Metro PCS 2011 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2011 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

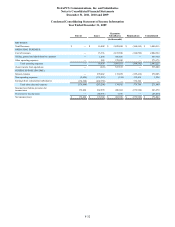

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2011, 2010 and 2009

F-33

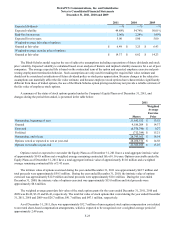

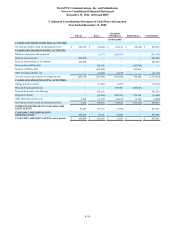

Condensed Consolidating Statement of Cash Flows Information

Year Ended December 31, 2011

Parent Issuer Guarantor

Subsidiaries Eliminations Consolidated

(in thousands)

CASH FLOWS FROM OPERATING ACTIVITIES:

Net cash provided by (used in) operating activities $ 1,363 $ (331,843) $ 1,392,288 $ — $ 1,061,808

CASH FLOWS FROM INVESTING ACTIVITIES:

Purchases of property and equipment — (5,944) (883,825) — (889,769)

Purchase of investments (599,765) — — — (599,765)

Proceeds from maturity of investments 675,000 — — — 675,000

Change in advances – affiliates 18,683 471,116 — (489,799) —

Other investing activities, net — (61,515) (10,822) — (72,337)

Net cash provided by (used in) investing activities 93,918 403,657 (894,647) (489,799) (886,871)

CASH FLOWS FROM FINANCING ACTIVITIES:

Change in advances – affiliates — — (489,799) 489,799 —

Change in book overdraft — 3,445 — — 3,445

Proceeds from debt issuance, net of discount — 1,497,500 — — 1,497,500

Retirement of long-term debt — (535,792) — — (535,792)

Repayment of debt — (24,292) — — (24,292)

Other financing activities, net 54,159 (15,351) (7,855) — 30,953

Net cash provided by (used in) financing activities 54,159 925,510 (497,654) 489,799 971,814

INCREASE (DECREASE) IN CASH AND CASH

EQUIVALENTS 149,440 997,324 (13) — 1,146,751

CASH AND CASH EQUIVALENTS, beginning of

period 507,849 287,942 740 — 796,531

CASH AND CASH EQUIVALENTS, end of period $ 657,289 $ 1,285,266 $ 727 $ — $ 1,943,282