Lexmark 2009 Annual Report Download - page 94

Download and view the complete annual report

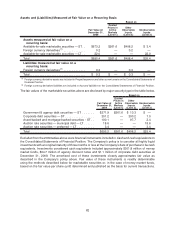

Please find page 94 of the 2009 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.There were no changes in methodology or significant assumptions in the fourth quarter of 2009 compared

to the third quarter of 2009, with the exception of the fourth quarter event regarding the insurer of one of the

Company’s municipal auction rate securities factored into the valuation as described previously.

Derivatives

The Company employs a foreign currency risk management strategy that periodically utilizes derivative

instruments to protect its interests from unanticipated fluctuations in earnings and cash flows caused by

volatility in currency exchange rates. Fair values for the Company’s derivative financial instruments are

based on pricing models or formulas using current market data. Variables used in the calculations include

forward points and spot rates at the time of valuation. Because of the very short duration of the Company’s

transactional hedges (three months or less) and minimal risk of nonperformance, the settlement price and

exit price should approximate one another. At December 31, 2009 and 2008, all of the Company’s forward

exchange contracts were designated as Level 2 measurements in the fair value hierarchy. Refer to Note 16

to the Consolidated Financial Statements for more information regarding the Company’s derivatives.

Senior Notes

In May 2008, the Company issued $350 million of five-year fixed rate senior unsecured notes and

$300 million of ten-year fixed rate senior unsecured notes.

At December 31, 2009, the fair values of the Company’s five-year and ten-year notes were estimated to be

$360.5 million and $306.0 million, respectively, based on the prices the bonds have recently traded in the

market as well as prices of debt with similar characteristics issued by other companies. The $666.5 million

total fair value of the debt is not recorded on the Company’s Consolidated Statements of Financial Position

and is therefore excluded from the 2009 fair value table above. The total carrying value of the senior notes,

net of $1.1 million discount, was $648.9 million on the December 31, 2009 Consolidated Statements of

Financial Position.

At December 31, 2008, the fair values of the Company’s five-year and ten-year notes were estimated to be

$280.0 million and $225.0 million, respectively, based on current rates available to the Company for debt

with similar characteristics. The $505.0 million total fair value of the debt is not recorded on the Company’s

Consolidated Statements of Financial Position and is therefore excluded from the 2008 fair value table

above. The total carrying value of the senior notes, net of $1.3 million discount, is $648.7 million on the

Consolidated Statements of Financial Position.

Refer to Part II, Item 8, Note 11 of the Notes to Consolidated Financial Statements for additional

information regarding the senior notes.

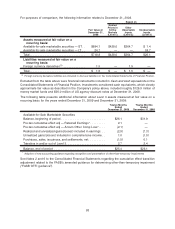

Plan Assets

Plan assets must be measured at least annually in accordance with accounting guidance on employers’

accounting for pensions and employers’ accounting for postretirement benefits other than pensions. The

fair value measurement guidance requires that the valuation of plan assets comply with its definition of fair

value, which is based on the notion of an exit price and the maximization of observable inputs. The fair

value measurement guidance does not apply to the calculation of pension and postretirement obligations

since the liabilities are not measured at fair value.

Refer to Part II, Item 8, Note 15 of the Notes to Consolidated Financial Statements for disclosures

regarding the fair value of plan assets.

Other Financial Instruments

The fair value of cash and cash equivalents, trade receivables, trade payables and short-term debt

approximates their carrying values due to the relatively short-term nature of the instruments.

88