Lexmark 2009 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2009 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Tax Positions

The Company adopted FASB guidance on accounting for uncertainty in taxes on January 1, 2007. As a

result of the implementation of this guidance, the Company reduced its liability for unrecognized tax

benefits and related interest and penalties by $7.3 million, which resulted in a corresponding increase in

the Company’s January 1, 2007, retained earnings balance. The Company also recorded an increase in its

deferred tax assets of $8.5 million and a corresponding increase in its liability for unrecognized tax benefits

as a result of adopting this guidance.

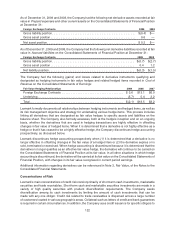

The amount of unrecognized tax benefits at December 31, 2009, was $33.0 million, all of which would

affect the Company’s effective tax rate if recognized. The amount of unrecognized tax benefits at

December 31, 2008, was $29.3 million, all of which would affect the Company’s effective tax rate if

recognized. The amount of unrecognized tax benefits at December 31, 2007, was $53.5 million, of which

$43.5 million would affect the Company’s effective tax rate if recognized.

The Company recognizes accrued interest and penalties associated with uncertain tax positions as part of

its income tax provision. As of December 31, 2009, the Company had $4.5 million of accrued interest and

penalties. For 2009, the Company recognized in its statement of earnings a net expense of $0.8 million for

interest and penalties. As of December 31, 2008, the Company had $3.7 million of accrued interest and

penalties. For 2008, the Company recognized in its statement of earnings a net benefit of $1.0 million

related to interest and penalties. As of December 31, 2007, the Company had $7.4 million of accrued

interest and penalties. For 2007, the Company recognized in its statement of earnings a net benefit of

$4.2 million related to interest and penalties.

It is reasonably possible that the total amount of unrecognized tax benefits will increase or decrease in the

next 12 months. Such changes could occur based on the expiration of various statutes of limitations or the

conclusion of ongoing tax audits in various jurisdictions around the world. If those events occur within the

next 12 months, the Company estimates that its unrecognized tax benefits amount could decrease by an

amount in the range of $0 to $6 million, the impact of which would affect the Company’s effective tax rate.

Several tax years are subject to examination by major tax jurisdictions. In the U.S., federal tax years 2006

and after are subject to examination. The Internal Revenue Service (“IRS”) is currently auditing tax years

2006 and 2007. In France, tax years 2006 and after are subject to examination. In Switzerland, tax years

2004 and after are subject to examination. In most of the other countries where the Company files income

tax returns, 2004 is the earliest tax year that is subject to examination. The Company believes that

adequate amounts have been provided for any adjustments that may result from those examinations.

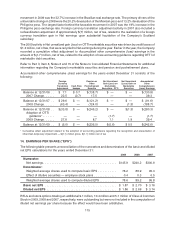

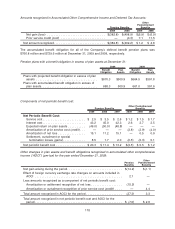

A reconciliation of the total beginning and ending amounts of unrecognized tax benefits is as follows:

2009 2008 2007

Balance at January 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $29.3 $ 53.5 $ 59.8

Increases/(decreases) in unrecognized tax benefits as a result of tax

positions taken during a prior period . . . . . . . . . . . . . . . . . . . . . . . . . . (0.6) (5.1) (5.5)

Increases/(decreases) in unrecognized tax benefits as a result of tax

positions taken during the current period . . . . . . . . . . . . . . . . . . . . . . . 5.8 5.9 10.4

Increases/(decreases) in unrecognized tax benefits relating to

settlements with taxing authorities . . . . . . . . . . . . . . . . . . . . . . . . . . . . (0.2) (24.2) (11.2)

Reductions to unrecognized tax benefits as a result of a lapse of the

applicable statute of limitations. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1.3) (0.8) —

Balance at December 31 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $33.0 $ 29.3 $ 53.5

Other

Cash paid for income taxes was $41.3 million, $97.8 million and $76.1 million in 2009, 2008 and 2007,

respectively.

112