Metro PCS 2011 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2011 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2011, 2010 and 2009

F-17

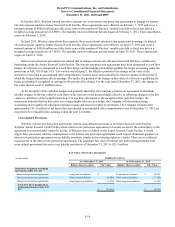

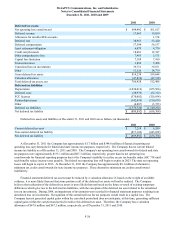

In September 2010, Wireless completed a cash tender offer to purchase $313.1 million of outstanding aggregate principal

amount of the Initial Notes and Additional Notes at a price equal to 104.625% for total cash consideration of $327.5 million,

which resulted in a loss on extinguishment of debt in the amount of $15.6 million.

In November 2010, Wireless completed the redemption of the remaining $1.6 billion in outstanding 9¼% Senior Notes at

a price equal to 104.625% for total cash consideration of $1.7 billion. The redemption resulted in a loss on extinguishment of

debt in the amount of $128.0 million.

7 7/8% Senior Notes due 2018

In September 2010, Wireless completed the sale of $1.0 billion of principal amount of 7 7/8% Senior Notes due 2018

(“7 7/8% Senior Notes”). The terms of the 7 7/8% Senior Notes are governed by the indenture, the first supplemental indenture,

dated September 21, 2010, and the third supplemental indenture, dated December 23, 2010, among Wireless, the guarantors

party thereto and the trustee. The net proceeds of the sale of the 7 7/8% Senior Notes were $974.0 million after underwriter fees,

discounts and other debt issuance costs of $26.0 million.

6 5/8% Senior Notes due 2020

In November 2010, Wireless completed the sale of $1.0 billion of principal amount of 6 5/8% Senior Notes due 2020

(“6 5/8% Senior Notes”). The terms of the 6 5/8% Senior Notes are governed by the indenture, the second supplemental

indenture, dated November 17, 2010, and the fourth supplemental indenture, dated December 23, 2010, among Wireless, the

guarantors party thereto and the trustee. The net proceeds of the sale of the 6 5/8% Senior Notes were $988.1 million after

underwriter fees, discounts and other debt issuance costs of approximately $11.9 million.

Senior Secured Credit Facility

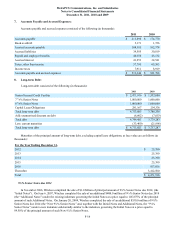

In November 2006, Wireless entered into the Senior Secured Credit Facility, which consisted of a $1.6 billion term loan

facility and a $100.0 million revolving credit facility. The term loan facility is repayable in quarterly installments in annual

aggregate amounts equal to 1% of the initial aggregate principal amount of $1.6 billion.

In July 2010, Wireless entered into an Amendment and Restatement and Resignation and Appointment Agreement (the

“Amendment”) which amended and restated the senior secured credit facility to, among other things, extend the maturity of

$1.0 billion of existing term loans (“Tranche B-2 Term Loans”) under the Senior Secured Credit Facility to November 2016,

increase the interest rate to LIBOR plus 3.50% on the extended portion only and reduce the revolving credit facility from

$100.0 million to $67.5 million. The remaining term loans (“Tranche B-1 Term Loans”) under the Senior Secured Credit

Facility will mature in November 2013 and the interest rate continues to be LIBOR plus 2.25%. This modification did not result

in a loss on extinguishment of debt.

In March 2011, Wireless entered into an Amendment and Restatement Agreement (the “New Amendment”) which further

amends and restates the Senior Secured Credit Facility. The New Amendment amended the Senior Secured Credit Facility to,

among other things, provide for a new tranche of term loans in the amount of $500.0 million (“Tranche B-3 Term Loans”), with

an interest rate of LIBOR plus 3.75% which will mature in March 2018, and increase the interest rate to LIBOR plus 3.821%

on the existing Tranche B-1 and Tranche B-2 Term Loans. The Tranche B-3 Term Loans are repayable in quarterly installments

of $1.25 million. In addition, the aggregate amount of the revolving credit facility was increased from $67.5 million to $100.0

million and the maturity of the revolving credit facility was extended to March 2016. The net proceeds from the Tranche B-3

Term Loans were $490.2 million after underwriter fees, discounts and other debt issuance costs of approximately $9.8 million.

In May 2011, Wireless entered into an Incremental Commitment Agreement (the “Incremental Agreement”) which

supplements the New Amendment to provide for an additional $1.0 billion of Tranche B-3 Term Loans (the “Incremental

Tranche B-3 Terms Loans”). The Incremental Tranche B-3 Term Loans have an interest rate of LIBOR plus 3.75% and will

mature in March 2018. The Incremental Tranche B-3 Term Loans are repayable in quarterly installments of $2.5 million. A

portion of the proceeds from the Incremental Tranche B-3 Term Loans was used to prepay the $535.8 million in outstanding

principal under the Tranche B-1 Term Loans, with the remaining proceeds to be used for general corporate purposes, including

opportunistic spectrum acquisitions. The net proceeds from the Incremental Tranche B-3 Term Loans were $455.5 million after

prepayment of the Tranche B-1 Term Loans, underwriter fees, and other debt issuance costs of approximately $7.9 million. The

prepayment of the Tranche B-1 Term Loans resulted in a loss on extinguishment of debt in the amount of $9.5 million. The

Incremental Agreement did not modify the interest rate, maturity date or any of the other terms of the New Amendment