Lexmark 2009 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2009 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

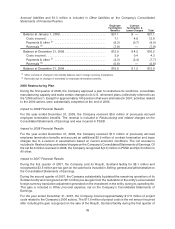

Accrued liabilities and $1.3 million is included in Other liabilities on the Company’s Consolidated

Statements of Financial Position.

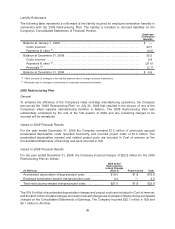

Employee

Termination

Benefits

Contract

Termination &

Lease Charges Total

Balance at January 1, 2008 . . . . . . . . . . . . . . . . . . . . . . . . . . . $21.1 $ — $21.1

Costs incurred . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.1 4.9 12.0

Payments & other

(1)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (8.3) (0.7) (9.0)

Reversals

(2)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (7.9) — (7.9)

Balance at December 31, 2008 . . . . . . . . . . . . . . . . . . . . . . . . $12.0 $ 4.2 $16.2

Costs incurred . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.9 0.4 4.3

Payments & other

(1)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (4.3) (3.4) (7.7)

Reversals

(2)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (0.8) — (0.8)

Balance at December 31, 2009 . . . . . . . . . . . . . . . . . . . . . . . . $10.8 $ 1.2 $12.0

(1)

Other consists of changes in the liability balance due to foreign currency translations.

(2)

Reversals due to changes in estimates for employee termination benefits.

2006 Restructuring Plan

During the first quarter of 2006, the Company approved a plan to restructure its workforce, consolidate

manufacturing capacity and make certain changes to its U.S. retirement plans (collectively referred to as

the “2006 actions”). Except for approximately 100 positions that were eliminated in 2007, activities related

to the 2006 actions were substantially completed at the end of 2006.

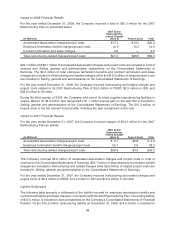

Impact to 2009 Financial Results

For the year ended December 31, 2009, the Company reversed $0.6 million of previously accrued

employee termination benefits. The reversal is included in Restructuring and related charges on the

Consolidated Statements of Earnings and was incurred in PSSD.

Impact to 2008 Financial Results

For the year ended December 31, 2008, the Company reversed $1.5 million of previously accrued

employee termination benefits and accrued an additional $0.9 million of contract termination and lease

charges due to a revision in assumptions based on current economic conditions. The net reversal is

included in Restructuring and related charges on the Company’s Consolidated Statements of Earnings. Of

the net $0.6 million reversed in 2008, the Company recognized $(0.3) million in PSSD and $(0.3) million in

All other.

Impact to 2007 Financial Results

During the first quarter of 2007, the Company sold its Rosyth, Scotland facility for $8.1 million and

recognized a $3.5 million pre-tax gain on the sale that is included in Selling, general and administrative on

the Consolidated Statements of Earnings.

During the second quarter of 2007, the Company substantially liquidated the remaining operations of its

Scotland entity and recognized an $8.1 million pre-tax gain from the realization of the entity’s accumulated

foreign currency translation adjustment generated on the investment in the entity during its operating life.

This gain is included in Other (income) expense, net on the Company’s Consolidated Statements of

Earnings.

For the year ended December 31, 2007, the Company incurred approximately $17.8 million of project

costs related to the Company’s 2006 actions. The $17.8 million of project costs is the net amount incurred

after including the gain recognized on the sale of the Rosyth, Scotland facility during the first quarter of

49