Metro PCS 2011 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2011 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

77

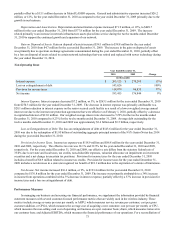

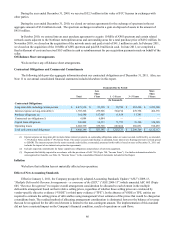

Year Ended December 31,

2011 2010 2009

(in thousands, except gross customer additions and

CPGA)

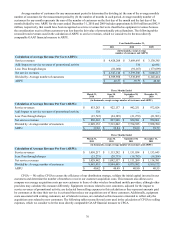

Calculation of Cost Per Gross Addition (CPGA):

Selling expenses $ 342,019 $ 330,593 $ 302,275

Less: Equipment revenues (419,174)(379,658)(350,130)

Add: Impact to service revenues of promotional activity — 778 42,931

Add: Equipment revenue not associated with new customers 261,271 225,115 169,929

Add: Cost of equipment 1,439,595 1,093,944 884,272

Less: Equipment costs not associated with new customers (704,257)(520,972)(275,793)

Gross addition expenses $ 919,454 $ 749,800 $ 773,484

Divided by: Gross customer additions 5,311,276 4,768,011 5,305,505

CPGA $ 173.11 $ 157.26 $ 145.79

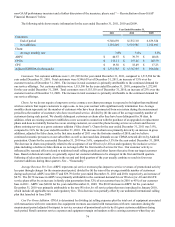

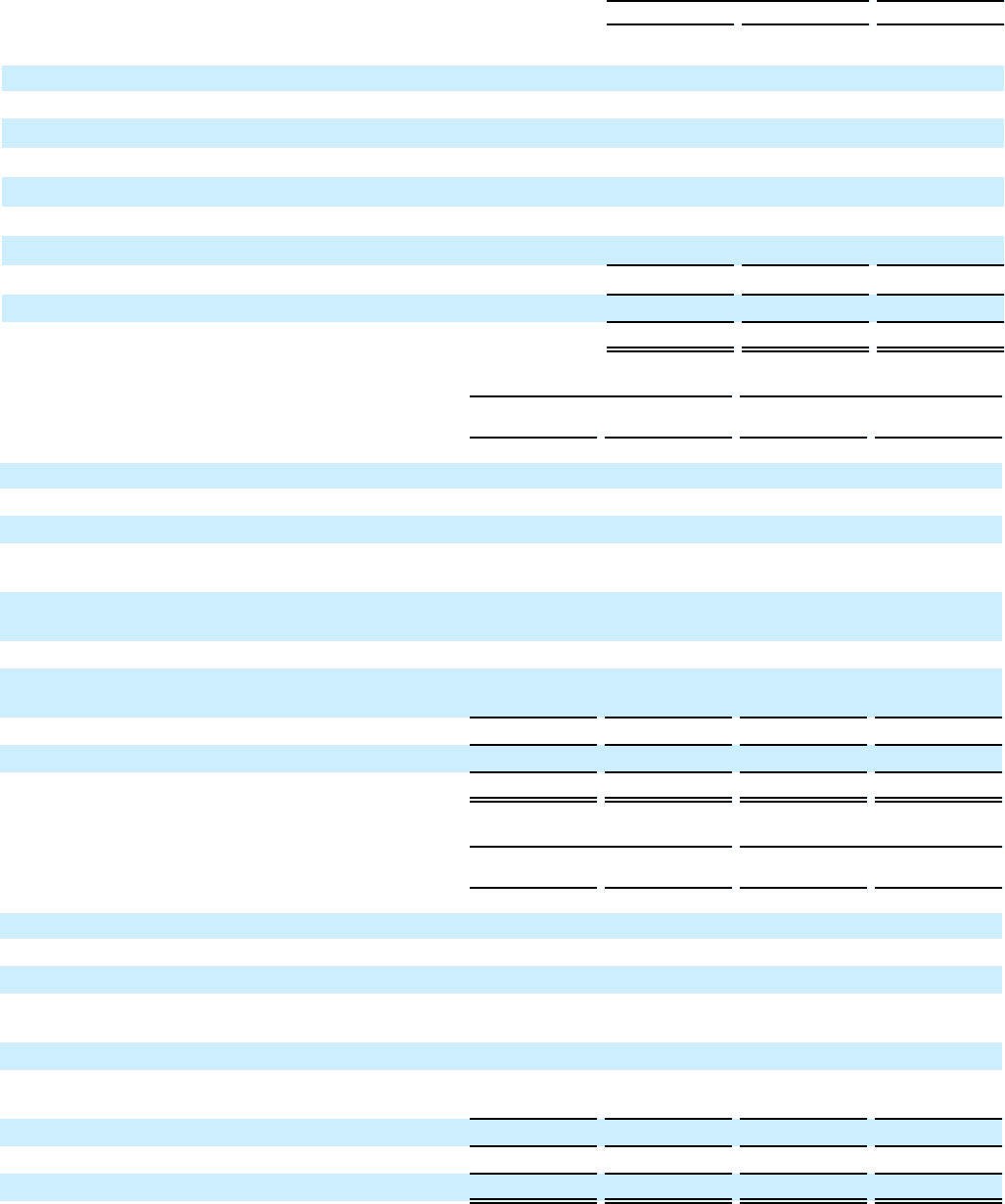

Three Months Ended

March 31,

2010 June 30,

2010 September 30,

2010 December 31,

2010

(in thousands, except gross customer additions and CPGA)

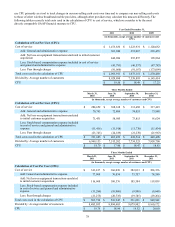

Calculation of Cost Per Gross Addition (CPGA):

Selling expenses $ 89,146 $ 86,194 $ 73,380 $ 81,872

Less: Equipment revenues (117,220)(90,399)(78,538)(93,502)

Add: Impact to service revenues of promotional

activity 778 — — —

Add: Equipment revenue not associated with new

customers 63,313 54,392 54,201 53,210

Add: Cost of equipment 313,738 235,354 256,265 288,587

