Lexmark 2009 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2009 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

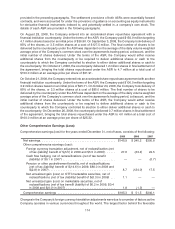

provided in the preceding paragraphs. The settlement provisions of both ASRs were essentially forward

contracts, and were accounted for under the provisions of guidance on accounting as equity instruments

for derivative financial instruments indexed to, and potentially settled in, a company’s own stock. The

details of each ASR are provided in the following paragraphs.

On August 28, 2008, the Company entered into an accelerated share repurchase agreement with a

financial institution counterparty. Under the terms of the ASR, the Company paid $150.0 million targeting

4.1 million shares based on an initial price of $36.90. On September 3, 2008, the Company took delivery of

85% of the shares, or 3.5 million shares at a cost of $127.5 million. The final number of shares to be

delivered by the counterparty under the ASR was dependent on the average of the daily volume weighted

average price of the Company’s common stock over the agreement’s trading period, a discount, and the

initial number of shares delivered. Under the terms of the ASR, the Company would either receive

additional shares from the counterparty or be required to deliver additional shares or cash to the

counterparty to which the Company controlled its election to either deliver additional shares or cash to

the counterparty. On October 21, 2008, the counterparty delivered 1.2 million shares in final settlement of

the agreement, bringing the total shares repurchased under the ASR to 4.7 million at a total cost of

$150.0 million at an average price per share of $31.91.

On October 21, 2008, the Company entered into an accelerated share repurchase agreement with another

financial institution counterparty. Under the terms of the ASR, the Company paid $100.0 million targeting

3.9 million shares based on an initial price of $25.71. On October 24, 2008, the Company took delivery of

85% of the shares, or 3.3 million shares at a cost of $85.0 million. The final number of shares to be

delivered by the counterparty under the ASR was dependent on the average of the daily volume weighted

average price of the Company’s common stock over the agreement’s trading period, a discount, and the

initial number of shares delivered. Under the terms of the ASR, the Company would either receive

additional shares from the counterparty or be required to deliver additional shares or cash to the

counterparty to which the Company controlled its election to either deliver additional shares or cash to

the counterparty. On December 26, 2008, the counterparty delivered 0.7 million shares in final settlement

of the agreement, bringing the total shares repurchased under the ASR to 4.0 million at a total cost of

$100.0 million at an average price per share of $25.22.

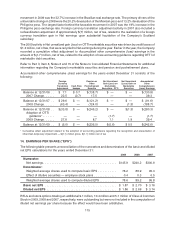

Other Comprehensive Earnings (Loss)

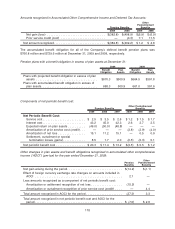

Comprehensive earnings (loss) for the years ended December 31, net of taxes, consists of the following:

2009 2008 2007

Net earnings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $145.9 $ 240.2 $300.8

Other comprehensive earnings (loss):

Foreign currency translation adjustment, net of reclassification (net

of tax (liability) benefit of $(5.5) in 2009 and $5.5 in 2008) . . . . . . 27.8 (63.4) 22.5

Cash flow hedging, net of reclassifications (net of tax benefit

(liability) of $0.1 in 2007) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — (0.7)

Pension or other postretirement benefits, net of reclassifications

(net of tax (liability) benefit of $(14.6) in 2009, $80.0 in 2008 and

$(2.8) in 2007) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8.7 (124.0) 17.5

Net unrealized gain (loss) on OTTI marketable securities, net of

reclassifications (net of tax (liability) benefit of $(0.3) in 2009) . . . 1.1 — —

Net unrealized gain (loss) on marketable securities, net of

reclassifications (net of tax benefit (liability) of $0.2 in 2009, $0.4

in 2008 and $(0.0) in 2007) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.8 (1.3) —

Comprehensive earnings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $185.3 $ 51.5 $340.1

Changes in the Company’s foreign currency translation adjustments were due to a number of factors as the

Company operates in various currencies throughout the world. The largest factor behind the favorable

114