Metro PCS 2011 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2011 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2011, 2010 and 2009

F-19

investment portfolio is subject to uncertainties that are difficult to predict. Factors that may impact the Company’s valuation

include changes to credit ratings of the securities as well as the underlying assets supporting those securities, rates of default of

the underlying assets, underlying collateral values, discount rates, counterparty risk and ongoing strength and quality of market

credit and liquidity. Significant inputs to the investments valuation are unobservable in the active markets and are classified as

Level 3 in the hierarchy.

Included in the Company’s derivative financial instruments are interest rate swaps. Derivative financial instruments are

valued in the market using discounted cash flow techniques. These techniques incorporate Level 1 and Level 2 inputs such as

interest rates. These market inputs are utilized in the discounted cash flow calculation considering the instrument’s term,

notional amount, discount rate and credit risk. Significant inputs to the derivative valuation for interest rate swaps are

observable in the active markets and are classified as Level 2 in the hierarchy.

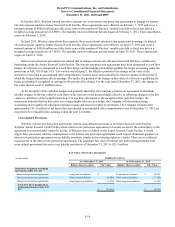

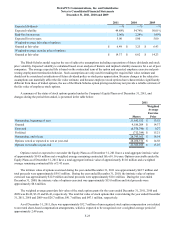

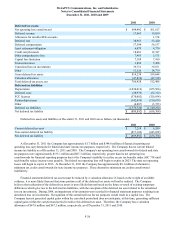

The following table summarizes assets and liabilities measured at fair value on a recurring basis at December 31, 2011, as

required by ASC 820 (in thousands):

Fair Value Measurements

Level 1 Level 2 Level 3 Total

Assets

Cash equivalents $ 1,815,538 $ — $ — $ 1,815,538

Short-term investments 299,972 — — 299,972

Restricted cash and investments 2,576 — — 2,576

Long-term investments — — 6,319 6,319

Total assets measured at fair value $ 2,118,086 $ — $ 6,319 $ 2,124,405

Liabilities

Derivative liabilities $ — $ 21,015 $ — $ 21,015

Total liabilities measured at fair value $ — $ 21,015 $ — $ 21,015

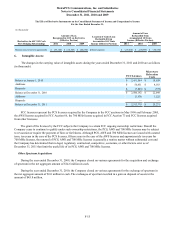

The following table summarizes assets and liabilities measured at fair value on a recurring basis at December 31, 2010, as

required by ASC 820 (in thousands):

Fair Value Measurements

Level 1 Level 2 Level 3 Total

Assets

Cash equivalents $ 787,829 $ — $ — $ 787,829

Short-term investments 374,862 — — 374,862

Restricted cash and investments 2,876 — — 2,876

Long-term investments — — 6,319 6,319

Derivative assets — 10,381 — 10,381

Total assets measured at fair value $ 1,165,567 $ 10,381 $ 6,319 $ 1,182,267

Liabilities

Derivative liabilities $ — $ 18,690 $ — $ 18,690

Total liabilities measured at fair value $ — $ 18,690 $ — $ 18,690