Metro PCS 2011 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2011 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.85

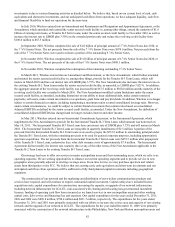

agreements expire on April 15, 2014.

9¼% Senior Notes Due 2014

In November 2006, Wireless consummated the sale of $1.0 billion principal amount of its 9¼% senior notes due 2014, or

initial notes. On June 6, 2007, Wireless consummated the sale of an additional $400.0 million of 9¼% Senior Notes due 2014,

or the additional notes. The initial notes and the additional notes are referred to together as the existing 9¼% senior notes. On

January 20, 2009, Wireless consummated the sale of additional 9¼% Senior Notes, or New 9¼% Senior Notes, resulting in net

proceeds of $480.3 million. The existing 9¼% senior notes together with the New 9¼% Senior Notes are referred to herein as

the 9¼% Senior Notes. In September 2010, Wireless completed a cash tender offer to redeem $313.1 million of outstanding

aggregate principal amount of the existing 9¼% Senior Notes at a price equal to 104.625% for total cash consideration of

$327.5 million. In November 2010, Wireless completed the redemption of the remaining $1.6 billion in outstanding aggregate

principal amount of the 9¼% Senior Notes at a price equal to 104.625% for total cash consideration of $1.7 billion.

7 7/8% Senior Notes due 2018

In September 2010, Wireless consummated the sale of $1.0 billion of principal amount of 7 7/8% Senior Notes. The terms

of the 7 7/8% Senior Notes are governed by the indenture, the first supplemental indenture, dated September 21, 2010, and the

third supplemental indenture, dated December 23, 2010, among Wireless, the guarantors party thereto and the trustee. The net

proceeds of the sale of the 7 7/8% Senior Notes were $974.0 million after underwriter fees, discounts and other debt issuance

costs of $26.0 million.

6 5/8% Senior Notes due 2020

In November 2010, Wireless consummated the sale of $1.0 billion of principal amount of 6 5/8% Senior Notes. The terms

of the 6 5/8% Senior Notes are governed by the indenture, the second supplemental indenture, dated November 17, 2010, and

the fourth supplemental indenture, dated December 23, 2010, among Wireless, the guarantor's party thereto and the trustee.

The net proceeds of the sale of the 6 5/8% Senior Notes were $988.1 million after underwriter fees, discounts and other debt

issuance costs of approximately $11.9 million.

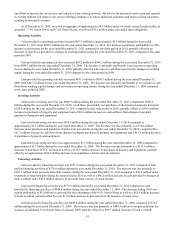

Capital Lease Obligations

We have entered into various non-cancelable capital lease agreements, with expirations through 2026. Assets and future

obligations related to capital leases are included in the accompanying consolidated balance sheets in property and equipment

and long-term debt, respectively. Depreciation of assets held under capital lease obligations is included in depreciation and

amortization expense. As of December 31, 2011, we had approximately $281.2 million of capital lease obligations, with

approximately $8.1 million and $273.1 million recorded in current maturities of long-term debt and long-term debt,

respectively.

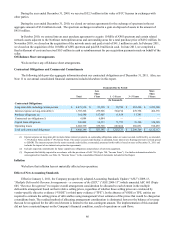

Capital Expenditures and Other Asset Acquisitions and Dispositions

Capital Expenditures. We currently expect to incur capital expenditures in the range of $900.0 million to $1.0 billion on a

consolidated basis for the year ending December 31, 2012.

During the year ended December 31, 2011, we incurred $889.8 million in capital expenditures. These capital

expenditures were primarily associated with our efforts to increase the service area and capacity of our existing CDMA network

and the upgrade of our network to 4G LTE.

During the year ended December 31, 2010, we incurred $790.4 million in capital expenditures. These capital

expenditures were primarily associated with our efforts to increase the service area and capacity of our existing CDMA network

and the upgrade of our network to 4G LTE in select metropolitan areas.

During the year ended December 31, 2009, we incurred $831.7 million in capital expenditures. These capital

expenditures were primarily for the expansion and improvement of our existing CDMA network infrastructure and costs

associated with the construction of new markets.

Other Acquisitions and Dispositions. During the year ended December 31, 2009 we closed on various agreements for the

acquisition and exchange of spectrum in the net aggregate amount of $14.6 million in cash.