Metro PCS 2011 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2011 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.82

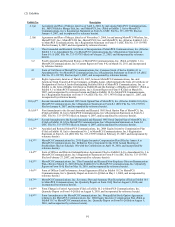

investments is due to various financing activities as detailed below. We believe that, based on our current level of cash, cash

equivalents and short-term investments, and our anticipated cash flows from operations, we have adequate liquidity, cash flow

and financial flexibility to fund our operations for the near-term.

In July 2010, Wireless entered into an Amendment and Restatement and Resignation and Appointment Agreement, or the

Amendment, which amended and restated the senior secured credit facility to, among other things, extend the maturity of $1.0

billion of existing term loans, or Tranche B-2 Term Loans, under the senior secured credit facility to November 2016 as well as

increase the interest rate to LIBOR plus 3.50% on the extended portion only and reduce the revolving credit facility from

$100.0 million to $67.5 million.

In September 2010, Wireless completed the sale of $1.0 billion of principal amount of 7 7/8% Senior Notes due 2018, or

the 7 7/8% Senior Notes. The net proceeds from the sale of the 7 7/8% Senior Notes were $974.0 million. Net proceeds from the

sale of the 7 7/8% Senior Notes were used to redeem a portion of the outstanding 9 1/4% Senior Notes.

In November 2010, Wireless completed the sale of $1.0 billion of principal amount of 6 5/8% Senior Notes due 2020, or

the 6 5/8% Senior Notes. The net proceeds of the sale of the 6 5/8% Senior Notes were $988.1 million.

In November 2010, Wireless completed the redemption of the remaining outstanding 9 1/4% Senior Notes.

In March 2011, Wireless entered into an Amendment and Restatement, or the New Amendment, which further amended

and restated the senior secured credit facility to, among other things, provide for the Tranche B-3 Term Loans, which will

mature in March 2018 and have an interest rate of LIBOR plus 3.75%. The New Amendment also increases the interest rate on

the existing Tranche B-2 Term Loans under the senior secured credit facility, as amended, to LIBOR plus 3.821%. In addition,

the aggregate amount of the revolving credit facility was increased from $67.5 million to $100.0 million and the maturity of the

revolving credit facility was extended to March 2016. The New Amendment modified certain limitations under the senior

secured credit facility, as amended, including limitations on our ability to incur additional debt, make certain restricted

payments, sell assets, make certain investments or acquisitions, grant liens and pay dividends. In addition, Wireless is no longer

subject to certain financial covenants, including maintaining a maximum senior secured consolidated leverage ratio. However,

under certain circumstances, we could be subject to certain financial covenants that contain ratios based on consolidated

Adjusted EBITDA as defined by the senior secured credit facility, as amended. Under the New Amendment, the definition of

consolidated Adjusted EBITDA has changed and no longer excludes interest and other income.

In May 2011, Wireless entered into an Incremental Commitment Agreement, or the Incremental Agreement, which

supplements the New Amendment to provide for the Incremental Tranche B-3 Term Loans which amount was borrowed on

May 10, 2011. The Incremental Tranche B-3 Term Loans have an interest rate of LIBOR plus 3.75% and will mature in March

2018. The Incremental Tranche B-3 Term Loans are repayable in quarterly installments of $2.5 million. A portion of the

proceeds from the Incremental Tranche B-3 Term Loans were used to prepay the $535.8 million in outstanding principal under

the Tranche B-1 Term Loans, with the remaining proceeds to be used for general corporate purposes, including opportunistic

spectrum acquisitions. The net proceeds from the Incremental Tranche B-3 Term Loans were $455.5 million after prepayment

of the Tranche B-1 Term Loans, underwriter fees, other debt issuance costs of approximately $7.9 million. The Incremental

Agreement did not modify the interest rate, maturity date or any of the other terms of the New Amendment applicable to the

Tranche B-2 Term Loans or the existing Tranche B-3 Term Loans.

Our strategy has been to offer our services in major metropolitan areas and their surrounding areas, which we refer to as

operating segments. We are seeking opportunities to enhance our current operating segments and to provide service in new

geographic areas generally adjacent to existing coverage areas. From time to time, we may purchase spectrum and related

assets from third parties or the FCC. We believe that our existing cash, cash equivalents and short-term investments and our

anticipated cash flows from operations will be sufficient to fully fund planned capital investments including geographical

expansion.

The construction of our network and the marketing and distribution of our wireless communications products and

services have required, and will continue to require, substantial capital investment. Capital outlays have included license

acquisition costs, capital expenditures for construction, increasing the capacity, or upgrade of our network infrastructure,

including network infrastructure for 4G LTE, costs associated with clearing and relocating non-governmental incumbent

licenses, funding of operating cash flow losses incurred as we launch services in new metropolitan areas and other working

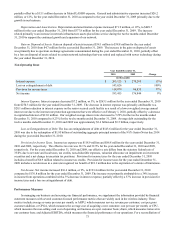

capital costs, debt service and financing fees and expenses. Our capital expenditures for the years ended December 31, 2011,

2010 and 2009 were $889.8 million, $790.4 million and $831.7 million, respectively. The expenditures for the years ended

December 31, 2011 and 2010 were primarily associated with our efforts to increase the service area and capacity of our existing

network and the upgrade of our network to 4G LTE. The expenditures for the year ended December 31, 2009 were primarily

associated with the construction of the network infrastructure in the Philadelphia, New York and Boston metropolitan areas and