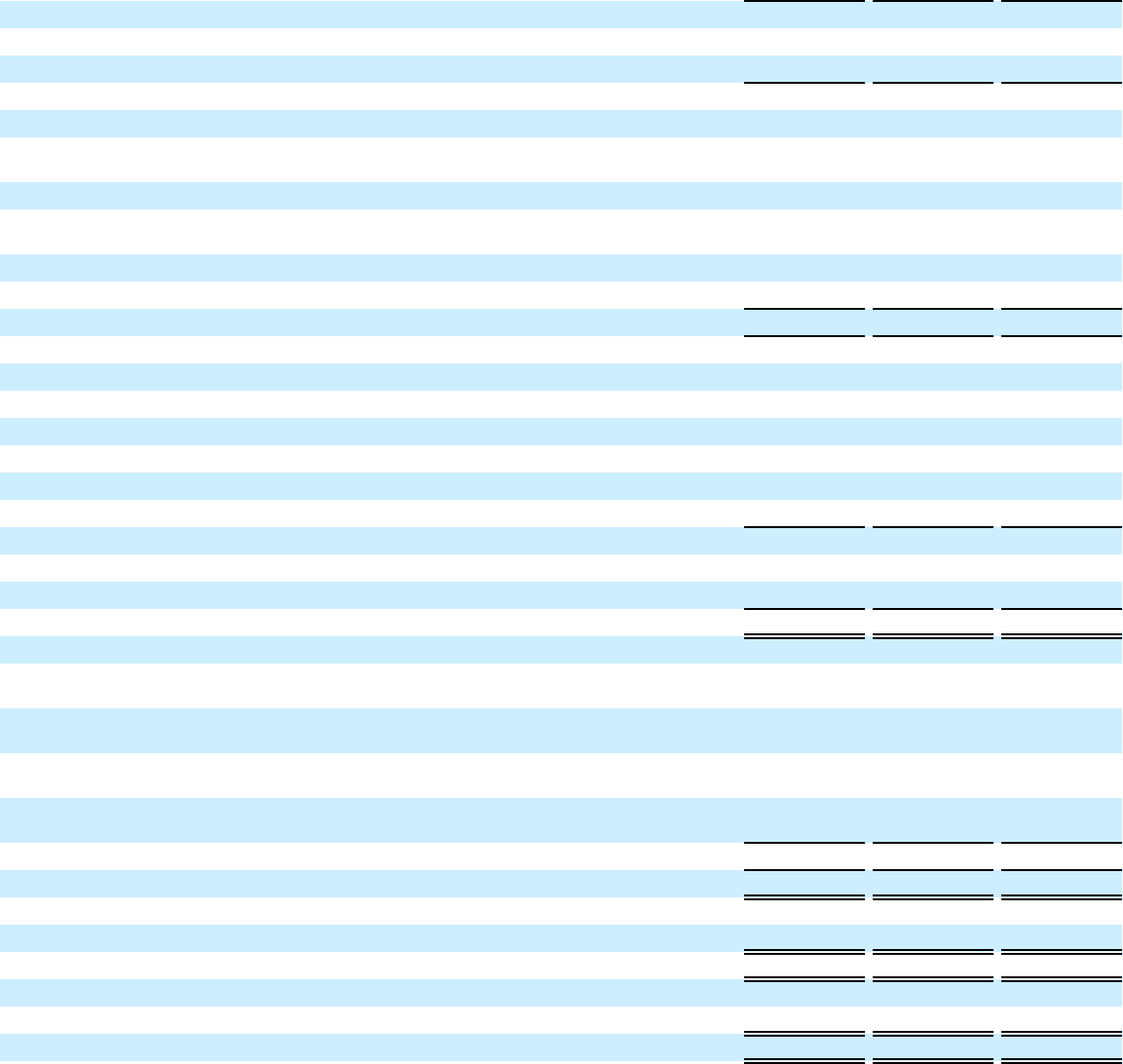

F-3

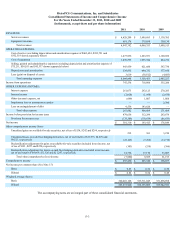

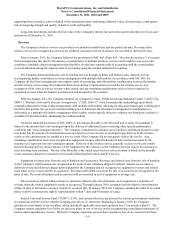

MetroPCS Communications, Inc. and Subsidiaries

Consolidated Statements of Income and Comprehensive Income

For the Years Ended December 31, 2011, 2010 and 2009

(in thousands, except share and per share information)

2011 2010 2009

REVENUES:

Service revenues $ 4,428,208 $ 3,689,695 $ 3,130,385

Equipment revenues 419,174 379,658 350,130

Total revenues 4,847,382 4,069,353 3,480,515

OPERATING EXPENSES:

Cost of service (excluding depreciation and amortization expense of $463,624, $393,721 and

$332,319 shown separately below) 1,473,836 1,223,931 1,120,052

Cost of equipment 1,439,595 1,093,944 884,272

Selling, general and administrative expenses (excluding depreciation and amortization expense of

$75,211, $56,011 and $45,537 shown separately below) 643,959 621,660 567,730

Depreciation and amortization 538,835 449,732 377,856

Loss (gain) on disposal of assets 3,619 (38,812) (4,683)

Total operating expenses 4,099,844 3,350,455 2,945,227

Income from operations 747,538 718,898 535,288

OTHER EXPENSE (INCOME):

Interest expense 261,073 263,125 270,285

Interest income (2,028) (1,954) (2,870)

Other (income) expense, net (699) 1,807 1,808

Impairment loss on investment securities — — 2,386

Loss on extinguishment of debt 9,536 143,626 —

Total other expense 267,882 406,604 271,609

Income before provision for income taxes 479,656 312,294 263,679

Provision for income taxes (178,346) (118,879) (86,835)

Net income $ 301,310 $ 193,415 $ 176,844

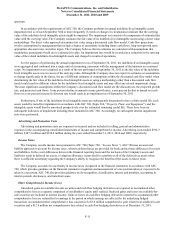

Other comprehensive income (loss):

Unrealized gains on available-for-sale securities, net of tax of $134, $242 and $294, respectively 212 361 3,210

Unrealized losses on cash flow hedging derivatives, net of tax benefit of $13,975, $4,879 and

$9,521, respectively (22,145) (7,268) (14,710)

Reclassification adjustment for gains on available-for-sale securities included in net income, net

of tax of $191, $227 and $250, respectively (303) (338) (394)

Reclassification adjustment for losses on cash flow hedging derivatives included in net income,

net of tax benefit of $9,059, $11,526 and $21,247, respectively 14,356 17,170 33,087

Total other comprehensive (loss) income (7,880) 9,925 21,193

Comprehensive income $ 293,430 $ 203,340 $ 198,037

Net income per common share (See Note 15):

Basic $ 0.83 $ 0.54 $ 0.50

Diluted $ 0.82 $ 0.54 $ 0.49

Weighted average shares:

Basic 360,410,168 353,711,045 351,898,898

Diluted 363,837,940 356,135,089 355,942,921

The accompanying notes are an integral part of these consolidated financial statements.