Metro PCS 2011 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2011 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

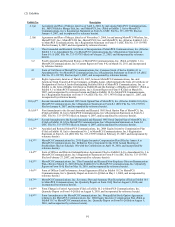

F-4

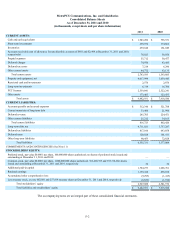

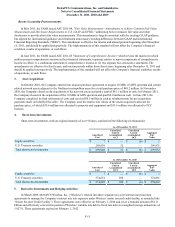

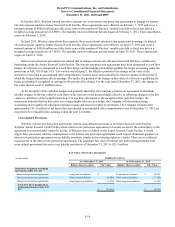

MetroPCS Communications, Inc. and Subsidiaries

Consolidated Statements of Stockholders' Equity

For the Years Ended December 31, 2011, 2010 and 2009

(in thousands, except share information)

Number of

Common

Shares Amount

Number of

Treasury

Shares Amount

Additional

Paid-In

Capital Retained

Earnings

Accumulated

Other

Comprehensive

Loss Total

BALANCE, January 1, 2009 350,918,272 $ 35 — $ — $ 1,578,972 $ 487,849 $ (32,533) $ 2,034,323

Exercise of Common Stock options 1,792,991 — — — 8,626 — — 8,626

Stock-based compensation expense — — — — 47,905 — — 47,905

Tax impact of Common Stock option forfeitures — — — — (749) — — (749)

Net income — — — — — 176,844 — 176,844

Unrealized gains on available-for-sale securities — — — — — — 3,210 3,210

Unrealized losses on cash flow hedging

derivatives — — — — — — (14,710)(14,710)

Reclassification adjustment for gains on

available-for-sale securities included in net

income — — — — — — (394)(394)

Reclassification adjustment for losses on cash

flow hedging derivatives included in net income — — — — — — 33,087 33,087

BALANCE, December 31, 2009 352,711,263 $ 35 — $ — $ 1,634,754 $ 664,693 $ (11,340) $ 2,288,142

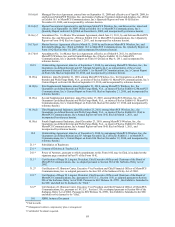

Exercise of Common Stock options 2,255,318 1 — — 10,122 — — 10,123

Restricted Common Stock vested and issued 589,903 — — — — — — —

Stock-based compensation expense — — — — 46,537 — — 46,537

Tax impact of Common Stock option and

restricted stock forfeitures — — — — (4,652) — — (4,652)

Purchase of Treasury Stock (237,818) — 237,818 (1,914) — — — (1,914)

Net income — — — — — 193,415 — 193,415

Unrealized gains on available-for-sale securities — — — — — — 361 361

Unrealized losses on cash flow hedging

derivatives — — — — — — (7,268)(7,268)

Reclassification adjustment for gains on

available-for-sale securities included in net

income — — — — — — (338)(338)

Reclassification adjustment for losses on cash

flow hedging derivatives included in net income — — — — — — 17,170 17,170

BALANCE, December 31, 2010 355,318,666 $ 36 237,818 $ (1,914) $ 1,686,761 $ 858,108 $ (1,415) $ 2,541,576

Exercise of Common Stock options 6,370,790 — — — 59,077 — — 59,077

Restricted Common Stock vested and issued 1,136,002 — — — — — — —

Stock-based compensation expense — — — — 41,791 — — 41,791

Tax impact of Common Stock option and

restricted stock forfeitures — — — — (3,356) — — (3,356)

Purchase of Treasury Stock (365,063) — 365,063 (4,918) — — — (4,918)

Net income — — — — — 301,310 — 301,310

Unrealized gains on available-for-sale securities — — — — — — 212 212

Unrealized losses on cash flow hedging

derivatives — — — — — — (22,145)(22,145)

Reclassification adjustment for gains on

available-for-sale securities included in net

income — — — — — — (303)(303)

Reclassification adjustment for losses on cash

flow hedging derivatives included in net income — — — — — — 14,356 14,356

BALANCE, December 31, 2011 362,460,395 $ 36 602,881 $ (6,832) $ 1,784,273 $ 1,159,418 $ (9,295) $ 2,927,600

The accompanying notes are an integral part of these consolidated financial statements.