Lexmark 2009 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2009 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.guidance such that tangible products containing software components and nonsoftware components that

function together to deliver the tangible product’s essential functionality are no longer in scope. The

amendments also require that hardware components of a tangible product containing software

components always be excluded from software revenue guidance. Furthermore, if the software

contained on the tangible product is essential to the tangible product’s functionality, the software is

excluded from software revenue guidance as well. This exclusion would include undelivered elements that

relate to the software that is essential to the tangible product’s functionality. The ASU provides various

factors to consider when determining whether the software and nonsoftware components function

together to deliver the product’s essential functionality. These changes would remove the requirement

to have VSOE of selling price of the undelivered elements sold with a software-enabled tangible product

and could likely increase the ability to separately account for the sale of these products from the

undelivered elements in an arrangement. ASU 2009-14 also provides guidance on how to allocate

consideration when an arrangement includes deliverables that are within the scope of software

revenue guidance (“software deliverables”) and deliverables that are not (“nonsoftware deliverables”).

The consideration must be allocated to the software deliverables as a group and the nonsoftware

deliverables based on the relative selling price method described in ASU 2009-13. The consideration

allocated to the software deliverables group would be subject to further separation and allocation based on

the software revenue guidance. Furthermore, if an undelivered element relates to both a deliverable within

the scope of the software revenue guidance and deliverable not in scope of the software revenue guidance,

the undelivered element must be bifurcated into a software deliverable and a nonsoftware deliverable.

Multiple-element arrangements that include deliverables within the scope of software revenue guidance

and deliverables not within the scope of software revenue guidance must provide the ongoing disclosures

required in ASU 2009-13. An entity must adopt the amendments in ASU 2009-14 in the same period and

using the same transition method that it uses to adopt the amendments included in ASU 2009-13.

The Company is in the process of assessing the impact of ASU 2009-13 and ASU 2009-14. The Company

enters into various types of multiple-element arrangements and, in many cases, uses the residual method

to allocate arrangement consideration. The elimination of the residual method and required use of the

relative selling price method will result in the Company allocating any discount over all of the deliverables

rather than recognizing the entire discount up front with the delivered items. Although the Company is in

the process of assessing this change quantitatively, the Company does not believe the change will be

material to the Company’s financial statements given the relatively low magnitude of multiple deliverable

arrangements to the Company’s overall business. The Company has not yet developed a policy for best

estimate of selling price nor has the adoption date and transition method been determined at this time.

Additionally, based on Lexmark’s current operations, the Company also believes the changes to the

software revenue guidance will not have a material impact to its financial statements.

In December 2009, the FASB issued ASU No. 2009-16, Transfers and Servicing (Topic 860) (“ASU

2009-16”) which codifies FAS 166 originally issued in June 2009. The amendments to the ASC contained

in ASU 2009-16 eliminate the concept of a qualifying special purpose entity and removes the exception

from applying consolidation guidance to such entities. ASU 2009-16 also amends and clarifies the

derecognition criteria for a transfer to be accounted for as a sale. The Company will continue to

account for its trade receivables facility as a secured borrowing based on its ability to repurchase the

receivable interests at a determinable price. The accounting guidance is effective for any transfers by the

Company in the first quarter of 2010.

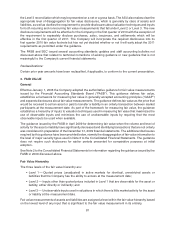

In January 2010, the FASB issued ASU No. 2010-06, Fair Value Measurements and Disclosures (Topic

820) (“ASU 2010-06”) which requires new disclosures and clarifies existing disclosures required under

current fair value guidance. Under the new guidance, a reporting entity must disclose separately gross

transfers in and gross transfers out of Levels 1, 2, and 3 and describe the reasons for the transfers. A

reporting entity must also disclose and consistently follow its policy for determining when transfers

between levels are recognized. The new guidance also requires separate presentation of purchases,

sales, issuances, and settlements rather than net presentation in the Level 3 reconciliation. ASU 2010-06

also requires that the fair values of derivative assets and liabilities be presented on a gross basis except for

80