Lexmark 2009 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2009 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

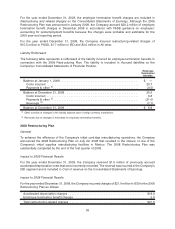

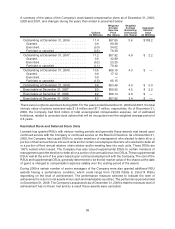

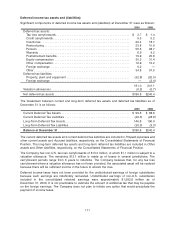

position. The gross unrealized loss of $3.7 million, pre-tax, is recognized in accumulated other

comprehensive income:

(In Millions)

Fair

Value

Unrealized

Loss

Fair

Value

Unrealized

Loss

Fair

Value

Unrealized

Loss

Less than 12 Months 12 Months or More Total

Auction rate securities . . . . . . . . $ — $ — $20.6 $(2.3) $ 20.6 $(2.3)

Corporate debt securities . . . . . 135.0 (0.3) 2.6 (0.2) 137.6 (0.5)

Asset-backed and

mortgage-backed securities. . . . 38.3 (0.1) 7.4 (0.7) 45.7 (0.8)

Government and Agency. . . . . . 107.4 (0.1) — — 107.4 (0.1)

Total . . . . . . . . . . . . . . . . . . . . . $280.7 $(0.5) $30.6 $(3.2) $311.3 $(3.7)

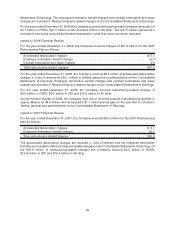

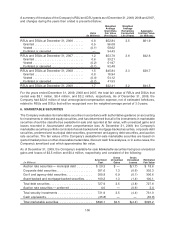

The following table provides information, at December 31, 2009, about the Company’s marketable

securities with gross unrealized losses for which other-than-temporary impairment has been incurred,

and the length of time that individual securities have been in a continuous unrealized loss position. The

gross unrealized loss of $0.7 million, pre-tax, is recognized in accumulated other comprehensive income:

(In Millions)

Fair

Value

Unrealized

Loss

Fair

Value

Unrealized

Loss

Fair

Value

Unrealized

Loss

Less than 12 Months 12 Months or More Total

Corporate debt securities . . . . . . . . $— $— $0.1 $(0.1) $0.1 $(0.1)

Asset-backed and

mortgage-backed securities . . . . . . . — — 6.5 (0.6) 6.5 (0.6)

Total . . . . . . . . . . . . . . . . . . . . . . . . $— $— $6.6 $(0.7) $6.6 $(0.7)

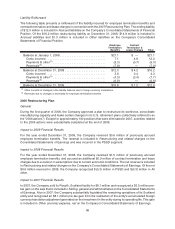

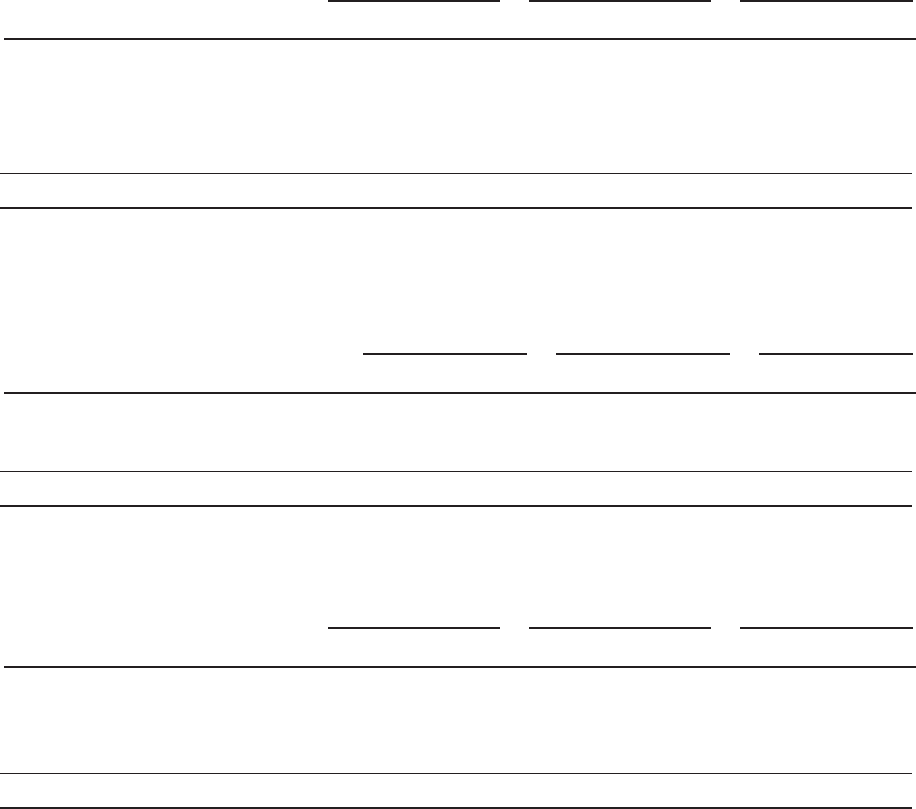

The table below is a summary of the Company’s marketable securities at December 31, 2008, for which the

fair value is less than cost (impaired), and for which other-than-temporary impairments have not been

recognized.

(In Millions)

Fair

Value

Unrealized

Loss

Fair

Value

Unrealized

Loss

Fair

Value

Unrealized

Loss

Less than 12 Months 12 months or More Total

Auction rate securities . . . . . . . . $ 22.7 $(0.6) $ — $ — $ 22.7 $(0.6)

Corporate debt securities . . . . . 42.4 (0.8) 26.0 (1.1) 68.4 (1.9)

Asset-backed and

mortgage-backed securities. . . . 54.0 (3.6) 10.1 (2.1) 64.1 (5.7)

Total . . . . . . . . . . . . . . . . . . . . . $119.1 $(5.0) $36.1 $(3.2) $155.2 $(8.2)

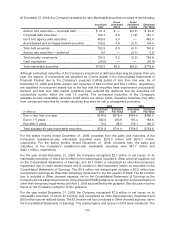

As of February 26, 2010, the Company does not believe that it has a material risk in its current portfolio of

investments that would impact its financial condition or liquidity.

Auction rate securities

The Company’s valuation process for its auction rate security portfolio began with a credit analysis of each

instrument. Under this method, the security is analyzed for factors impacting its future cash flows, such as

the underlying collateral, credit ratings, credit insurance or other guarantees, and the level of seniority of

the specific tranche of the security. The discount rate used to determine the present value of cash flows

expected to be collected is based on those outlined in the authoritative guidance on creditors’ accounting

for impairment of a loan. In this method, the interest rate used for amortizing the security is used to derive

the present value (with no adjustment to the discount rate for increases in credit risk or other risk factors)

and the present value will generally be significantly different from par only if estimated cash flows are

significantly different from contractual cash flows. Based on the analysis, the estimated future cash flows

are equal to contractual cash flows for all but one auction rate security for which the amount related to

credit loss has been written down through earnings. The Company has the intent to hold the remaining

103