Metro PCS 2011 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2011 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2011, 2010 and 2009

F-16

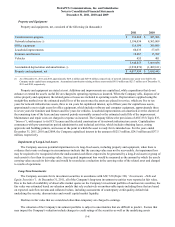

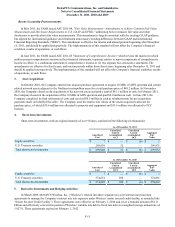

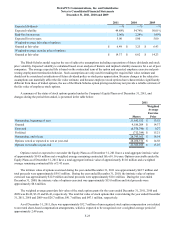

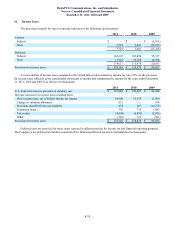

7. Accounts Payable and Accrued Expenses:

Accounts payable and accrued expenses consisted of the following (in thousands):

2011 2010

Accounts payable $ 211,890 $ 174,770

Book overdraft 5,171 1,726

Accrued accounts payable 108,385 162,378

Accrued liabilities 39,585 30,819

Payroll and employee benefits 40,356 43,132

Accrued interest 41,253 34,541

Taxes, other than income 57,795 65,503

Income taxes 7,911 8,919

Accounts payable and accrued expenses $ 512,346 $ 521,788

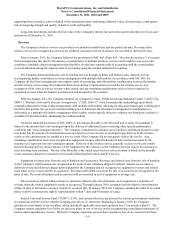

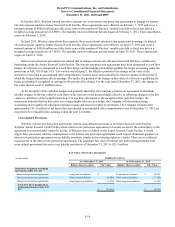

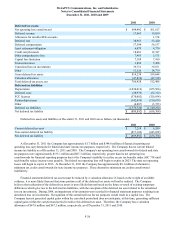

8. Long-term Debt:

Long-term debt consisted of the following (in thousands):

2011 2010

Senior Secured Credit Facility $ 2,471,916 $ 1,532,000

7 7/8% Senior Notes 1,000,000 1,000,000

6 5/8% Senior Notes 1,000,000 1,000,000

Capital Lease Obligations 281,167 254,336

Total long-term debt 4,753,083 3,786,336

Add: unamortized discount on debt (8,602)(7,053)

Total debt 4,744,481 3,779,283

Less: current maturities (33,460)(21,996)

Total long-term debt $ 4,711,021 $ 3,757,287

Maturities of the principal amount of long-term debt, excluding capital lease obligations, at face value are as follows (in

thousands):

For the Year Ending December 31,

2012 $ 25,390

2013 25,390

2014 25,390

2015 25,390

2016 957,856

Thereafter 3,412,500

Total $ 4,471,916

9¼% Senior Notes due 2014

In November 2006, Wireless completed the sale of $1.0 billion of principal amount of 9¼% Senior Notes due 2014, (the

“Initial Notes”). On June 6, 2007, Wireless completed the sale of an additional $400.0 million of 91/4% Senior Notes due 2014

(the “Additional Notes”) under the existing indenture governing the Initial Notes at a price equal to 105.875% of the principal

amount of such Additional Notes. On January 20, 2009, Wireless completed the sale of an additional $550.0 million of 9¼%

Senior Notes due 2014 (the “New 9¼% Senior Notes” and, together with the Initial Notes and Additional Notes, the “9¼%

Senior Notes”) under a new indenture substantially similar to the indenture governing the Initial Notes at a price equal to

89.50% of the principal amount of such New 9¼% Senior Notes.