Metro PCS 2011 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2011 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2011, 2010 and 2009

F-37

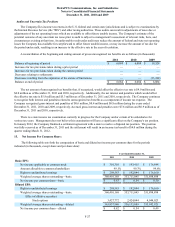

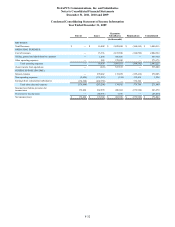

Year Ended December 31,

2011 2010 2009

Capital lease payments included in financing activities $ 6.9 $ 2.9 $ 2.8

One of the Company's current directors is an officer of a company whose wholly-owned subsidiaries provide rating and

market research services to the Company. The Company paid approximately $0.4 million, $1.0 million and $0.4 million to

these companies for these services during the years ended December 31, 2011, 2010 and 2009, respectively. The majority of

these costs were associated with the issuance of long-term debt and were capitalized as deferred debt issuance costs within

other assets in the accompanying consolidated balance sheets. The costs are being amortized to interest expense over the life of

the related debt.

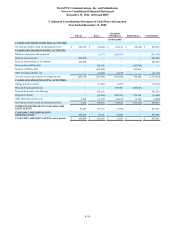

18. Supplemental Cash Flow Information:

Year Ended December 31,

2011 2010 2009

(in thousands)

Cash paid for interest $ 247,702 $ 255,960 $ 248,800

Cash paid for income taxes 4,521 2,857 3,085

Non-cash investing and financing activities

The Company’s accrued purchases of property and equipment were $90.9 million, $102.6 million and $21.4 million as of

December 31, 2011, 2010 and 2009, respectively. Included within the Company’s accrued purchases are estimates by

management for construction services received based on a percentage of completion.

Assets acquired under capital lease obligations were $33.4 million, $76.6 million and $92.2 million for the years ended

December 31, 2011, 2010 and 2009, respectively.

During the years ended December 31, 2011, 2010 and 2009, the Company returned obsolete network infrastructure assets

to one of its vendors in exchange for $6.4 million, $24.4 million and $17.4 million in credits towards the purchase of additional

network infrastructure assets with the vendor.

During the years ended December 31, 2010 and 2009, the Company received $53.4 million and $52.3 million in fair value

of FCC licenses in exchanges with other parties.

The Company's accrued assets acquired in asset acquisitions were $8.0 million as of December 31, 2010.

See Note 2 for the non-cash changes in the Company's asset retirement obligations.

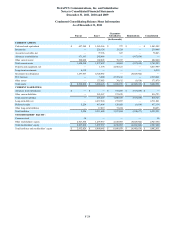

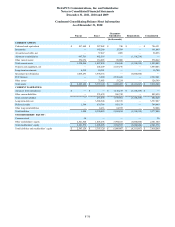

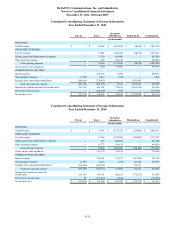

19. Quarterly Financial Data (Unaudited):

The following financial information reflects all normal recurring adjustments that are, in the opinion of management,

necessary for a fair statement of the Company's results of operations for the interim periods. Summarized data for each interim

period for the years ended December 31, 2011 and 2010 is as follows (in thousands, except per share data):

Three Months Ended

March 31,

2011 June 30,

2011 September 30,

2011 December 31,

2011

Total revenues $ 1,194,377 $ 1,209,453 $ 1,205,388 $ 1,238,164

Income from operations 145,337 210,255 176,831 215,115

Net income 56,378 84,335 69,326 91,271

Net income per common share - basic $ 0.16 $ 0.23 $ 0.19 $ 0.25

Net income per common share - diluted $ 0.15 $ 0.23 $ 0.19 $ 0.25