Less: Equipment costs not associated with new

customers (134,744)(113,377)(128,016)(144,834)

Gross addition expenses $ 215,011 $ 172,164 $ 177,292 $ 185,333

Divided by: Gross customer additions 1,470,865 1,047,898 1,104,350 1,144,898

CPGA $ 146.18 $ 164.29 $ 160.54 $ 161.88

Three Months Ended

March 31,

2011 June 30,

2011 September 30,

2011 December 31,

2011

(in thousands, except gross customer additions and CPGA)

Calculation of Cost Per Gross Addition (CPGA):

Selling expenses $ 91,863 $ 78,522 $ 88,702 $ 82,933

Less: Equipment revenues (144,160)(96,161)(74,334)(104,519)

Add: Equipment revenue not associated with new

customers 75,234 59,355 58,026 68,655

Add: Cost of equipment 409,262 342,534 343,473 344,326

Less: Equipment costs not associated with new

customers (192,202)(159,931)(163,610)(188,514)

Gross addition expenses $ 239,997 $ 224,319 $ 252,257 $ 202,881

Divided by: Gross customer additions 1,525,880 1,261,091 1,300,611 1,223,694

CPGA $ 157.28 $ 177.88 $ 193.95 $ 165.79

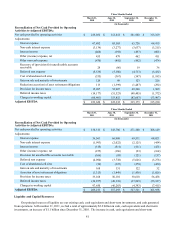

CPU — We utilize CPU as a tool to evaluate the non-selling cash expenses associated with ongoing business operations

on a per customer basis, to track changes in these non-selling cash costs over time, and to help evaluate how changes in our

business operations affect non-selling cash costs per customer. In addition, CPU provides management with a useful measure to

compare our non-selling cash costs per customer with those of other wireless broadband mobile providers. We believe investors