Metro PCS 2011 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2011 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2011, 2010 and 2009

F-18

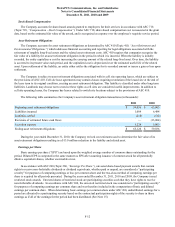

applicable to the Tranche B-2 Term Loans or the existing Tranche B-3 Term Loans.

The facilities under the Senior Secured Credit Facility are guaranteed by MetroPCS, MetroPCS, Inc. and each of

Wireless’ direct and indirect present and future wholly-owned domestic subsidiaries. The Senior Secured Credit Facility

contains customary events of default, including cross-defaults. The obligations under the Senior Secured Credit Facility are also

secured by the capital stock of Wireless as well as substantially all of Wireless’ present and future assets and the capital stock

and substantially all of the assets of each of its direct and indirect present and future wholly-owned subsidiaries (except as

prohibited by law and certain permitted exceptions).

The New Amendment modified certain limitations under the Senior Secured Credit Facility, including limitations on

Wireless' ability to incur additional debt, make certain restricted payments, sell assets, make certain investments or acquisitions,

grant liens and pay dividends. In addition, Wireless is no longer subject to certain financial covenants, including maintaining a

maximum senior secured consolidated leverage ratio, except under certain circumstances.

The interest rate on the outstanding debt under the Senior Secured Credit Facility is variable. The weighted average rate

as of December 31, 2011 was 5.065%, which includes the impact of the interest rate protection agreements (See Note 5).

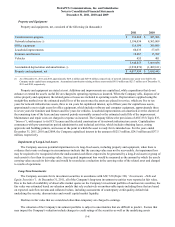

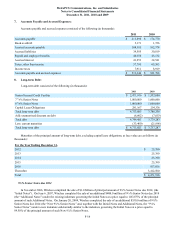

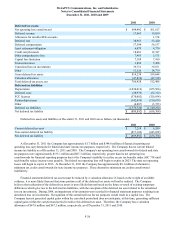

Capital Lease Obligations

The Company has entered into various non-cancelable capital lease agreements, with varying expiration terms through

2026. Assets and future obligations related to capital leases are included in the accompanying consolidated balance sheets in

property and equipment and long-term debt, respectively. Depreciation of assets held under capital leases is included in

depreciation and amortization expense. As of December 31, 2011, the Company had $8.1 million and $273.1 million of capital

lease obligations recorded in current maturities of long-term debt and long-term debt, respectively.

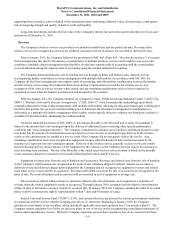

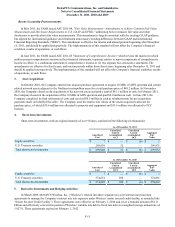

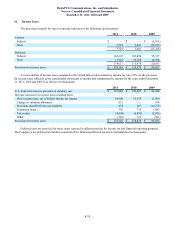

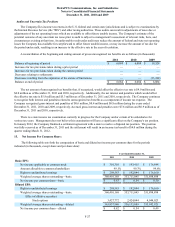

9. Fair Value Measurements:

The Company follows the provisions of ASC 820 (Topic 820, “Fair Value Measurements and Disclosures”) which

establishes a three-tiered fair value hierarchy that prioritizes inputs to valuation techniques used in fair value calculations. The

three levels of inputs are defined as follows:

• Level 1 - Unadjusted quoted market prices for identical assets or liabilities in active markets that the Company has the

ability to access.

• Level 2 - Quoted prices for similar assets or liabilities in active markets; quoted prices for identical or similar assets or

liabilities in inactive markets; or valuations based on models where the significant inputs are observable (e.g., interest

rates, yield curves, prepayment speeds, default rates, loss severities, etc.) or can be corroborated by observable market

data.

• Level 3 - Valuations based on models where significant inputs are not observable. The unobservable inputs reflect the

Company’s own assumptions about the assumptions that market participants would use.

ASC 820 requires the Company to maximize the use of observable inputs and minimize the use of unobservable inputs. If

a financial instrument uses inputs that fall in different levels of the hierarchy, the instrument will be categorized based upon the

lowest level of input that is significant to the fair value calculation. The Company’s financial assets and liabilities measured at

fair value on a recurring basis include cash and cash equivalents, short and long-term investments securities and derivative

financial instruments.

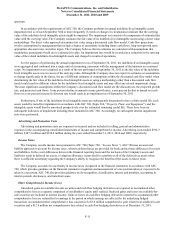

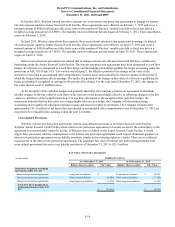

Included in the Company’s cash equivalents are investments in money market funds consisting of U.S. Treasury

securities with an original maturity of 90 days or less. Included in the Company’s short-term investments are securities

classified as available-for-sale, which are stated at fair value. These securities include U.S. Treasury securities with an original

maturity of over 90 days. Fair value is determined based on observable quotes from banks and unadjusted quoted market prices

from identical securities in an active market at the reporting date. Significant inputs to the valuation are observable in the active

markets and are classified as Level 1 in the hierarchy.

Included in the Company’s long-term investments securities are certain auction rate securities, some of which are secured

by collateralized debt obligations with a portion of the underlying collateral being mortgage securities or related to mortgage

securities. Due to the lack of availability of observable market quotes on the Company’s investment portfolio of auction rate

securities, the fair value was estimated based on valuation models that rely exclusively on unobservable Level 3 inputs

including those that are based on expected cash flow streams and collateral values, including assessments of counterparty credit

quality, default risk underlying the security, discount rates and overall capital market liquidity. The valuation of the Company’s