Metro PCS 2011 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2011 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2011, 2010 and 2009

F-22

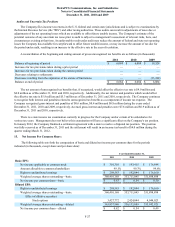

Company believes could, individually or in the aggregate, have a material adverse effect on the Company's business, financial

condition, results of operations or liquidity. However, legal proceedings are inherently unpredictable, and the matters in which

the Company is involved often present complex legal and factual issues. The Company intends to vigorously pursue defenses in

litigation in which it is involved and where appropriate engage in discussions to resolve these matters on terms favorable to the

Company. The Company believes that any amounts which parties to such litigation allege the Company is liable for are not

necessarily meaningful indicators of the Company's potential liability. The Company determines whether it should accrue an

estimated loss for a contingency in a particular legal proceeding by assessing whether a loss is probable and can be reasonably

estimated. The Company reassesses its views on estimated losses on a quarterly basis to reflect the impact of any developments

in the matters in which it is involved. It is possible, however, that the Company's business, financial condition, results of operations,

and liquidity in future periods could be materially adversely affected by increased expense, including legal and litigation expenses,

significant settlement costs and/or unfavorable damage awards relating to such matters.

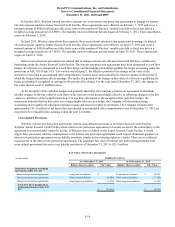

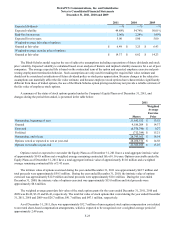

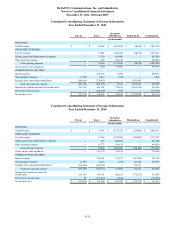

12. Share-Based Payments:

In accordance with ASC 718, the Company recognizes stock-based compensation expense in an amount equal to the fair

value of share-based payments, which includes stock options granted and restricted stock awards to employees and non-

employee members of MetroPCS' Board of Directors. The Company records stock-based compensation expense in cost of

service and selling, general and administrative expenses. Stock-based compensation expense was $41.8 million, $46.5 million

and $47.8 million and related deferred tax benefits of approximately $15.8 million, $17.9 million, and $18.9 million were

recognized for the years ended December 31, 2011, 2010 and 2009, respectively. Cost of service for the years ended December

31, 2011, 2010 and 2009 includes $3.5 million, $3.5 million and $4.2 million, respectively, of stock-based compensation.

Selling, general and administrative expenses for the years ended December 31, 2011, 2010 and 2009 include $38.3 million,

$43.0 million and $43.6 million, respectively, of stock-based compensation.

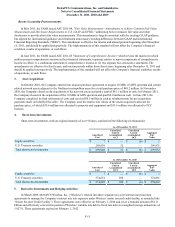

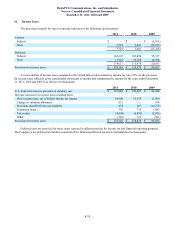

MetroPCS has three equity compensation plans (the “Equity Plans”) under which it grants stock awards: the Second

Amended and Restated 1995 Stock Option Plan, as amended (“1995 Plan”), the Amended and Restated 2004 Equity Incentive

Compensation Plan (“2004 Plan”), and the MetroPCS Communications, Inc. 2010 Equity Incentive Compensation Plan (“2010

Plan”). The 1995 Plan was terminated in November 2005 and no further awards can be made under the 1995 Plan, but all

awards previously granted will remain valid in accordance with their original terms. The 2004 Plan has 40,500,000 shares of

common stock reserved for issuance under the plan, and in June 2010, shareholders of MetroPCS Communications, Inc.

approved the adoption of the 2010 Plan which authorized a reserve of up to an additional 18,075,825 shares of common stock

for issuance under the 2010 Plan. Vesting periods and terms for stock awards are determined by the plan administrator, which

is MetroPCS' Board of Directors for the 1995 Plan and the Compensation Committee of the Board of Directors of MetroPCS

for the 2004 Plan and the 2010 Plan. No award granted under the 1995 Plan has a term in excess of fifteen years and no awards

granted under the 2004 Plan and the 2010 Plan shall have a term in excess of ten years. Awards granted during the years ended

December 31, 2011, 2010 and 2009 have a vesting period of three to four years and options to purchase common stock are only

exercisable upon vesting.

Compensation expense is recognized over the requisite service period for the entire award, which is generally the

maximum vesting period of the award.

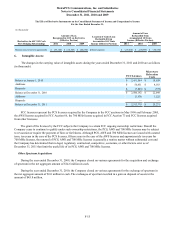

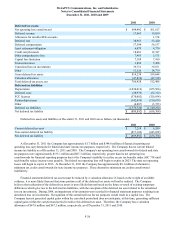

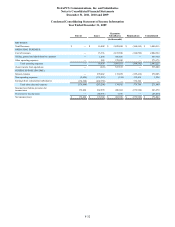

Stock Option Grants

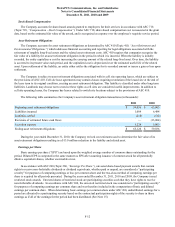

The value of the options is determined by using a Black-Scholes pricing model that includes the following variables:

1) exercise price of the instrument, 2) fair market value of the underlying stock on date of grant, 3) expected life, 4) estimated

volatility and 5) the risk-free interest rate. The Company utilized the following weighted-average assumptions in estimating the

fair value of the option grants in the years ended December 31, 2011, 2010 and 2009: