Metro PCS 2011 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2011 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2011, 2010 and 2009

F-21

Concentrations of credit risk with respect to trade accounts receivable are limited due to the diversity of the Company's

indirect retailer base.

11. Commitments and Contingencies:

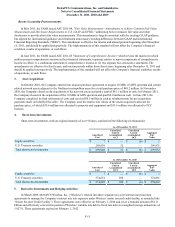

Operating and Capital Leases

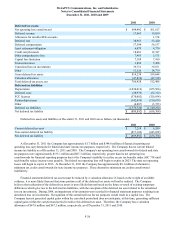

The Company has entered into non-cancelable operating lease agreements to lease facilities, certain equipment and sites

for towers and antennas required for the operation of its wireless networks. Total rent expense for the years ended December

31, 2011, 2010 and 2009 was $358.7 million, $325.1 million and $281.2 million, respectively.

The Company entered into various non-cancelable distributed antenna systems (“DAS”) capital lease agreements, with

varying expiration terms through 2026.

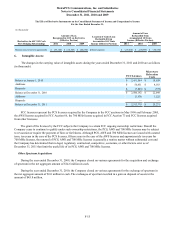

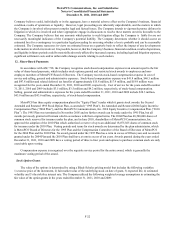

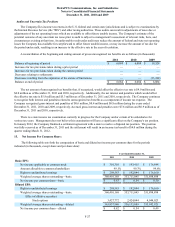

Future annual minimum rental payments required for all non-cancelable operating and capital leases at December 31,

2011 are as follows (in thousands):

For the Year Ending December 31, Operating

Leases Capital

Leases

2012 $ 339,765 $ 34,333

2013 344,499 35,347

2014 342,965 36,408

2015 338,915 37,500

2016 317,936 38,626

Thereafter 918,659 338,588

Total minimum future lease payments $ 2,602,739 520,802

Amount representing interest and maintenance (239,635)

Present value of minimum lease payments 281,167

Current portion (8,070)

Long-term capital lease obligations $ 273,097

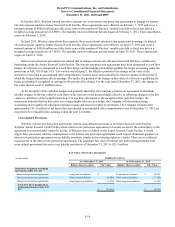

Purchase Obligations

The Company has several commitments with various network infrastructure and equipment providers for the acquisition

of assets to be used in the ordinary course of business. These amounts are not reflective of the Company's entire anticipated

purchases under the related agreements, but are generally determined based on the non-cancelable quantities or termination

amounts to which the Company is contractually obligated. In addition, the Company intends to purchase certain equipment

under an agreement in which it has the option, but not the obligation, to purchase the equipment.

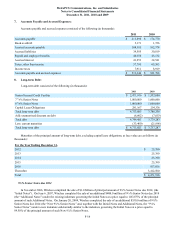

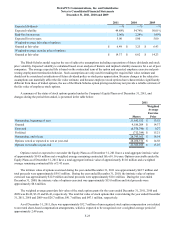

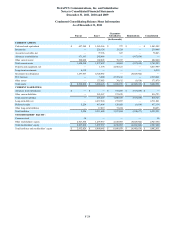

The following table provides aggregate information about the commitments under the Company's purchase obligations

and other agreements as of December 31, 2011 (in thousands):

For the Year Ending December 31,

2012 $ 157,907

2013 6,320

2014 5,618

2015 5,786

2016 5,959

Litigation

The Company is involved in litigation from time to time, including litigation regarding intellectual property claims, that it

considers to be in the normal course of business. The Company is not currently party to any pending legal proceedings that the