Metro PCS 2011 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2011 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2011, 2010 and 2009

F-10

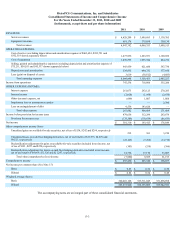

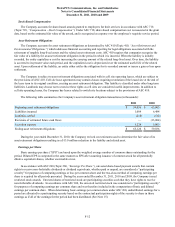

service plans that do not include taxes or regulatory fees, the Company reports these regulatory fees on a gross basis in service

revenues and cost of service on the accompanying consolidated statements of income and comprehensive income. For the

years ended December 31, 2011, 2010 and 2009, the Company recorded approximately $68.6 million, $81.8 million and $171.3

million, respectively, of FUSF, E-911, and other fees on a gross basis. Sales, use and excise taxes for all service plans are

reported on a net basis in selling, general and administrative expenses on the accompanying statements of income and

comprehensive income.

Costs and Expenses

The Company's costs and expenses include:

Cost of Service. The major components of the Company's cost of service are:

• Cell Site Costs. The Company incurs expenses for the rent of cell sites, network facilities, engineering operations,

field technicians and related utility and maintenance charges.

• Interconnection Costs. The Company pays other telecommunications companies and third-party providers for

leased facilities and usage-based charges for transporting and terminating network traffic from the Company's cell

sites and switching centers. The Company has pre-negotiated rates for transport and termination of calls

originated by its customers, including negotiated interconnection agreements with relevant exchange carriers in

each of its service areas.

• Variable Long Distance. The Company pays charges to other telecommunications companies for long distance

service provided to its customers. These variable charges are based on its customers' usage, applied at pre-

negotiated rates with the long distance carriers.

• Customer Support. The Company pays charges to nationally recognized third-party providers for customer care,

billing and payment processing services.

Cost of Equipment. Cost of equipment primarily includes the cost of handsets and accessories purchased from third-party

vendors to resell to the Company's customers and independent retailers in connection with its services. The Company does not

manufacture any of this equipment.

Selling, General and Administrative Expenses. The Company's selling expenses include advertising and promotional

costs associated with marketing and selling to new customers and fixed charges such as retail store rent and retail associates'

salaries. General and administrative expenses include support functions including technical operations, finance, accounting,

human resources, information technology and legal services. The Company records stock-based compensation expense in cost

of service and in selling, general and administrative expenses for expense associated with employee stock options and restricted

stock awards.

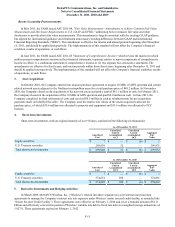

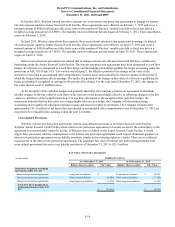

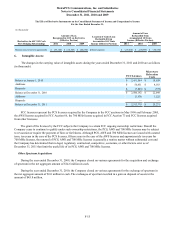

Intangible Assets

The Company operates wireless broadband mobile networks under licenses granted by the FCC for a particular

geographic area on spectrum allocated by the FCC for terrestrial wireless broadband services. The Company holds personal

communications services (“PCS”) licenses, advanced wireless services (“AWS”) licenses, and 700 MHz licenses granted or

acquired on various dates. The PCS licenses previously included, and the AWS licenses currently include, the obligation and

resulting costs to relocate existing fixed microwave users of the Company's licensed spectrum if the Company's use of its

spectrum interferes with their systems and/or reimburse other carriers (according to FCC rules) that relocated prior users if the

relocation benefits the Company's system. Accordingly, the Company incurs costs related to microwave relocation in

constructing its PCS and AWS networks.

FCC Licenses on the accompanying consolidated balance sheets, which includes the Company's microwave relocation

costs, are recorded at cost. Although PCS, AWS and 700 MHz licenses are issued with a stated term, ten years in the case of the

PCS licenses, fifteen years in the case of the AWS licenses and approximately ten years for 700 MHz licenses, the renewal of

PCS, AWS and 700 MHz licenses is generally a routine matter without substantial cost and the Company has determined that

no legal, regulatory, contractual, competitive, economic, or other factors currently exist that limit the useful life of its PCS,

AWS and 700 MHz licenses. As such, under the provisions of ASC 350 (Topic 350, "Intangibles - Goodwill and Other"), the

Company does not amortize PCS, AWS and 700 MHz licenses and microwave relocation costs (collectively, its “indefinite-

lived intangible assets”) as they are considered to have indefinite lives and together represent the cost of the Company's